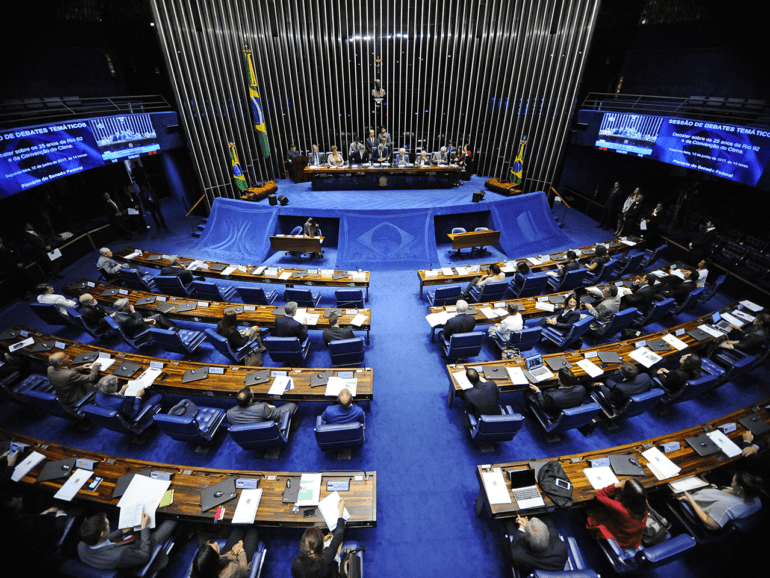

Brazil, the largest country in Latin America, is moving closer to regulating cryptocurrencies with its own version of a Bitcoin law.

Patrick McHenry is one of the most proactive advocates for fintech in Congress; at LendIt USA 2017 he provided his insight from Congress on fintech and also spoke with Lend Academy in their podcast; his views are framing many of Washington D.C.'s legislative debates and his legislation, the Financial Services Innovation Act of 2016 (HR 6118), could be a significant factor helping to support future fintech innovation in the US. Source

Parliament and the Council agreed to track crypto transfers continuously and block suspicious transactions in a provisional agreement.

In a case that has taken three years to reach a verdict, XRP token is found not to be a security. But Ripple isn't completely off the hook.

It seems that regulators in Pennsylvania have had some misgivings about p2p lending. So, the PA Securities Commission issued this...

PricewaterhouseCoopers' DeNovo team says transparency, credibility and evolving business models will be key factors for marketplace lending in 2017; increased disclosures and new solutions for data analytics are expected to help transparency while also improving confidence and credibility; new regulations will also be an important factor for the landscape overall, potentially creating new business requirements while also validating funding sources; the DeNovo team also cites potentially lower investment taxes from House Speaker Paul Ryan's "A Better Way" plan and expansion to broader lending categories as important for the new year; in 2017 funding disbursement is also expected to come from a wider range of sources with securitization in the lead; originations overall in 2016 are down 4.9% through September at $7.8 billion versus $8.2 billion in 2015 while securitizations have increased by 80% at $5.4 billion versus $3.0 billion in 2015 according to Orchard. Source

I first wrote about the GAO report on p2p lending last year. The GAO have been doing an analysis of...

Congressman Patrick McHenry and Congressman Jeb Hensarling have both released comments supporting President Donald Trump's executive order on Dodd-Frank; the executive order on Dodd-Frank signed on Friday outlines core principles for regulating the United States financial system and asks the Treasury secretary and regulators to come up with a plan for replacing Dodd-Frank; Congressman Jeb Hensarling has proposed the Financial Choice Act to overhaul Dodd-Frank; if new policies are enacted it would ease lending requirements for banks making credit more available for consumers and small businesses from mainstream financial institutions. Source

On November 7, China passed data control laws that had been put on the table in August; the laws include government security checks on companies in finance, telecommunications and other critical data industries as well as mandatory in-country data storage; also, individuals will have to register with their real names on messaging services; businesses are concerned that information flow will be curtailed in industries where this is critical to be effective and corporate security checks have the potential to be invasive rather than simply regulatory; the law will go into effect next summer; some aspects of the law will need clarification over time from the government. Source

[Editor’s note: This is a guest post from Ryan Metcalf, Head of Public Policy & Social Impact at Funding Circle.] Fintech...