The rise of fintech and the move of financial services to a more digital plane benefit the masses.

The rise of “customer-centric” fintech has added competition to the financial market, creating improved accessibility and inclusion while offering consumers an expanse of extra services.

However, this has come at a price. Stories of data breaches and hacks are becoming more commonplace. In 2021 there were a reported 1,862 data breaches in the U.S.

In addition, the nebulous nature of how data is stored, used, and sold to third parties, has caused concern for consumers.

Increasing pressure to create digital identities, whether to streamline financial processes or improve competition for the user’s benefit, has made securing digital privacy more critical.

The idea of digital identity has been fraught with controversy, many seeing it as an “end to freedom.” However, the concept of Self-Sovereign Identity (SSI) turns these concerns somewhat on their head.

SSI – A growing market

SSI is a form of digital identity which allows consumers to retain complete control of their data.

“The whole purpose is to give consumers ownership and control over their data and privacy. Allowing them to be able to control what they share and with who,” said Landon Glenn, CEO, and founder of ASA.

In Europe, tests with digital identity are underway; many member states already have government-issued digital identity keys. However, 72% are uncertain about how their data is used.

The US government has also started exploring the idea of digital identity, although they are facing similar consumer concerns.

SSI acts like a private ledger or digital wallet based on the blockchain. Users have direct control of the information they share, which is only accessible with digital keys. Using certificates within the wallet can also give the user credentials and access to financial products without sharing specific data.

Interest in the technology is growing. According to Juniper Research, SSI revenue is expected to reach $53.2 billion by 2026, increasing at a rate of 15.16% per year between 2022 and 2026.

“One of the concepts that ring the truest to me is that you can prove things about yourself without giving up private information,” continued Glenn.

“For example, you could prove that you have a credit score over a certain number without sharing your social security number, score, or any other identifying information you don’t want to share.”

He explained that as a blockchain-based technology, SSI had, until now, encountered reduced adoption. “If you need to issue millions of credentials, sometimes it can take a week or more. I think the next steps for this as an industry is to get it into the hands of the users, get them using the vault, get them connecting and managing their identities.”

Benefitting financial inclusion and empowerment

This alternative way of sharing data benefits financial inclusion and empowerment.

Primarily, it could enhance accessibility to a more competitive marketplace, allowing access to fintechs with reduced trust concerns. Although 90% of Americans now use at least one type of fintech, Ondot found that 74% considered fintechs more likely to sell on their data. Pew Research found 81% of the public feel the potential risks they face because of data collection by companies outweigh the benefits, with many feeling a lack of control over their data.

“I’ve gone into certain apps several times, and then they start asking me for more information; I just stopped giving it,” said Lisa Gold Schier, CSO of ASA. “If you think about it that way, when we talk about financial empowerment, that’s keeping me from using some technology I might want.”

“Now, you no longer have to share that information because we will anonymize that. So you are now able to get the technology you want. Without feeling like you have to give the thing away.”

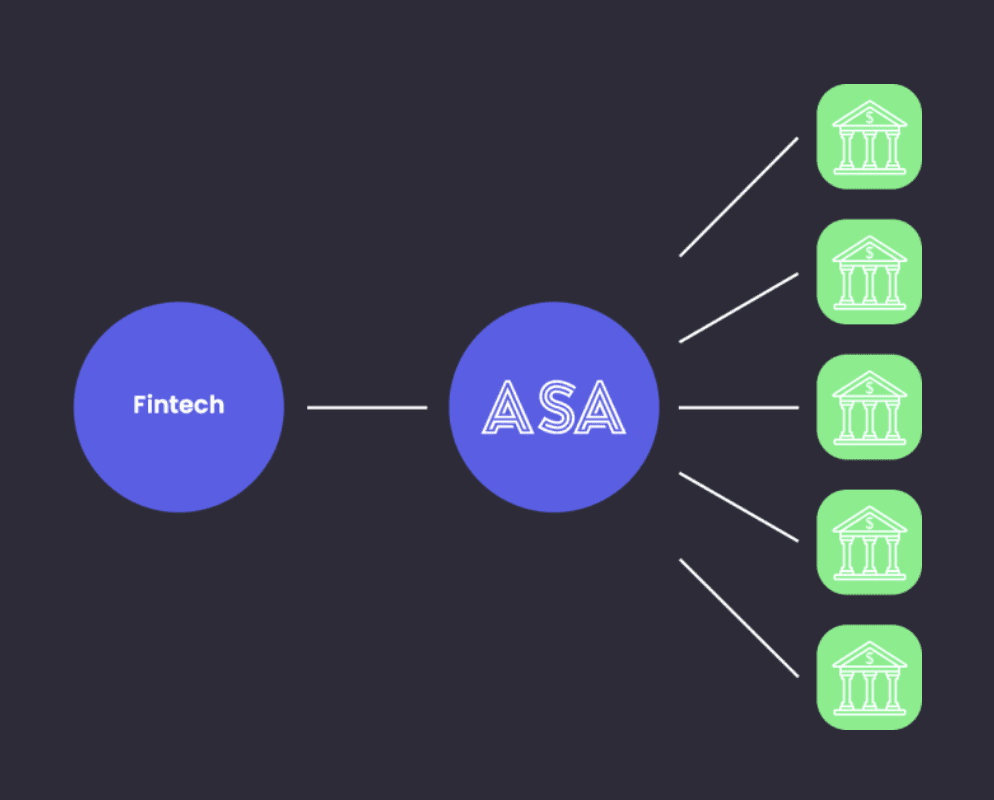

ASA employs the concept of SSI in collaboration with financial institutions and fintechs. Much like a digital wallet, users can store their credentials within the ASA account, which will then be tokenized. This is attached to their trusted primary bank and then connects with fintechs which have added the ASA open API.

“It’s allowing the bank not to have to do one-to-one integrations with each fintech out there,” she continued. “It brings that trust and security.”

“As an end-user consumer, I now feel more comfortable using the fintech that’s out there; I don’t have to share any identifiable information. And it brings scale to all because now we all have that access. So it allows both sides to scale again, for the benefit of the end consumer.”

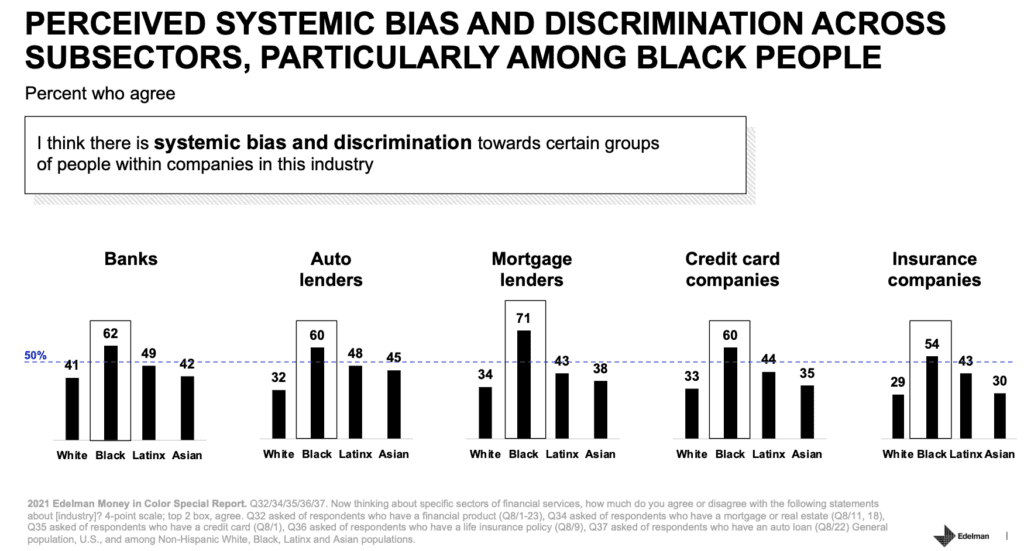

Additionally, SSI could help with financial inclusion. Numerous studies have found that a systematic bias exists within financial services. According to Fortune, 68% of black respondents earning over $100,000 reported a negative experience, compared to 36% of white respondents. The anonymity proposed by SSI could directly facilitate access to financial services based on neutral data.

“All that might have been used in the past, whether or not it was meant to be used to make a decision, that won’t be seen,” Gold Schier continued.

The company solves the technology issue currently facing full SSI models by combining the components of SSI within its third-party framework instead of conducting all verifications through blockchain technology.

“As the technology progresses, we see it as us finishing out the loop, adopting a full SSI model. We’re waiting for the technology to hit the point it needs to hit the scale that we’re going to require to service our customers,” said Glenn.

Creating impact through collaborative banking

“I think one of the biggest impacts is the accessibility of technology,” said Glenn. “When you wonder why hasn’t technology been available before? Why can’t I get apps through my bank? People don’t understand the regulatory burden that banks have. They don’t understand the compliance hurdles that cripple them from being able to innovate, the time it takes for the approvals.”

“The industry is at a fork. Either we have to let fintechs try to become banks, which means they’re now selling credit cards and loans and accounts. But it extends that regulatory burden to them. And now they have to worry about lending, KYC, AML, and on and on. And they have to have that security because they can access the consumers’ finances.”

“The other path is something we refer to as collaborative banking or embedded fintech, and that path allows the fintech to go to market without seeing that regulated data. And so what that means is it opens up the world to where you can have an unlimited number of solutions that go to market very quickly. And they don’t put the customer at risk in any way.”

He explained that by maintaining this flexibility, the market could benefit from fintechs in very niche markets, creating products for specific groups.

“Financial empowerment is getting this technology in the hands of the people who crave and need it, and they don’t have access to it today. They don’t have that kind of help.”