In part one of this series we explored the interest rate movements at Lending Club over the past year. In this post we’ll review the actual performance of loans to get an idea on how the recent vintages are trending since the first quarter of 2014.

Delinquency Rates with Lending Club

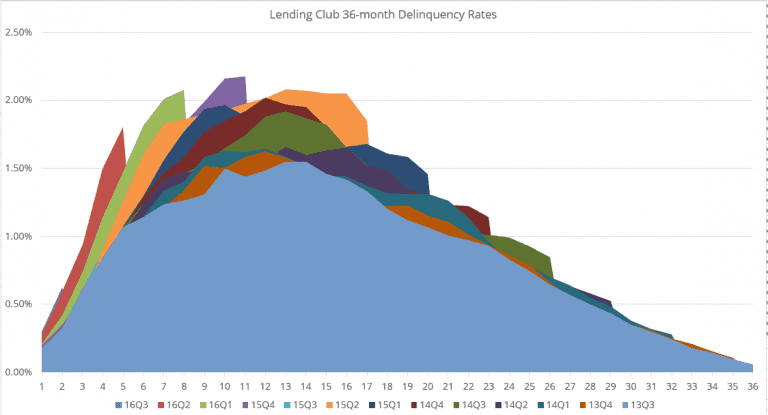

To begin with we’ll take a broad look at the vintages using delinquency rates which helps paint a picture of what’s going on with all loans originated by Lending Club. Lending Club club shares delinquency rates on their additional statistics page. The below charts are courtesy of NSR Invest and include the most recent data from Lending Club as of Q3 2016.

36 month Delinquency rates from Q3 2013 are shown below. The light blue shaded area represents Q3 2013 36 month loans which are now fully mature. Vintages through Q2 2014 remained pretty stable, but you can start seeing noticeable increases in delinquencies in notes originated in Q3 2014 and Q4 2014. Starting in 2015, delinquencies had a much steeper slope which has continued into the 2016 vintages. Delinquency rates break 2% for many vintages compared to the peak of 1.5% for Q3 2013. What will be interesting to see is how Q3 2016 delinquencies trend once we receive 3 more months of Lending Club data on February 14, 2017 when Lending Club announces their Q4 earnings.

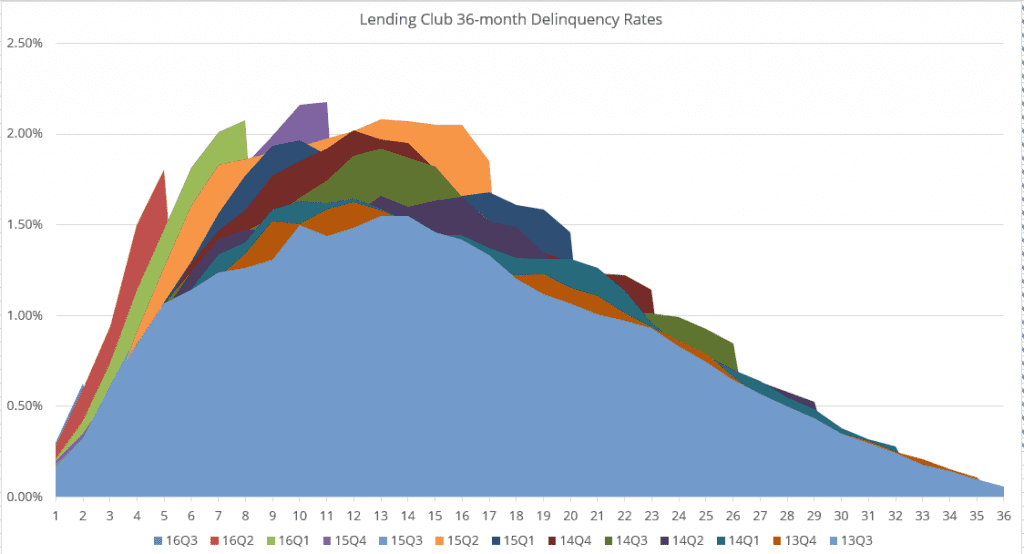

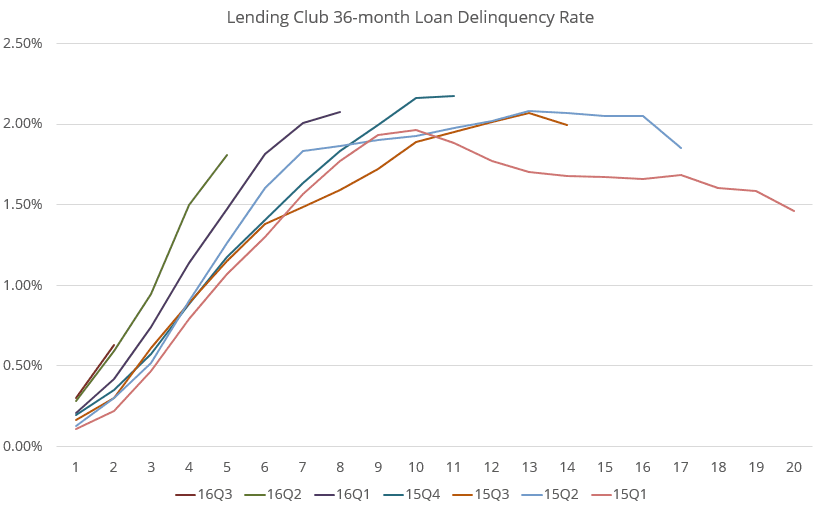

The chart below also tracks delinquency rates, but only includes 2015 and 2016 vintages. It is also easier to compare the vintages with the line chart. It’s clear that early delinquency rates have been increasing in recent quarters.

Loan Performance – Lending Club

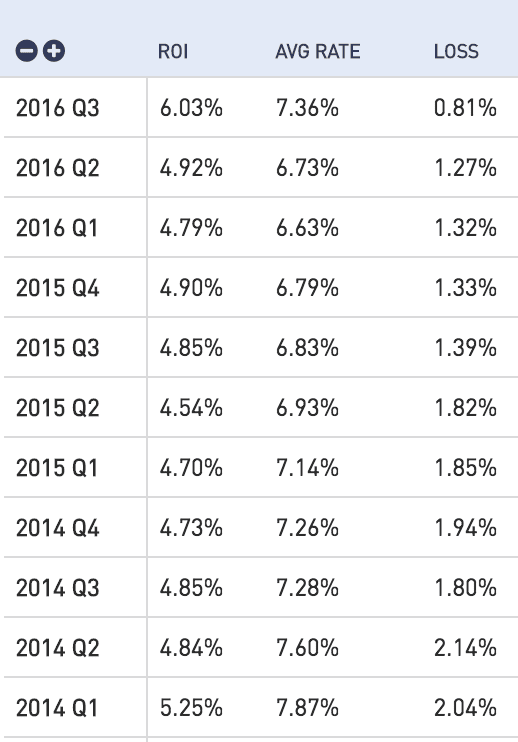

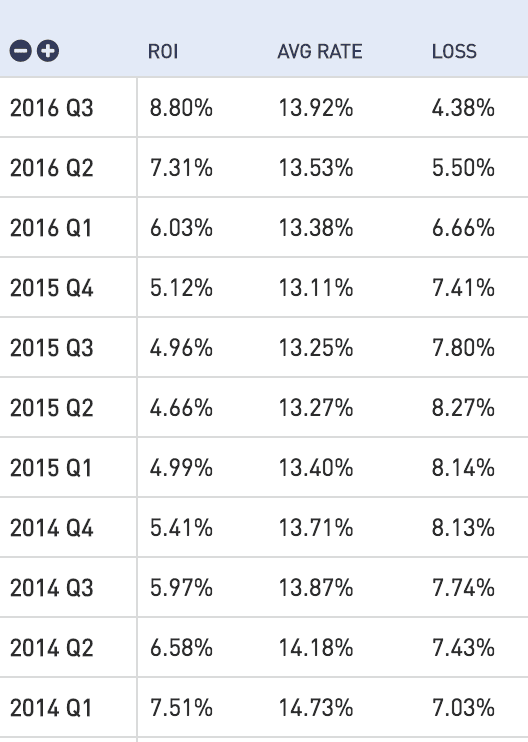

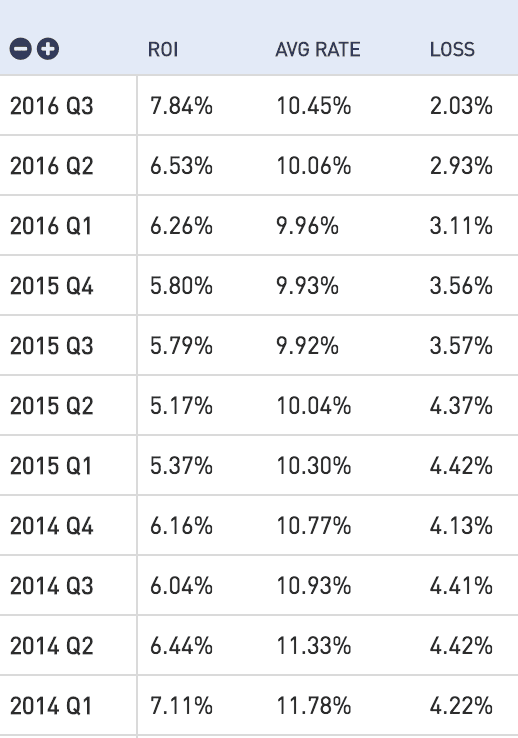

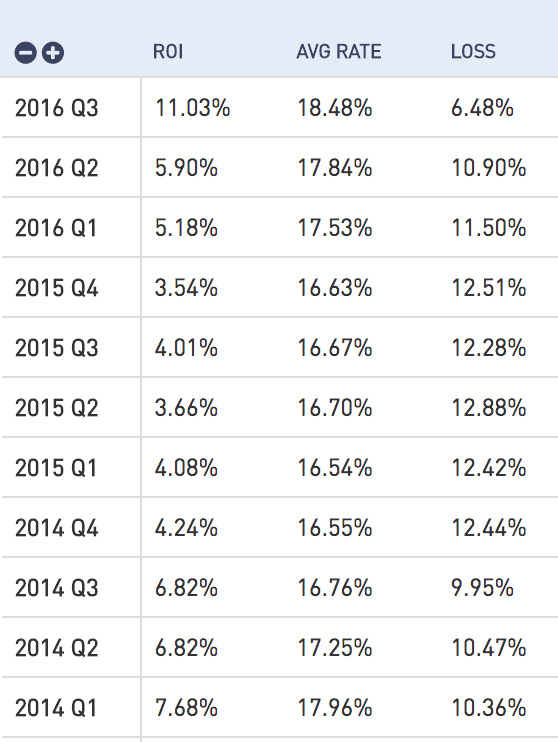

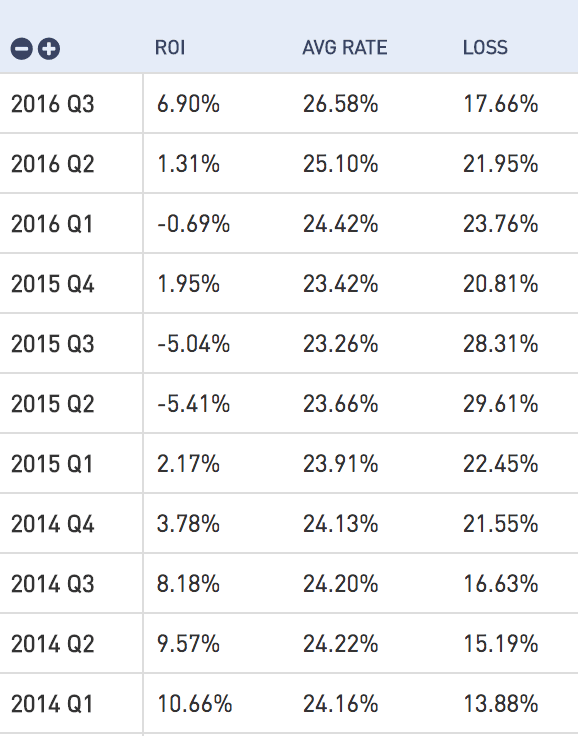

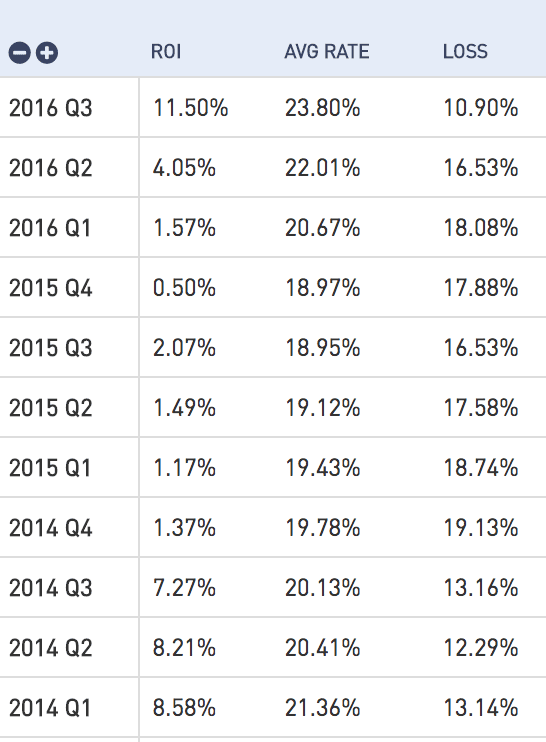

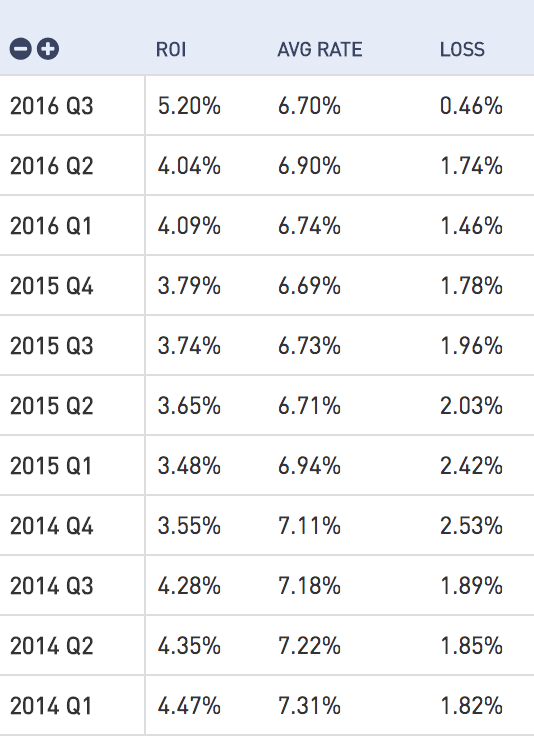

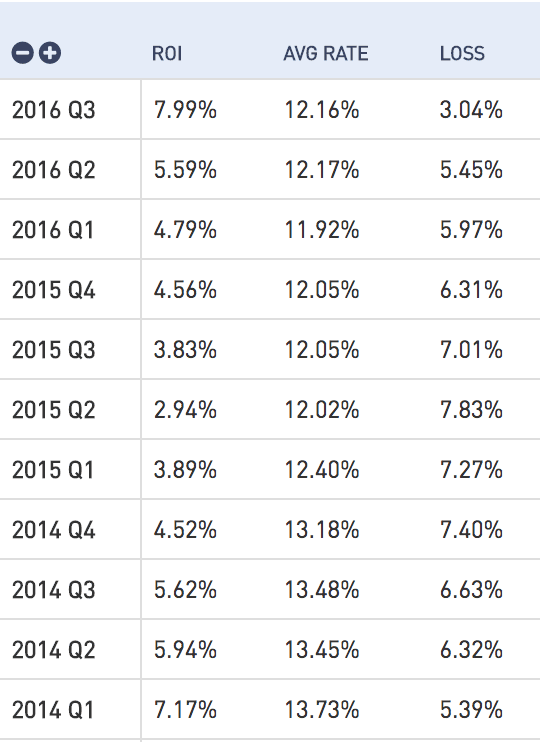

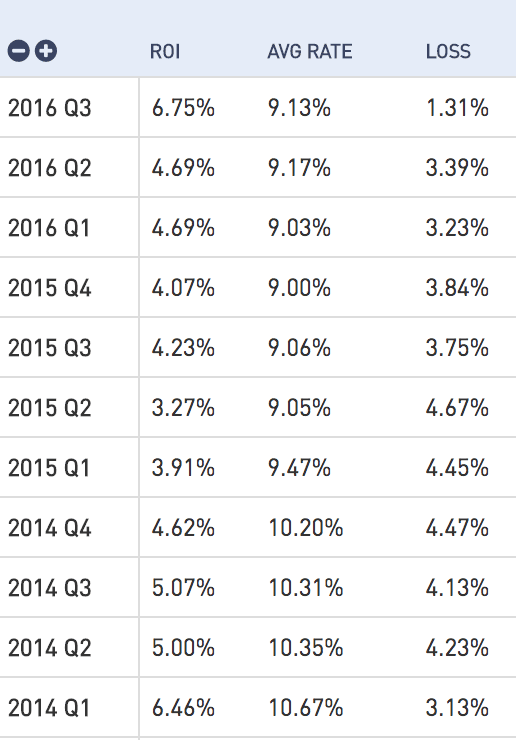

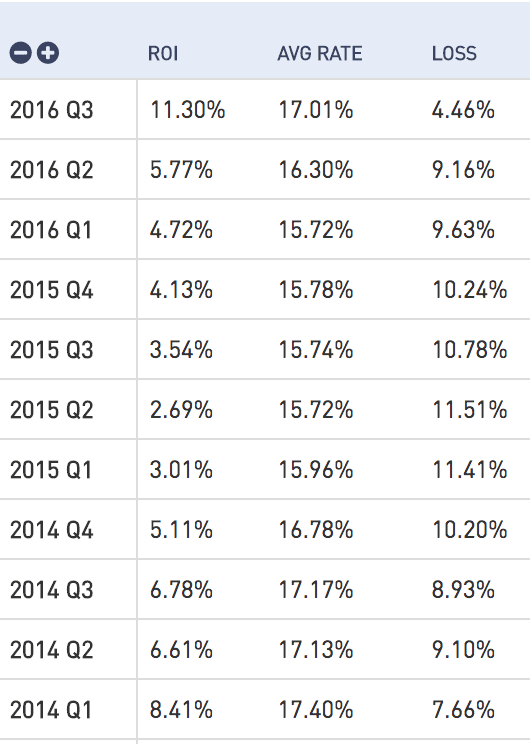

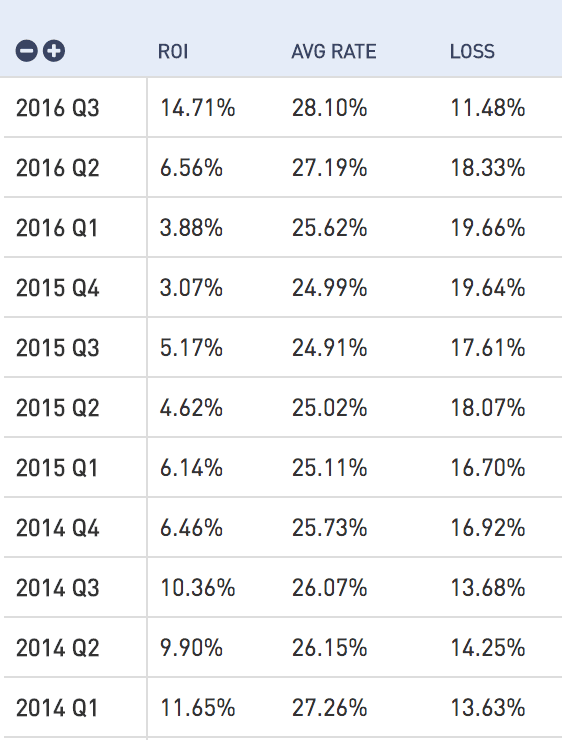

While looking at delinquency rates is important, there is still the question of how returns are tracking for investors, especially with the changes in interest rates. For this exercise we’ll focus on Lending Club’s 36 month loans since they are more mature. The three screenshots below show show returns across loan grades. They were produced using NSR Invest, filtering on 36 month loans and selecting the option “Equally weight all loans at $1000”.

As you look at these tables it’s important to keep in mind the maturity of the various vintages or the average age which isn’t displayed. The 2014 Q1 vintage is nearly mature whereas the 2016 vintages are still relatively young. Regardless of this fact, you can still get an understanding of how the vintages are trending.

It’s hard to distinguish any degradation of performance in an index of A grade loans. In fact, the 5.25% return of 2014 Q1 A grade loans is one of the best performing quarters for A grade loans if you look at the entire history of Lending Club loans.

There is a noticeable drop in ROI however for grades B and C. Notice how on some of the younger vintages, particularly around Q1 and Q2 2015, have loss rates exceeding a nearly mature vintage (2014 Q1). Despite the lackluster performance of some of these vintages, returns are still well into positive territory.

Grades D, E and F have seen more substantial impacts to performance from originations starting with Q4 2014. As you compare the loan performance by loan grades you’ll see that generally the higher on the risk spectrum you go, the lower the returns are tracking. Performance continues to lag through Q2 2016. It’s too early to make a judgement call on Q3 for Grades D and E although it’s apparent that Q3 2016 won’t be a good vintage for grade F loans.

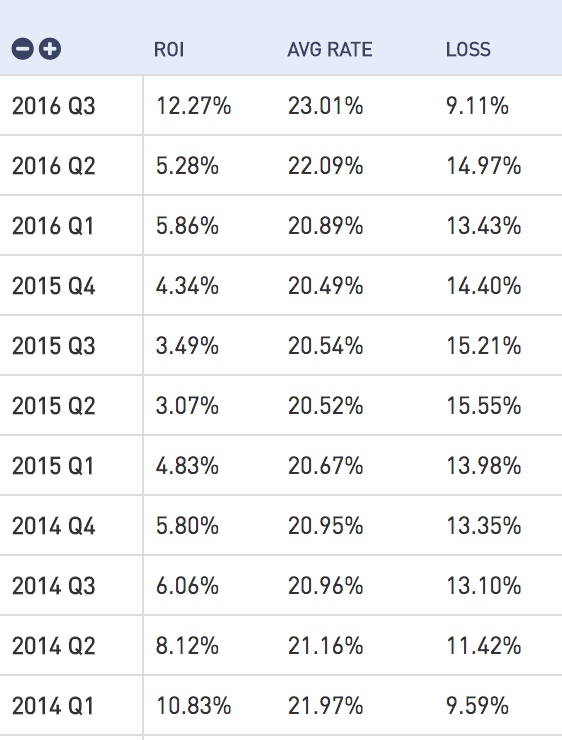

Loan Performance – Prosper

For Prosper we’ll also look at the 36 month loan performance by grade. Generally the findings are very similar to that with Lending Club. Returns in the loan grades AA, A and B have seen returns decrease, but to a lesser extent than the higher risk loans.

When looking at the higher risk loans what’s interesting is even E grade loans still have a positive ROI so far. These loan interest rates are comparable to Lending Club’s F grade loans which already have a negative ROI for Q2 and Q3 2015 as well as Q1 2016. As a side note, Prosper currently has a problem with their data files right now where recoveries are not being recorded properly. Therefore, the Prosper returns are likely to be higher than those displayed.

While we have seen numerous interest rate changes from Lending Club, there have been fewer from Prosper. The performance trends are similar, although one could argue that higher risk vintages are currently performing better at Prosper. In a recent blog post from NSR Invest, they touch on what might be the explanation for fewer interest rate changes:

It should also be noted that Prosper’s interest rate changes over the last year are dwarfed by Lending Club’s rate increases in the higher risk grades. However, Prosper’s rates already were, on average, higher than Lending Club’s in 2015 – particularly at the end of the spectrum.

Conclusion

For a long time investors have enjoyed healthy returns by investing in loans both on Lending Club and Prosper. Certainly part of the degradation in loan performance can be attributed to the platforms’ expanded underwriting and it’s clear now that interest rates were lowered too much. But there is also an important lesson to be learned. Many investors focused on the highest risk grades which historically had produced higher returns. Now that returns have come down, investors are realizing the risk in investing in the higher risk borrowers. I don’t think some investors carefully considered their personal risk tolerance before investing, they simply sought after the highest returns.

It’s hard to draw any conclusions on what will happen with the newest vintages as the latest rate changes went into affect on Lending Club in October, 2016 but a lot has changed since the loans in 2015 were originated. On a positive note, unemployment, which is highly correlated with performance of unsecured lending continues to remain low. We will carefully be looking at Q3 and Q4 2016 vintages once new data is available in February.

If you are an investor who experienced lower returns as of late, now is a great time to reconsider your investment approach whether that be continuing to invest as is, modifying the loan grades you invest in or rethinking your allocation to p2p lending within your entire portfolio. Returns in this asset class, as with others are likely to rise and fall over time and this is just one example of it.

Update January 18, 2017: Lending Club released an 8-K discussing recent loan performance. According to the release:

We have seen early signs of stabilization in delinquency rates across the existing loan portfolio following changes made several times in 2016, and implemented additional changes on January 11, 2017 to tighten the thresholds on borrower leverage on unique combinations of risk factors such as number of recent installments loans, revolving utilization, and higher risk scores on our proprietary scorecard.

The document goes on to comment on the economic backdrop, borrower performance, interest rates, and other factors such as prepayment rates and diversification. It is worth reading to learn Lending Club’s view on current trends. You can find the latest 8-K here.

Full disclosure: NSR Invest is a sister company to Lend Academy.