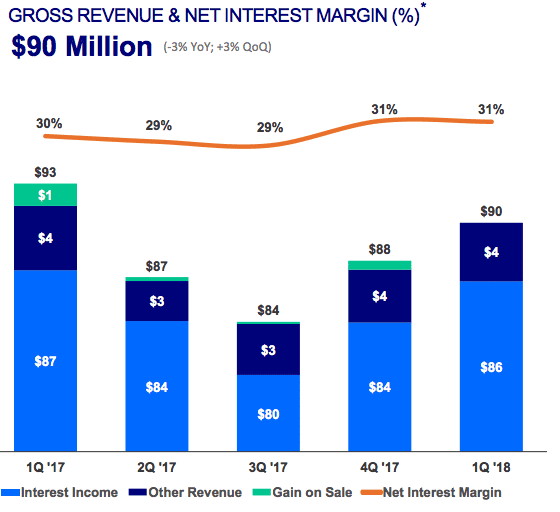

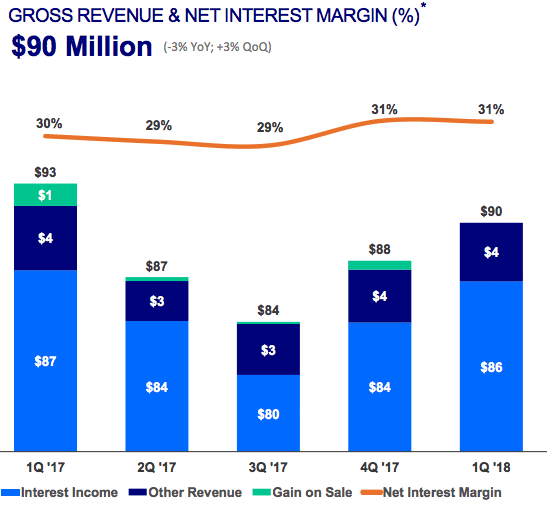

This morning OnDeck released their Q1 2018 earnings. Last quarter we highlighted that the company had reached GAAP profitability which was a significant milestone. While the company posted a net loss of $1.9 million for the quarter, this was within guidance. Gross revenues were $90 million, coming in at the top end of projections for the quarter. The increase in revenue was attributable to higher interest income or the company’s effective interest yield, or EIY which came in at 35.6%, compared to 34.8% in the previous quarter. OnDeck also beat on adjusted income which came in at $6.4 million (Q1 2018 guidance was between $1 and $5 million).

The below chart outlines OnDeck’s revenue sources. It’s interesting to note that OnDeck reported zero for gain on sale revenue. While this hasn’t made up a significant amount of the business for quite some time, there has been a small amount of revenue coming from this source in previous quarters. It seems they have officially shut the marketplace down for the time being. It is also worth noting that other revenue remained consistent. This is a number to keep an eye on as it includes income from OnDeck-as-a-Service, with OnDeck’s longstanding partnership with JPMorgan Chase as the central piece here. While the company may continue to grow originations this is the area with the most potential of upside for the company. Noah Breslow noted that another significant bank partnership would be announced this year, along with a new lending product which could boost originations.

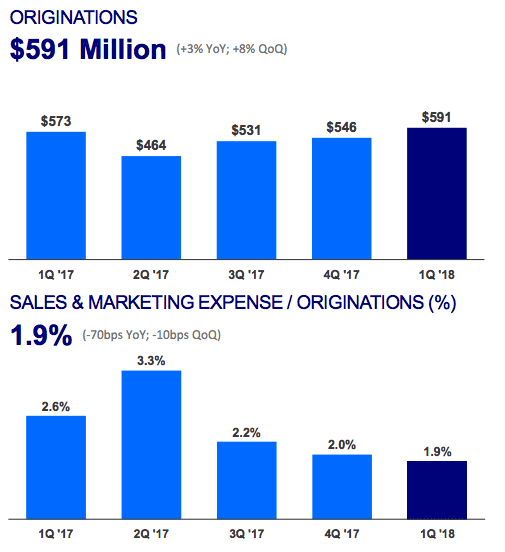

Originations were up 8% from the previous quarter at $591 million. At the same time the company was able to control sales in marketing costs which came in slightly lower than the previous quarter. This is a significant decrease from the prior year period.

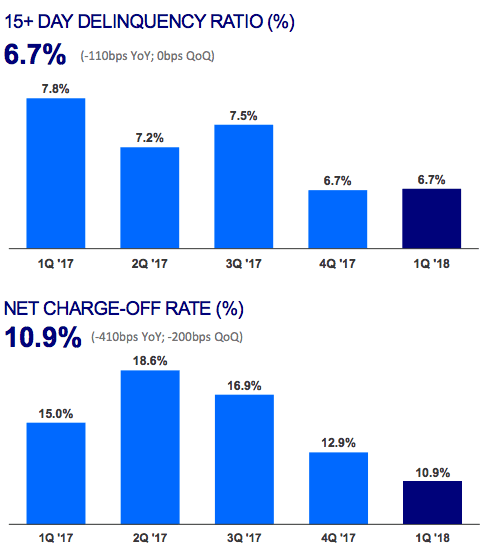

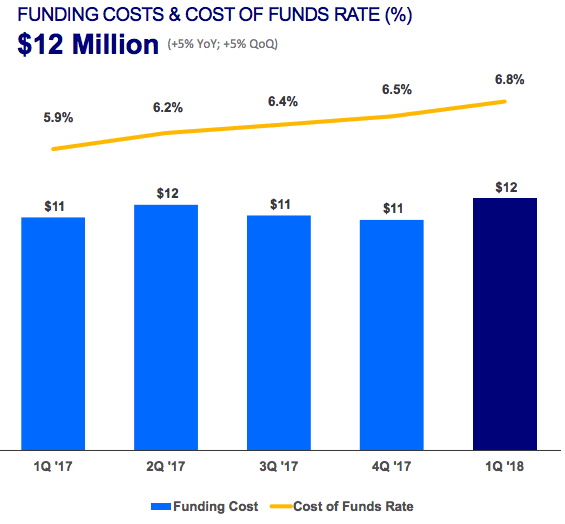

OnDeck’s business is highly impacted by interest rates so I imagine we will see this continue to be a hot topic going forward. As interest rates climb so too does the average loan pricing on OnDeck loans. This also has an effect on the performance of these loans which results in the metric I wrote about earlier called effective interest yield. On the funding side, OnDeck is also affected by interest rates with their cost of funds. So far delinquency ratio and net charge offs are trending in the right direction, but you can also see in the second chart that their cost of funds rate has been increasing slowly, but steadily as expected.

OnDeck announced two financing transactions in April that will help control funding costs. Per the press release:

The first, a $225 million securitization, has a weighted average fixed interest rate of 3.75% and the highest rating ever for an asset-backed securitization of small business loans in the online lending industry. The second, a new 4-year, $100 million asset-backed revolving credit facility, has a rate of 1-month LIBOR +2.00%, the lowest variable rate of any of OnDeck’s funding facilities.

One other milestone worth noting is that OnDeck began their pilot of instant funding with the Visa card network in April. This pilot will be expanded in May and is a feature we’ve seen offered from other online small business lenders. It allows for funds to be distributed instantly to a Visa card which can be extremely valuable to small business owners who value that speed.

OnDeck updated their full year guidance by slightly increasing the lower end of gross revenues, net income and adjusted net income.

Guidance for Second Quarter 2018

- Gross revenue between $91 million and $95 million,

- Net income (loss) attributable to OnDeck between $(3) million and $1 million, and

- Adjusted Net income between $1 million and $5 million.

Guidance for Full Year 2018

- Gross revenue between $372 million and $382 million,

- Net income attributable to OnDeck between $0 million and $10 million, and

- Adjusted Net income between $18 million and $28 million.

Conclusion

On the earnings call CEO Noah Breslow reiterated their five strategic initiatives for this year: grow responsibly, strengthened credit management, invest in high-growth areas, enhance our product offerings, and drive operating leverage. With their Q1 2018 earnings they are well on their way to executing on these initiatives. Credit appears stable, originations are growing, they have reduced their costs and teased some new products they are working on. What will be most impactful on the business though are their investments in growth areas. If and when will the JPMorgan Chase partnership ramp up and what will be the impact of their new bank partner are certainly on the minds of their shareholders.