Gensler said his biggest worry about the equity market was competition and consolidation. While retail investing has taken off, the PFOF that enables it is ripe for conflict of interest.

The use of messaging apps raises compliance issues that SnipperSentry addresses. This issue is not going away for fintechs and banks.

State regulators are stepping into action to regulate earned wage access. But the process is slow and could create a mismatch for providers.

It seems that regulators in Pennsylvania have had some misgivings about p2p lending. So, the PA Securities Commission issued this...

Researchers from the University of Texas published a study Tuesday morning that claims fintech lenders who participated in the Paycheck Protection Program dropped the ball on underwriting.

The Federal Council of Switzerland is seeking to make the regulatory framework more flexible for fintech companies; they have instructed the Federal Department of Finance to devise a policy statement setting such a direction; recommendations to be considered include: (a) setting a maximum of 60 days for holding money in a settlement account, which will make settlements better aligned with crowdfunding project funding deadlines, (b) creating of an innovation sandbox in which a platform can accept funds up to CHF 1 million, and (c) establishing a new fintech license, with fewer restrictions than on traditional banks. Source

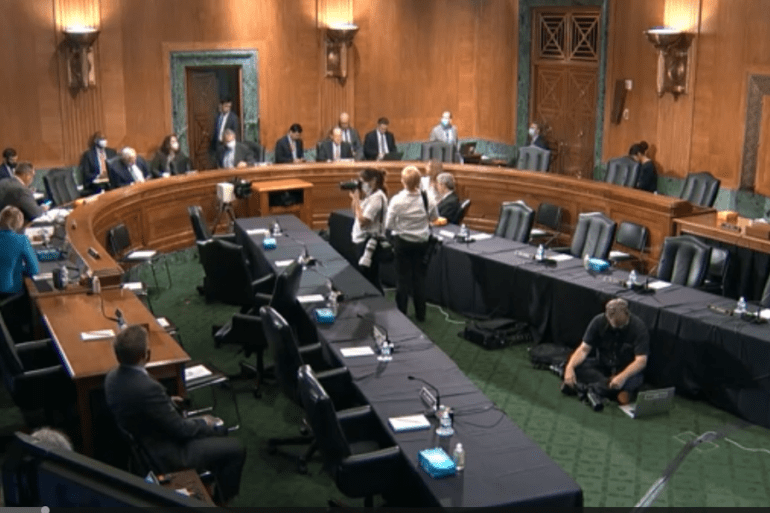

I was in Washington DC last week for the fourth annual Online Lending Policy Summit. This one day event is...

Congressman Patrick McHenry and Congressman Jeb Hensarling have both released comments supporting President Donald Trump's executive order on Dodd-Frank; the executive order on Dodd-Frank signed on Friday outlines core principles for regulating the United States financial system and asks the Treasury secretary and regulators to come up with a plan for replacing Dodd-Frank; Congressman Jeb Hensarling has proposed the Financial Choice Act to overhaul Dodd-Frank; if new policies are enacted it would ease lending requirements for banks making credit more available for consumers and small businesses from mainstream financial institutions. Source

The Economist magazine's intelligence unit (EIU) has published a report on regulatory support for financial inclusion in developing countries and it is now gaining traction with press and analysts; the report scores countries on having an inclusiveness strategy and building governmental and private sector expertise, then provides in-depth details in areas including credit markets, non-regulated lenders, payments and insurance; Colombia ties Peru this year for the most progressive country; India has shown the most improvement; Latin America and East/South Asia are leaders regionally while Africa and the Middle East remain behind; the EIU performed the research in conjunction with the Center for Financial Inclusion at Accion and the Multilateral Investment Fund at the Inter-American Development Bank. Source

There is big news on the trade association front today. The Marketplace Lending Association (MLA), the trade organization for fintech...