![]() For a majority of investors there are two ways to access the family rental market, either buying a property directly or purchasing a publicly traded real estate fund or REIT. Roofstock first tackled opening up individual direct ownership by creating a platform for buyers and sellers of single family rentals. To date, they have transacted over $1 billion on the platform which allows investors to browse properties in select markets. Most often, these homes already have tenants in place. The platform removed a major hurdle for investors to access real estate if the numbers simply didn’t work locally. You can learn more about this offering in our Lend Academy podcast episode from October of 2018.

For a majority of investors there are two ways to access the family rental market, either buying a property directly or purchasing a publicly traded real estate fund or REIT. Roofstock first tackled opening up individual direct ownership by creating a platform for buyers and sellers of single family rentals. To date, they have transacted over $1 billion on the platform which allows investors to browse properties in select markets. Most often, these homes already have tenants in place. The platform removed a major hurdle for investors to access real estate if the numbers simply didn’t work locally. You can learn more about this offering in our Lend Academy podcast episode from October of 2018.

Earlier this year Roofstock launched Roofstock One, which is a hybrid between the completely hands off approach a REIT offers and still having direct ownership of an individual property. I spoke with CEO and Co-Founder Gary Beasley to learn more about this unique offering and how they position the product.

Roofstock One is a platform which allows fractional ownership on rental homes with minimums as low was $5,000. It is truly a passive product where everything from financing to property management is taken care of. Interestingly, it was born out of feedback from users. Beasley spoke with people who had been on the original Roofstock.com platform over 20 times but had yet to make a purchase. He learned that potential investors were paralyzed by the choice of picking an individual property and some were reluctant when it came to financing. Some investors didn’t want to be on the title of the property and others simply expressed concerns over dealing with property managers/tenants. That, coupled with the lack of diversification when you invest in one property is how Roofstock One was born.

So how does Roofstock One compare to REITs? As I alluded to earlier there are many ways to get access to real estate. REITs or real estate investment trusts are similar in that you are invested in the same asset class. One benefit of direct ownership is that you are much less correlated to the equity market according to Beasley. Some REITs in the market today currently have low yields and instead count on the equity appreciation. Investments through Roofstock One aim to provide more income and you can also select the markets you’re interested in. One of the downsides for some investors is that you need to be an accredited investor to access Roofstock One.

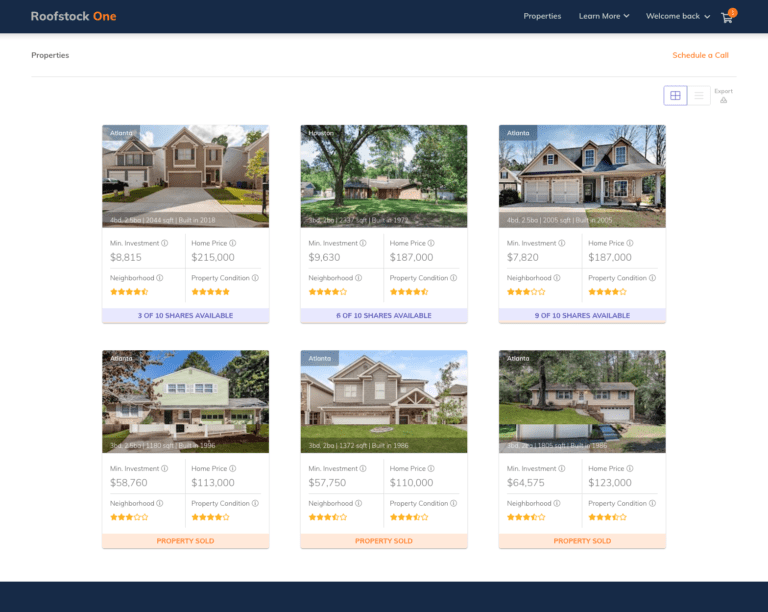

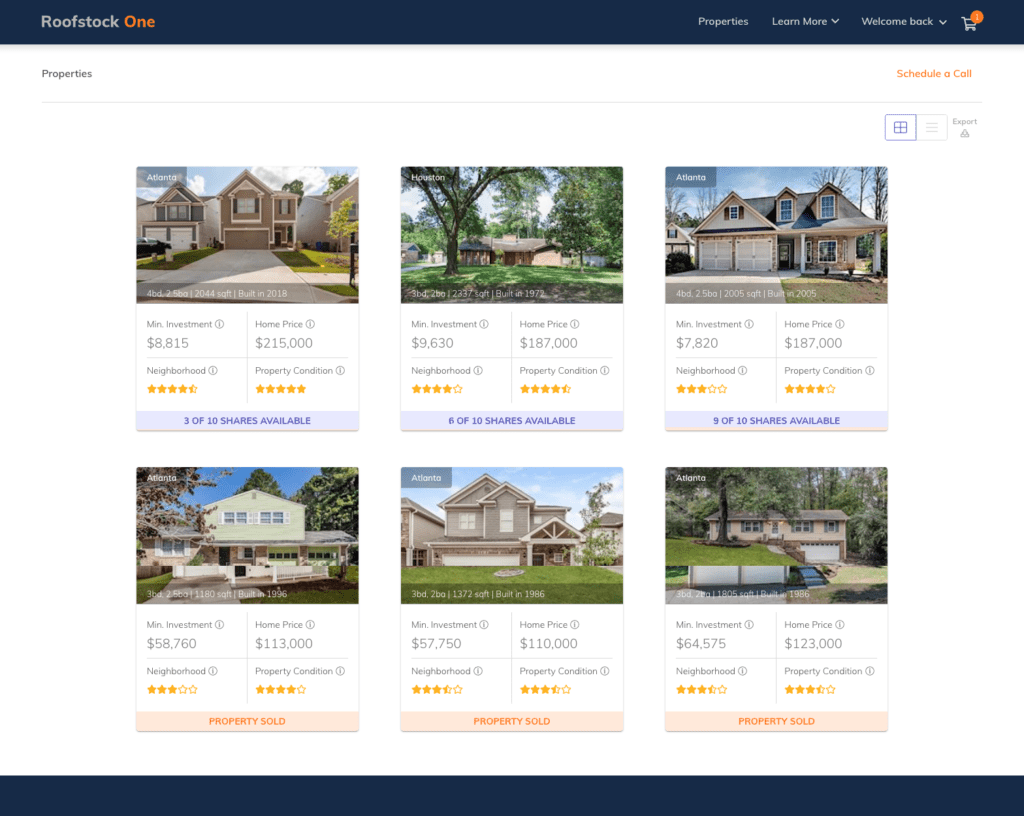

When you log in to the site you are presented with all of the details on the property including the price per share. As an example, you might pay $6,645 for 1 out of 10 shares for a house priced at $129,000 and thus hold 10% ownership in the house. Note that this represents only half of the cost of the home. The rest is financed by Roofstock and they also purchase at least a 10% ownership in the property for the first year so interests are aligned. Part of the proceeds of the shares are allocated to reserves which will pay for any maintenance. If the reserves are ever not sufficient to cover expenses, Roofstock One will draw additional debt on the property to avoid capital calls. Below is a screenshot of Roofstock One in how deals are presented.

I was curious to hear how the team at Roofstock is making all of this possible since it does diverge quite a bit from their core offering. One of the main things the company did to make Roofstock One a reality is to purchase institutional level property management company Streetlane Homes. This allows for Roofstock to act as the asset manager which ultimately makes all decisions related to the property.

As far as how these deals are structured, investors are buying a share in a series of a trust. It is a Delaware statutory trust and each homes sits in a separate series. Investors are able to access liquidity options after a six month holding period where they may exit by selling their series interest. Investors have two options when it comes to liquidity:

- Try to sell their shares at whatever price the market will bear after an initial six month holding period.

- Or Roofstock agrees to provide a backstop to buy shares at a discount equating to 92.5% of the fair market value minus a pro rata share of outstanding principal and interest on the loans. This second option ensures that investors will be able to exit the investment quickly.

Beasley noted that Roofstock One has a pretty tight buy box and is currently live in Atlanta, Dallas, Houston and Indianapolis. In these markets they target specific neighborhoods, bedroom setups and price points which make for attractive returns. These homes are purchased directly for Roofstock One and oftentimes Roofstock takes care of renovations to get the property ready.

Similar to the original Roofstock offering, Roofstock One makes a spread of 3% when a home is sold into the trust. They also earn long term property management fees along with the interest by providing the financing on the properties.

Conclusion

It’s still relatively early days for the platform as Roofstock has purchased about 100 homes for Roofstock One, a majority of which have already been sold. There are plenty of opportunities for expansion which Beasley shared. In the future you could see banks and insurance companies acting as the lender on the properties and on the investor side we could see wider distribution to RIAs who value this type of ownership and the low fees of Roofstock One. It’s a unique offering that the company has built and it will be interesting to see where it goes from here as they continue their quest of opening up opportunities for investors to access the single family rental market.