Last month, Brazilian fintech unicorn Creditas surprised many with a bold acquisition move.

The Sao-Paulo-based institution recently announced a $50 million extension to its $260 million series-F round, bringing total financing to $310 million. The company, one of Brazil’s leading fintech lending platforms, applied a part of the proceeds to purchase Andbank’s local banking license. Andbank is an Andorran-based institution focused on wealth management services in the country.

Creditas did so in a context of uncertainty for the sector, as valuations for many financial technology companies have plunged amid rising interest rates and volatility. The company is backed by prominent venture capital investors such as QED, Softbank, and Fidelity.

The fintech, which hires north of 4,000 employees in Brazil, Spain, and Mexico, is one of the few startups that have made inroads in Brazil’s colossal loan market. Large traditional financial institutions heavily dominate this undisputed territory.

The company has an outstanding portfolio of $5 billion reais (close to $1 billion U.S. dollars). Creditas provides cheaper financing to individuals by using collateral to lower rates. These can include real estate, car, or payroll.

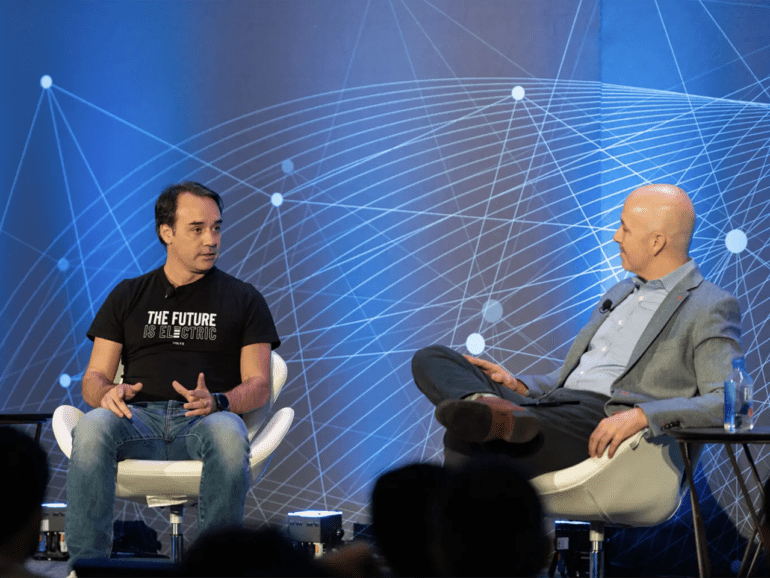

In a conversation with Fintech Nexus, Sergio Furio, CEO, and Founder, discusses the strategy as we advance as fintechs in Latin America face more challenging operative environments, with inflation undermining borrowers’ capacity to repay and risk aversion worldwide making funding more difficult.

Fintech Nexus: Why did you decide to execute the deal right now?

Sergio Furio: It was a combination of factors. We already planned to obtain a bank license to diversify funding sources. At the same time, around March, we saw stronger signs of deterioration in the capital market, so we began to think about ways to increase Creditas’ capitalization to weather a phase of stronger volatility. Ultimately, Andbank led a funding round in Creditas, where the use of proceeds was applied mainly to buying the license.

How does your funding model work?

Today it’s 100% capital market-based. As soon as we write a loan, we sell it through an investment vehicle we put together for fixed-income investors who might want exposure to that kind of transaction. From a capital perspective, it is very efficient. But it also creates a dependency on the market. For that reason, we thought it made sense to diversify funding sources. Now we can get deposits, and that brings us closer to profitability. If you take them at a lower cost than you would securitize your loans, you can get (to break even) faster.

How are you planning to attract deposits to Creditas?

Andbank will start offering deposits for existing clients, but the normal thing would be for us to capture deposits through our existing fundraising partners, such as Nubank or XP.

Will you leverage the license to launch new banking products as well?

We do not intend to turn Creditas into a day-to-day bank with a card, an account, and a slew of transactional products. That is not our cup of tea, and we have no interest in becoming a neobank in the broad sense.

How is the risk-averse market sentiment affecting Creditas?

The most significant impact on our business is the rise in interest rates. The benchmark rate in Brazil went from 2.0% to 13.75%. Our loans are pre-fixed, for which we are seeing a higher funding cost while we catch up with our prices. Once rates stabilize, we do not care whether they are low or high because we have repriced our loans. But in the meanwhile, it can have an impact on short and medium-term non-performing loans, although (milder) because our product has collateral and is less sensitive to variations.

How is this environment affecting your plans to do an IPO?

We always said that it makes sense for Creditas to become a publicly-traded company. But at some point, the IPO market dried up completely due to increased volatility and falling valuation multiples. At the beginning of 2021, fintech multiples were crazy high. Some companies were trading at 35 times future revenues, which did not make sense to us. But now those have gone down to 5 or 6 times, and I do not see a recovery anytime soon. The usual thing would be tighter valuation multiples to reflect those companies’ reality. I see a high risk in companies that raised last year at much-stretched valuations, with very high cash burn.

Related:

How has the crisis affected your growth strategies in the future?

I think everyone reviewed their growth plans with more or less depth. In our case, we had the objective of tripling this year, and now we plan to double in size this year and next. We are taking the opportunity to strengthen the company by focusing on what we do best and optimizing our (resources). We are well capitalized, and that helps us to look at things without pause but calmly. In terms of valuations, we are a fast-growing company. Multiples may have halved, but if the company keeps doubling in size yearly, you have already made up for that loss. We have a credit portfolio of more than 5 billion reais in a credit market of 2 trillion reais. I have enough space to double in size every year for many years.

It’s time to put your head down and work. Do the things that companies thought they probably would have a timeframe of 2 or 3 years to do. To win, you have to survive and to survive. You have to be efficient. It’s the right time to do that.