Look beyond the initial aftereffects of recent market shocks and there are plenty of positive developments happening in blockchain-related industries, the leader of a global investment firm believes.

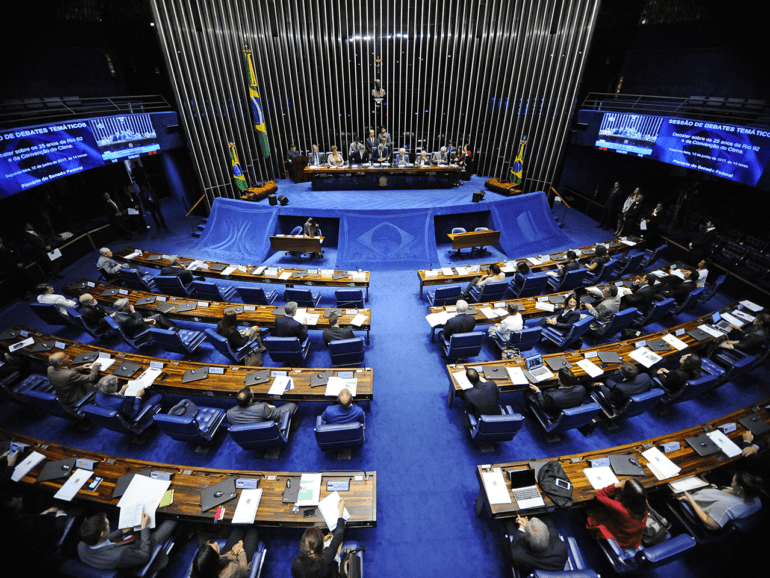

Brazil, the largest country in Latin America, is moving closer to regulating cryptocurrencies with its own version of a Bitcoin law.

After the FTX crash rocked the crypto world, Brazil was one of the fastest nations to adapt to the new scenario. Now what's next?

The Digital Real is one of the most ambitious undertakings of the BCB, which has been seeking to accelerate financial inclusion in Brazil.

The UK's Cambridge Center for Alternative Finance (CCAF) is actively involved in industry research and is currently doing three alternative finance surveys; much of the research is in conjunction with the Financial Conduct Authority (FCA), providing insight for its crowdfunding consultation period; CCAF is surveying crowdfunding investors and crowdfunding borrowers; CCAF has also announced it will now be doing a survey on blockchain and cryptocurrencies; as part of the FCA's regulatory study, CCAF is working with 25 crowdfunding and P2P lending platforms in the UK to gain greater insight into the crowdfunding ecosystem. Source

CFPB director Rohit Chopra lobbed a surprise grenade onto the expo floor Tuesday morning by announcing plans for an open banking rule.

The Consumer Financial Protection Bureau (CFPB) will appeal the court's unconstitutional ruling in the case of CFPB v. PHH in which PHH argued the CFPB's authoritative powers were too broad following enforcement actions that resulted in penalties primarily for referring consumers to mortgage insurers for compensation; the CFPB is requesting that the case be heard by all judges in the D.C. Circuit Court of Appeals rather than a panel of only three judges which provided the October ruling; if the verdict in the case is unchanged, the president will still be able to replace the CFPB director at his discretion; it's likely that Director Cordray could be replaced by President-Elect Donald Trump given his plans for Dodd-Frank. Source

In a speech at the Money 20/20 conference in Las Vegas, the head of the CFPB said he was troubled by banks who would shut off access to third-party data providers and believes consumers should have access to their data; though the agency declined to comment on the possibility of a new rule, they did make it clear that consumers should be the ones who decide when and who should have access to their data; this puts banks in a tough position as they work to comply with the current regulations and burgeoning fintech market that has given consumers a variety of technology options to use their personal data. Source

The Consumer Financial Protection Bureau (CFPB) has released a report on financial innovation; the report entitled “Project Catalyst Report: Promoting Consumer Friendly Innovation” is an effort from the CFPB to expand its knowledge and inform consumers on the benefits of financial innovation. One specific approaches reflected upon is the CFPB's "Trial Disclosure Waiver Policy" to test and revise disclosure statements in a controlled environment, and no-action letters. Source

These operations had been legally challenged by credit card companies, which currently dominate this type of activity in Chile.