In the wake of MiCA, the European crypto industry is set to get much stricter. Aimed at cleaning up the “wild west” of the crypto industry, the bill won’t go into effect until late 2023. However, businesses are already responding.

Yesterday, it was announced that Revolut, one of the largest Neobanks in Europe, had been given the regulatory seal of approval from the Cyprus Securities and Exchange Commission (CYSEC).

This approval, the first of its kind from the regulatory authority, will allow Revolut to set up a crypto hub in Cyprus, providing exposure to crypto services for all its 17 million Europe area users.

Cyprus as a cryptocurrency Hub

Although the CYSEC is issuing this first approval to Revolut, the country is no stranger to the crypto industry. In early June of this year, The government of Cyprus passed a bill to establish itself as a premier destination for digital asset innovators and companies.

The Distributed Ledger Technology Bill was published for public comment in 2021 and is now undergoing legal vetting. It clarifies the policies around digital assets and amends existing property and tax laws to allow for the new assets.

“What we see as an opportunity for Cyprus and what we’re working on is to develop a new pillar of our economy,” said Kyriacos Kokkinos, Cyprus’ deputy minister to the president for research, innovation, and digital policy. “Through focusing on the technology sector, especially on new and disruptive technologies like fintech and blockchain, we aim to build a new pillar of the economy that will give economic competitiveness and social prosperity.”

Revolut will join the likes of Crypto.com, Bitpanda, eToro, and CMC markets, all of which have a base in Cyprus.

According to AltFi, Revolut representatives say Cyprus was chosen after an “in-depth survey of all EU countries,” with CYSEC selected due to the country’s “sophisticated and robust regulatory regime, as well as the strength of the existing crypto industry in Cyprus.”

Revolut Expand their crypto offering.

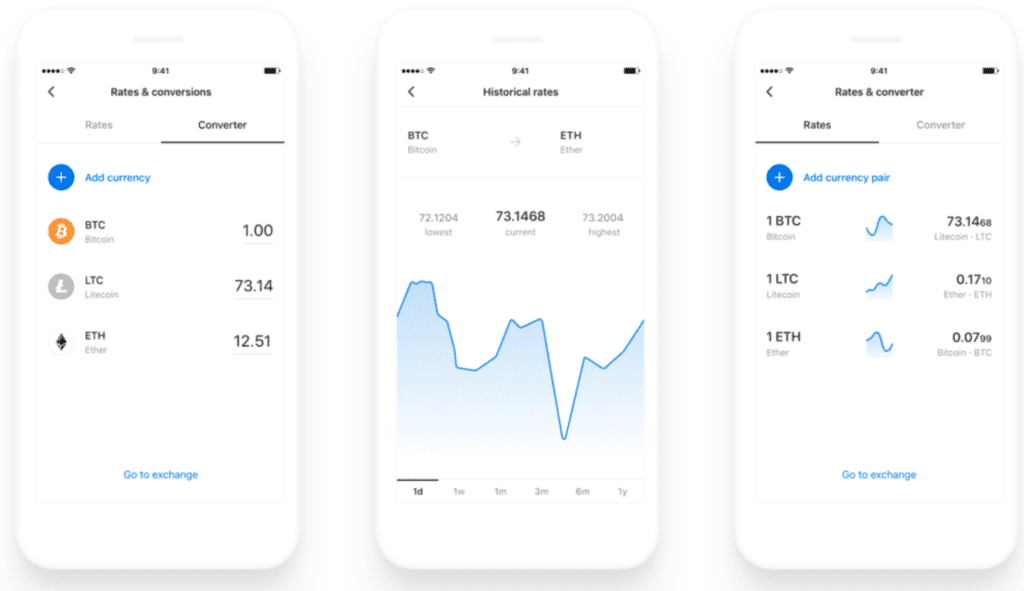

Revolut has been slowly expanding its crypto services, with its current cryptocurrency offering standing at over 80 different tokens. This follows the news of an additional 22 tokens made available on the platform at the beginning of this month.

In addition, their “Earn and Learn” feature, which aims at educating the bank’s users and rewarding course completion with tokens, also launched just over a month ago. The feature has attracted over 1 million users in the short time it has been live.

The new regulatory approval from CYSEC will allow the neobank to continue offering these services even after the MiCA bill comes into effect.

“We welcome the EU-wide regulation and wholeheartedly embrace the European Parliament’s clear intention to support innovation while requiring strong customer protection measures to prevent any type of market abuse, ” a spokesperson for Revolut said to AltFi.

“In establishing a hub for our crypto operations in the EU, we recognize that CYSEC has in-depth knowledge of crypto and its efforts to be a leader in crypto regulation.”

Revolut will continue to offer its crypto services in the UK, the app’s single largest userbase. However, they still await regulatory approval from the FCA. Currently running under the FCA’s Temporary Registration Regime, their application for full registration remains unresolved.

RELATED: