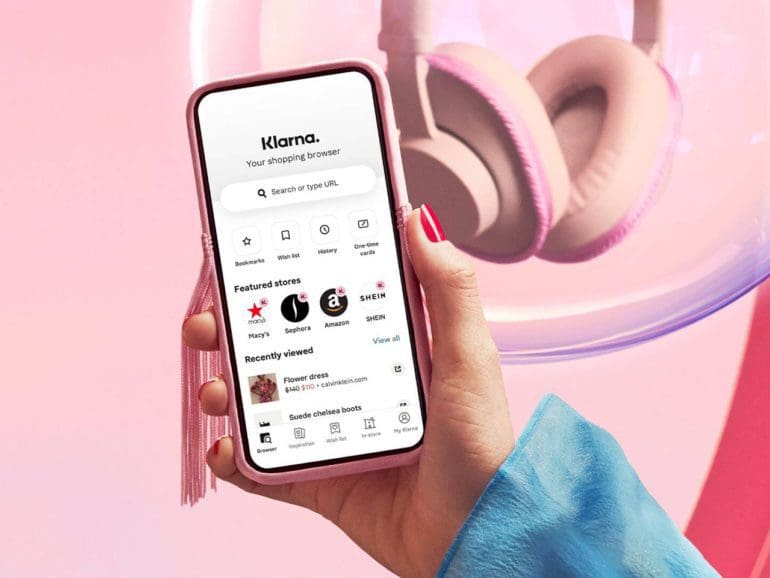

Buy now, pay later (BNPL) giant Klarna will start reporting data on customers' usage of its products to credit bureaus in the UK.

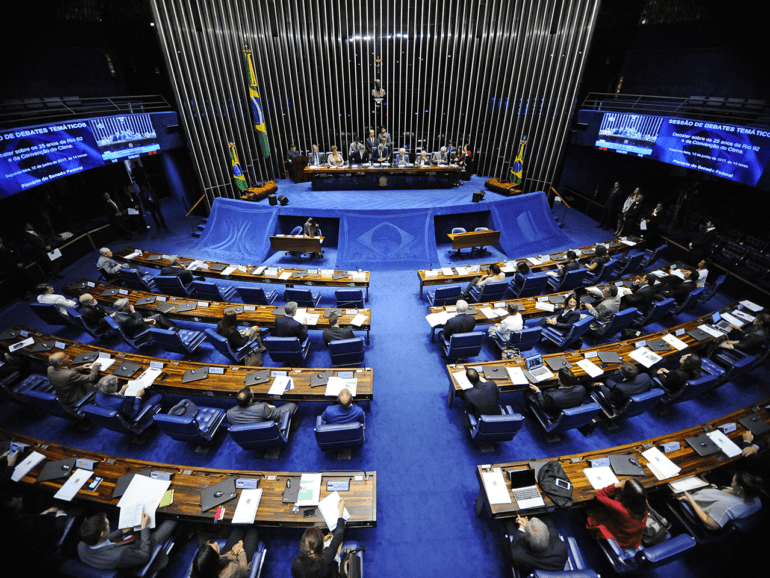

Brazil, the largest country in Latin America, is moving closer to regulating cryptocurrencies with its own version of a Bitcoin law.

Russia's invasion of Ukraine triggered a rapid wave of sanctions, bringing challenges for financial services firms looking to stay compliant.

Fintech faces a flurry of changes, LexisNexis Risk Solutions director of financial crime compliance Tracy Manning said.

On Monday, April 14, the EU's committee, Economic and Monetary Affairs, adopted a new position on rules on crypto-assets.

The Financial Conduct Authority (FCA) removed 12 UK crypto firms from its registration list, leaving only five companies with a temporary registration status.

Anew approach to the FCA and how they interact with fintech, focusing on fostering innovation, being intelligence-led, and preparing for the future.

Secretary of Treasury Janet Yellen spoke at American University about the government's role in creating cryptocurrencies or CBDCs.

CFPB Director Rohit Chopra has made it clear that he embraces an expansive view of the Bureau's authority to remedy inequities.

The report found that more than half of banks reported challenges reducing cyberattacks, and nearly half of firms are concerned with safeguarding sensitive data and adapting to consumer privacy laws.