For many years there have been few opportunities for yield which is one of the reasons some investors turned to marketplace lending or real estate. For those looking into safe investments there weren’t any appealing options as savings deposit rates and CD rates at banks haven’t been attractive for years. Since Lend Academy attracts fixed income investors it’s no surprise that they have been watching rates closely.

This thread called Cash Parking on the Lend Academy Forum was created back in December 2016 and since then, forum members have discussed opportunities at banks and credit unions. Forum members have discussed where it makes most sense to have their money and how other investment opportunities like marketplace lending compare.

The discussion caught my eye when one user posted a 3% 5 year CD which happened to be offered by my local credit union. Since these accounts offer FDIC insurance earning 3% guaranteed by the government is a good deal some investor’s eyes. In fact this is the best deal in almost 10 years. I have since been following CD rates and savings deposit rates at various banks over at Bankrate.com which I find is a simple site to use. Another website mentioned on the forum thread is DepositAccounts.com by LendingTree.

Signing Up for a Savings Account at Marcus

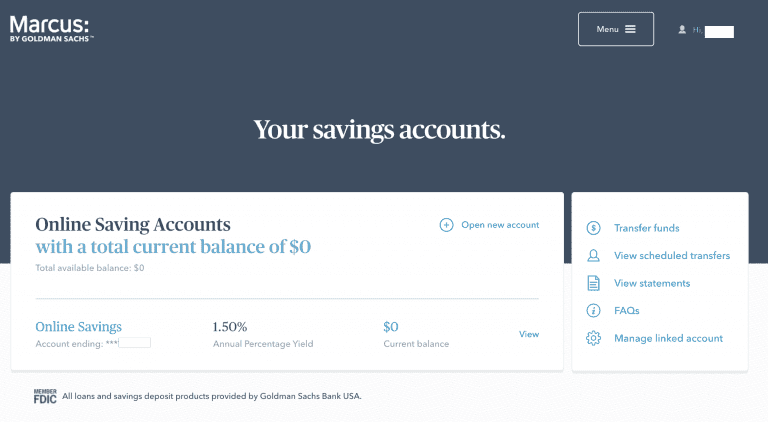

Although rates vary from day to day by any given bank, Marcus by Goldman Sachs has been near the top of the list since I began checking. We last did a piece on savings account rates back in June 2017 when Goldman Sachs’ deposit accounts were still branded under GS Bank. Rates are now 30 basis points higher at 1.5% on Marcus accounts. I already hold one savings account at Ally which tends to be competitive with other banks and as I was looking to open up another savings account I decided to test out the newly branded Marcus by Goldman Sachs.

The user experience was about what I expected as the branding around Marcus has always been simple and modern. The signup process was straight forward as they took a minimalistic approach to signup as well as the account homepage. A few screenshots from the process are included below.

Marcus has invested heavily into consumer finance and the newly branded Marcus savings accounts are just one example. Their investment has paid off and it was recently reported that they had $17 billion of deposits. These deposits can be drawn on to fund the personal loans branded under the same name. Since Goldman Sachs acquired GE Capital’s retail deposits, deposits have grown a whopping 90%.

Conclusion

With rates where they currently are it is probably a bit too early to get excited with more rate hikes expected this year. However, a strong case can be made for holding your savings account at one of the banks with current rates in the 1.5% range if your bank’s rates are significantly lower. Current CD rates for 1 year are hovering around 2% while 5 year CD rates at the large institutions are around 2.60%. It’s important to be aware of these options and weigh the risk and rewards of each. For me, I am keeping an eye on CD rates as they approach the mortgage rates on my home and investment properties. If I can earn what I am paying in interest on a mortgage I have the additional benefit of the cash cushion for emergencies.

Have you made any changes as rates have increased? Where are you parking cash? Let us know in the comments section below.