The first Bitcoin Futures ETF in the U.S. has gone live.

After months of releasing anti-cryptocurrency statements, the SEC decided late Friday to allow the first crypto-based ETF.

ProShares, a firm that manages hundreds of high-risk, high-yield investing funds, said it would be the first firm to launch.

Investors will be able to gain exposure to bitcoin through the fund, without direct exposure to the volatile currency that traded over $62,000 over the weekend alongside this and other pro-crypto news. On Tuesday morning, the ProShares ETF went live under the ticker BITO at around $40.

After bickering on Twitter with Coinbase and making stances clear in statements to Congress, why has the SEC seemed to change directions?

As Howard Kreiger from the Unfederal Reserve explained, the SEC plans on introducing more crypto regulation in general. And if they are going to regulate anything first, of course, it would be bitcoin-related and take the form of an existing highly regulated product. So, a Bitcoin Futures ETF labeled “high-risk” could be one of the safest, most compliant ways to invest in cryptocurrency in the regulator’s eyes.

“So, the SEC was probably going to, you know, gave risk Bitcoin before anything else. If they’re going to de-risk some aspect of Bitcoin, an ETF application by a well-funded, well regarded, already highly regulated business was kind of a no-brainer.”

ETFs are institutionally traded funds, giant balls of money with usually a set goal, like giving investors in the fund exposure to the top S&P 500 stocks or a cross-section of oil companies or manufacturers.

Kreiger said that in the case of the ProShares ETF, the SEC approved it over the 15 or more other applications because the mechanics of the fund must somehow make up for the risk of being related to Bitcoin.

“I don’t know offhand, but I would if I had to guess it would be something in the way the ETF was structured with some sort of insurance, some sort of risk balancing mechanism that the applicant had to have included in the application.”

The Bitcoin ETF breakdown

ProShares, in their summary application in August, laid out those specifics: the fund will allocate “approximately 25 percent” towards buying month-out bitcoin futures contracts traded on the Chicago Mercantile Exchange.

The Chicago exchange is the only American exchange that can offer futures on bitcoin, and the contracts are big and made for large institutions: this isn’t Robinhood options betting.

The quarter of the fund set for bitcoin futures will be allocated through a Caymen Islands subsidiary of ProShares.

As Dave Nadig writes in his ETF column, those funds may be leveraged in the Cayman Islands to multiple times their size, making the exposure to bitcoin more than just 25 percent, but still through a forging subsidiary.

The rest of the fund will bet on arguably safer plays, like U.S. Treasury bills, money market funds, and, interestingly, Canadian Bitcoin ETFs.

Canada conditionally legalized crypto purchasing by ETFs earlier in the year, and some funds have taken advantage, owning a portfolio of bitcoin, Ethereum, and other coins.

The vast majority of U.S. brokerages have not been able to buy into these Canadian ETFs. Instead, some have argued ETF futures funds are not far enough, that the SEC should allow indexes to buy coins outright.

Kreiger said that even still, this is a significant first step for institutional bitcoin trading. Just returning from a Dubai Blockchain conference, Kreiger said the entire world takes its cues from regulators in the U.S. and China, even if Europe and Canada have bitcoin ETFs.

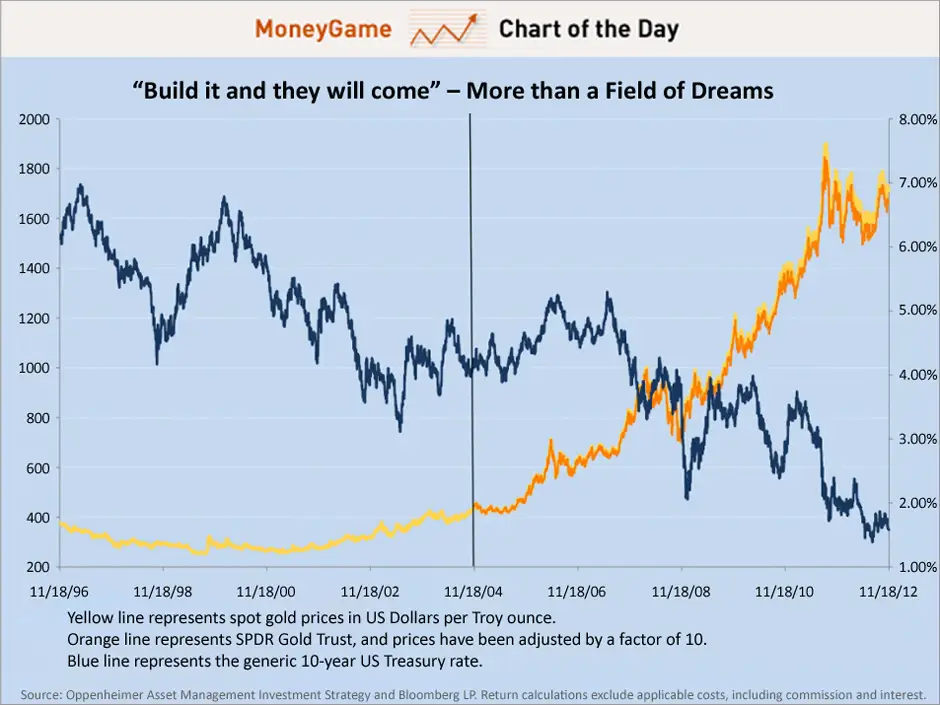

Bitcoin is often compared to gold, another commodity that buyers soak up as a hedge against inflation. Looking back at the commodity, Before Gold Spot ETFs were launched in 2004, it wasn’t easy to invest in the stuff.

Then, according to data from Oppenheimer Asset Management and Bloomberg, the introduction of Gold Trust funds began a seven-year-long price bull run.

Now that Futures are allowed, other firms are already pushing for a Spot market ETF or crypto ETF. Grayscale Investments said Monday it planned on turning its seven-year-old bitcoin fund into a Bitcoin Spot ETF, meaning it would allow investors to gain exposure to purchase bitcoin directly.

At the same time, as bitcoin exposure finally launches on “the big board,” and both the ETF and crypto price are on the rise, regulators are still on the attack.

Regulators still attacking crypto

On Monday, the New York Attorney General went after two cryptocurrency lending companies, ordering them to shut down for exposing N.Y. investors to risk. According to Bitcoin.com news, the two companies Nexo was one, and the Celsius Network was one of the three other firms the AG asked for more information from.

The AG under Letitia James argued that the lending services these companies offer function as unregulated securities. The order said that all securities must be registered with the A.G. office under the Martin Act. The news comes a week after Celsius posted a $400-million funding round at a $3 billion valuation.

In a response, Nexo Co-Founder Antoni Trenchev said that his firm does not offer lending products in N.Y. and that the letter must have been sent to the wrong recipient. The AG also sent out three other letters, asking for more information and compliance from different lenders.

It’s not just the NY AG: the CFTC also hit the stable coin Tether with a $41M fine for misleading claims as to the coin’s backing.

These moves and spats between regulators and crypto firms have caused outspoken comments from the emerging industry.

For example, Coinbase CEO Brian Armstrong called for an outright new regulatory policy because cryptocurrency is fundamentally different than other financial products.

Ripple CEO Brad Garlinghouse agreed in a recent interview with the Information, saying, “The SEC’s posture towards crypto in the U.S. is definitely hurting innovation.”

Kreiger would agree that new types of regulation are on the horizon for the crypto industry. However, as a whole, regulation is only good when industry and regulators work together.

“Regulation is a necessary good,” Kreiger said. “With proper oversight with involvement from companies in the crypto space, smart regulation that protects the consumer and business can be achieved. If either one of those groups tries to act independently, regulators act without industry, or industry acts out and protests: then really the whole system fails, and you end up with a subpar product.”