Companies across many industries have fared well serving the needs of the middle and upper-middle classes, yet convenience and quality of service were missing from IRA and 401K accounts for a long time.

Henry Yoshida is changing that.

He is the CEO of Rocket Dollar, an alternative investment platform that allows individuals to invest in alternative assets.

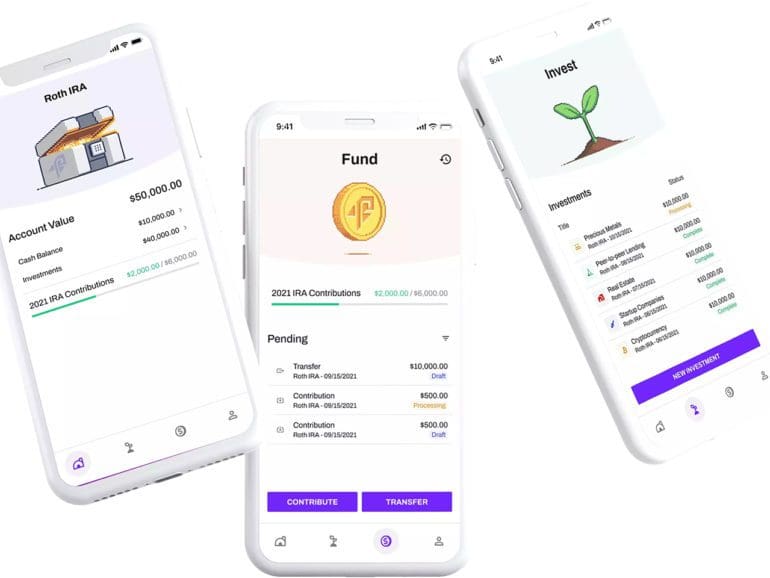

Its recently improved platform will enable people to sign up in less than five minutes and use only six screens. They help people gain exposure to a broader range of assets that the rich long have had.

After graduating, Yoshida spent a decade at Merrill Lynch, where he specialized in setting up small company retirement plans.

He then created an SEC-registered RIA acquired by CAPTRUST and Honest Dollar (now Marcus Invest) that Goldman Sachs acquired.

Given his background, Yoshida wanted to let people unlock the power of their IRA and 401K accounts by giving them the ability to purchase private and alternative investments, anything from cryptocurrency to physical real estate to even a piece of a private venture or equity fund.

Tech-enabled workflow

“Anything private, they can own inside of an IRA using our platform,” Yoshida said.

Rocket Dollar doesn’t offer investment opportunities. They provide a tech-enabled workflow platform that lets people create their own IRA. The company is paid to unlock that money and maintain the regulatory and reporting requirements.

Yoshida described it as an IRA bank account where customers make their own investments but need to wire ACH or conduct other transactions allowed within an IRA.

Yoshida said that the 60/40 stocks and bonds ratio we’ve been taught as the successful retirement formula hasn’t held up for most of his two-decade career. The two asset classes have moved in lockstep for that entire time.

“What we helped facilitate is for folks that are not beginning investors, but let’s say mid-career, (who) have anywhere from $50,000 up to $2.5 million in investable monies, that a 60/40 portfolio won’t suffice,” he said. “You actually will generate higher returns with better diversification and less risk if you incorporate some percentage, whatever you’re might be comfortable with, into something that’s not a traditional public-traded stock-bond or mutual fund.”

“I enable people with their regular IRAs if they have some money saved up, to now be able to diversify the way that a wealthy, very wealthy individual or an institution has actually always done.”

Not stocks or bonds

And remember, alternative investments mean anything that is not a traditional stock or bond. If they meet the criteria, it could be cryptocurrency, a private real estate fund, or even an early-stage angel investment.

“I think it’s pretty empowering because we’re able to tap into one side of a capital pool, which is about $13.5 trillion today; very long-term, relatively illiquid money in the form of you can’t use it to spend, but you can, if you’re invested in stocks, you take it in and out…You may be able to use a small portion and go bet on the company at the earliest stages, or if you find them later on the website like Equities, it could be that growth stage but still pre IPO, which is where there’s a lot of potential upsides.

“We’ve seen that play out in the markets because now the same companies 15 years ago that would have gone public and existed as small and micro-cap publicly traded companies are actually now taking serious C D and E rounds from hedge funds and late-stage venture companies.”

The ethos of Rocket Dollar is it is hard for the retail investor to diversify the way institutions and high net worth individuals have done for so long. Yoshida said he’s long thought about how to level that playing field. Some make asset classes available to investors on platforms, but Rocket Dollar approaches it differently.

‘Unlock the money’

“We can unlock the money that typically can’t go into these types of private investments and make it available for doing private alternative investments. There’s there plenty of companies creating marketplaces and platforms for alt investments. Still, I would argue that most of them are in the business of trying to create an investment product or an idea or securitizing some investment, and we’re in the business of helping people unlock money that they already have.”

Yoshida disagrees with people who think regulatory bodies will be in the business of creating more restrictions. With $13.5 trillion in IRAs and more when you add in 401Ks, such large sums mean regulations will actually make it easier for people to go into investments of their choosing.

“There’s too much money to put too many guardrails around. You look at 10 years ago. It looked like Uber and Lyft were going to get shut down by various local municipalities and taxi organizations. Now it looks like the public actually wants the flexibility to have different types of shared-ride options for transportation options.

“We can exist to regulate them, but we’re not going to exist to restrict choice. It’s going to happen in the investment world. I think they’ll create more regulations, especially around cryptocurrencies. They are already suggesting maybe upping the reporting requirements for private investments. I’m supportive of that. I think that that actually is a good thing. I don’t think they’re going to restrict like, you can invest in this or that you can invest in that-type of regulation.”

Broader platform on horizon

Yoshida sees Rocket Dollar becoming a broader platform for middle and upper-middle-class Americans who do not have the private banking capabilities long enjoyed by HNWs served by the Goldman Sachs of the world.

“Our goal is a company’s to actually be a broader platform for the massive fluid retail investor,” Yoshida said. “And that means that my team and I have a responsibility to keep delivering products and features that are both relevant in demand by that sub-segment of the population.”

Fintech 1.0 was all about the democratization of access to regular, middle-class financial products, Yoshida said. Now 2.0 will be focused on meeting the clear need for private banking services for folks making between $200,000 and $2 million.

“I that’s actually the big blue ocean part of the economy that we’re going after, and in wealth management, no one’s specifically going after that target segment, but I think that Marriott, Southwest Airlines, Nordstrom, Disney+, Netflix, and Costco are living very well in that sub-segment of the US population. I just wanted to complete the circle and see Rocket Dollar be the financial services company for that demographic in the United States.”

Rocket Dollar recently hired Mike Panzarella as its chief technology and product officer.

A long-term advisor to the company, Panzarella was most recently at Block (nee Square), where he helped launch their internal bank charter.

He was also CPO and Green Dot and has overseen the build and distribution of several consumer fintech products now used by millions of consumers.

Product officer was key

Yoshida said that Panzarella played a crucial role in overhauling Rocket Dollar’s onboarding process, which has now been streamlined to six screens and under five minutes.

The redesigned user interface allows investors to manage different types of Rocket Dollar accounts using one login and the integration of Rocket Dollar’s patented fund transfer module for full funding transparency.

Rocket Dollar also employs a password-less architecture, with the customer’s phone number used as part of an enhanced, two-factor authentication process.

“We’re trying to strike that right balance of great customer experience and ease of onboarding, along with making sure that we check all the necessary boxes for the correct information, the correct security procedures,” Yoshida concluded.