Even Financial is a supply-side platform for online financial services, they have integrated with the top online lenders and affiliate partners to create a loan search, comparison and matching tool with real time analytics. They provide the power behind the affiliate, it’s an out of the box solution for anyone to integrate a comparison tool. Online lending partners include Avant, Discover, Upstart, Lending Club, SoFi and Ascend. The top affiliate partners are Credit Sesame, Bank Rate, Smart Asset, XO Group, CNN Money and MarketWatch.

They recently released their end of year statistics showing their industry leading API generated over 1.8B in loan requests, 100+ affiliate partners integrated, 12+ top online loan providers, and over 360,000 activated users. This article will take a look at Even’s affiliate lead generation business and what they see as the top five trends in lead generation today.

In reviewing Even’s program what you will find is that loan size on average is under $10,000 and the average age of borrowers in the top three loan categories is 44 years old. The top three categories for loans are debt consolidation, weddings, and home improvement.

Average loan size by credit score showed some interesting data points, top tier credit profiles on average received the highest loan amount and consistently requested the highest loan amount. The credit spectrum of borrowers ranges from 720 or higher for the top tier to under 600 on the lowest tier. Average self reported income showed that the fair credit score reported the highest income, with borrowers reporting over $6,000 more per year as compared to the excellent credit tier.

An increasingly important aspect when it comes to borrowers is time to fund, you can see below it is one of the top trends and this shows that the quicker a borrower can access capital the better chance they will use that originator. Over a third of borrowers selected their originator based on how quickly they could access funds, even over APR. Additionally, data from Even shows that the lenders with the fastest time to fund also had the fastest take rate. Average time to fund was about 4.5 days, with the fastest being same day and the slowest being 16 days.

As digital marketing continues to take off lenders are comparing the organic and inorganic borrower. Inorganic leads that come from display ads and search channels show a 30% higher rate of default in the first three months as compared to organic leads. The borrowers who come to a lender through credit education or cross promotion have shown to be a lot more reliable to repay the loan.

More and more borrowers are moving away from their desktops and using their phones to organize their financial lives. What the research shows is mobile earnings per click are less than half the cost as compared to the desktop. Having a strong mobile experience and strategy is not only a key for lenders it looks to be able to save them a significant amount of money. Here are the top five trends in lead generation from Brian Brauntuch VP, Partnerships and Operations, Even Financial.

Top 5 Trends in Lead Generation for 2017:

- Organic vs. Inorganic Lead Sources – There is increasing importance on understanding the borrower’s traffic source – the industry has noticed much stronger loan performance from borrowers originating from organic traffic sources (email, cross-sell, purpose-driven, content-driven) vs. inorganic (SEM, PPC, Social Ads).

- The Importance of Time to Fund – As the number of originators continues to increase, consumers see time to fund as a major product differentiator. Over 33% of borrowers now choose the originator with the fastest time to fund over the originator offering the lowest APR.

- Marketing Compliance – Online lenders are finding scalable ways to monitor online channel partners and ensure that their marketing language stays up to date and fully compliant.

- The Necessity of a Mobile Applications – Customers are increasingly finding online lenders through mobile services, whether through search or natively through partnerships with personal finance apps. Online lenders must ensure that they have mobile-friendly experiences to drive higher fulfillment rates with interested borrowers.

- Loan Stacking – There is increasing concern about loan stacking as more originators leverage pre-qualification APIs to screen applicants, and while no clear solution exists today, there are a number of companies building solutions to mitigate this.

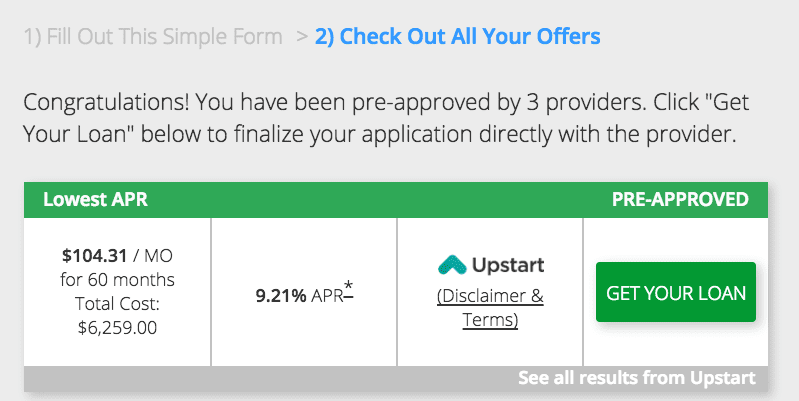

One of the key components to online lenders is borrower acquisition. While adwords can generate leads for a lender, loan performance also depends on where a lead comes from as well. In addition, aggregator platforms such as Even are a popular place for consumers to find loans. This can be compared to travel industry with flights. With so many options, many consumers find it beneficial to use services like Kayak, etc.

To keep up with Even Financial’s progress, partner with them or market with them you can visit the team at https://evenfinancial.com/. For reference here is the 2016 statistics review.