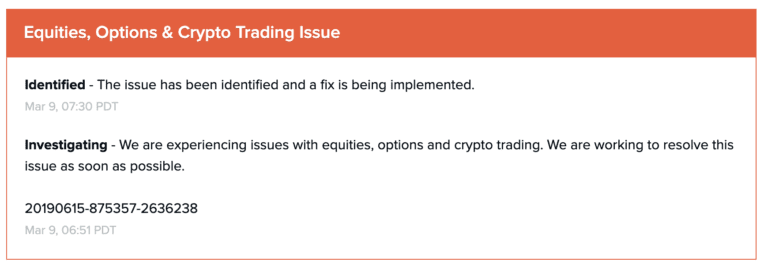

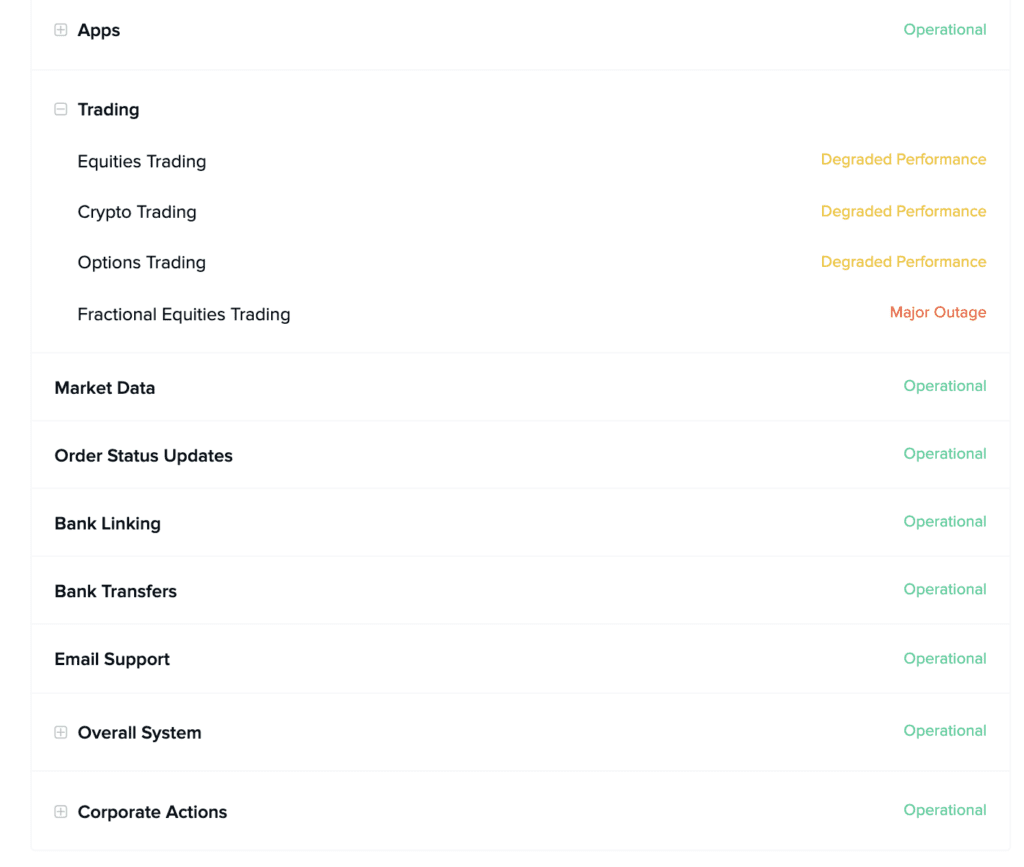

I can’t imagine the frustration of Robinhood users. One week ago the brokerage firm that pioneered no-fee stock trading encountered a major outage and users were unable to make trades. The very next day they experienced another outage and then again today Robinhood reported yet another outage. It comes at a time when the markets remain volatile which has increased the amount of media attention. Robinhood shared that they would evaluate complaints on a case by case basis and at the same time offered a discount of $15. The first lawsuits started to be filed last week and there is now a petition on Change.org to “Ban Robinhood Financial LLC from FINRA”. Below are two screenshots taken on March 9 from Robinhood’s website sharing the outage.

While unfortunate for the millions of Robinhood users, there is something bigger at risk to the fintech industry. Consumer relationships with financial institutions of all kinds are built on trust. It’s this trust which prevents some consumers from switching to a different provider altogether.

Robinhood’s problems may potentially give fintech a bad name and the news could damage the reputation of other fintech companies. Consumers should hold fintech companies to a higher standard than that of traditional financial institutions who are of course not immune to their own issues. Both TD Ameritrade and Charles Schwab also experienced technical issues with some clients in recent weeks.

Hopefully, Robinhood has learned from their experience over the last week and will put in measures to make sure this doesn’t happen again. Unprecedented transactions for a brokerage company should never come as a surprise. For the rest of the fintech community, it is important to continue to show that not only are our products superior to the offerings by traditional financial institutions in the market today they are also robust and trustworthy.