Last year New York Governor Andrew Cuomo signed a bill that required the State’s Department of Financial Services (DFS) to analyze online lending. Last week the NYDFS released their Online Lending Report as a result of this legislation. There was also an accompanying press release that summarized the report’s findings.

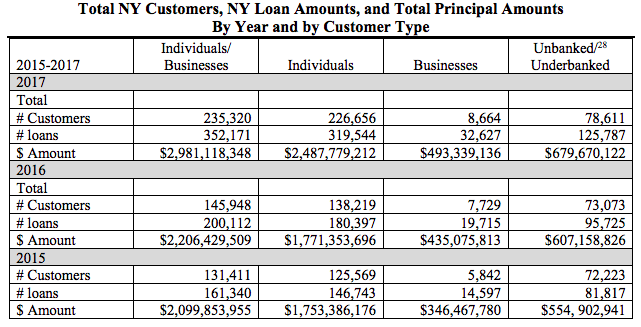

The New York DFS sent out surveys to 48 companies in the online lending space, both consumer and small business lenders. They received responses back from 35 companies. There is some interesting data from these 35 companies particularly when it comes to loan volumes. The table below shows the loan growth from 2015-17 for consumer and small business loans in New York.

Keep in mind that this data is only for online lenders who operate in New York AND who responded to the survey. This is by no means an accurate assessment of total lending activity but it is in interesting nonetheless.

As to the findings of the report here is a comment from DFS Superintendent Maria T. Vullo that summarizes their position, taken from the press release:

DFS supports the promise that new technologies are able to reach more consumers, but innovation must also be responsible, and all associated risks must be appropriately managed, including by strong underwriting standards, compliance with usury laws, and capital requirements. All lenders must operate on a level playing field and address market risk.

The 31-page report is broken up into several parts, below is a quick summary of these parts.

- Background – description of the DFS’s oversight work, the threat posed by payday loans, lessons from the financial crisis, New York’s leadership in consumer protection and a mention of consumer litigation financing.

- Survey results – data from the 35 responding companies that provides a snapshot of the lenders’ loan books.

- Comments from other stakeholders – the DFS received 12 additional comments from associations, chambers of commerce and other stakeholders.

- Analysis – the DFS assessment of the risks and benefits from online lenders.

- Recommendations – three recommendations that could have far reaching implications for the online lending industry

The Recommendations

Let’s break down these three recommendations because this is really the crux of the report:

- Equal Application of Consumer Protection Laws

The DFS recommends that consumer protection laws and regulations apply equally to consumer lending and small business lending activity. This is interesting because all states and the federal government regulate consumer lending and small business lending differently. So, in reality this is quite an extreme recommendation and they don’t make it clear exactly what they mean here. - Usury Limits Must Apply to All Lending in New York

The DFS argues that a loan must adhere to New York usury limits (25% is most circumstances), whether or not the borrowers applied at a bank, credit union or online lender, making a level playing field for all participants. - Licensing and Supervision

Online lenders should be subject to the same direct supervision and oversight as New York State chartered banks, credit unions and licensed non-depositories.

I reached out to Nat Hoopes, the Executive Director of the Marketplace Lending Association for comment on the overall report and here is what he said:

This report shows that there is both great promise for access to credit and the potential for abusive practices in online lending. One of the key reasons that leading online lenders have come together to form this Association is to set high standards for conduct; only platforms that offer low APR, affordable, transparent, borrower friendly products are eligible for MLA membership. We will continue to offer independent data and information to the Department that will help them continue to draw these distinctions as they move forward.

The Online Lending Policy Institute, a nonprofit public policy organization based in Boston, had this to say about the report:

For anyone involved in this space, the DFS report is worthy of study and will undoubtedly be the subject of additional comment and criticism over the course of time. It is important to note that any recommendation from the DFS would still likely require action by the state legislature and signature of the Governor. OLPI seeks to educate regulators and legislators alike about the benefits of online lending and its distinction from potentially harmful loan products, such as pay day loans.

My Take

The DFS made clear their opposition to the “Madden Fix” bill that was passed by the House earlier this year, as did many other states. But at the same time states like New York want increased access to credit for consumers and small businesses. The reality is that DFS supervised institutions only serve a small portion of the population of New York. Banks have strict underwriting rules and will only lend to the most creditworthy consumers and small businesses. I have no problem with that because non-bank lenders are willing to serve far greater populations although as a result of the Madden decision many online lenders are currently only providing loans to consumers in New York below the usury rate.

It almost seems to me that the DFS wants to wave a magic wand and make a large segment of the population suddenly creditworthy. If a segment of borrowers will default at a 25% rate then clearly no one will ever lend to them at 25% interest. So, these people will now become underbanked. And yet, the DFS provides no insight on how to serve these people. Don’t get me wrong, I am dead against predatory lending. Every lending transaction should be a win-win for the borrower and the lender but I also think when you have a relatively low interest rate limit you will exclude a large segment of the population.

Fintech platforms have brought great innovation to the lending business. They have not only expanded access to credit but have made the borrowing process faster and more efficient. These kinds of innovations should be encouraged not stymied as the New York DFS seems to want to do.