This week, Isabelle sat down with CEO and Founder of Nucleus Commercial Finance, Chirag Shah, to talk about super app innovation.

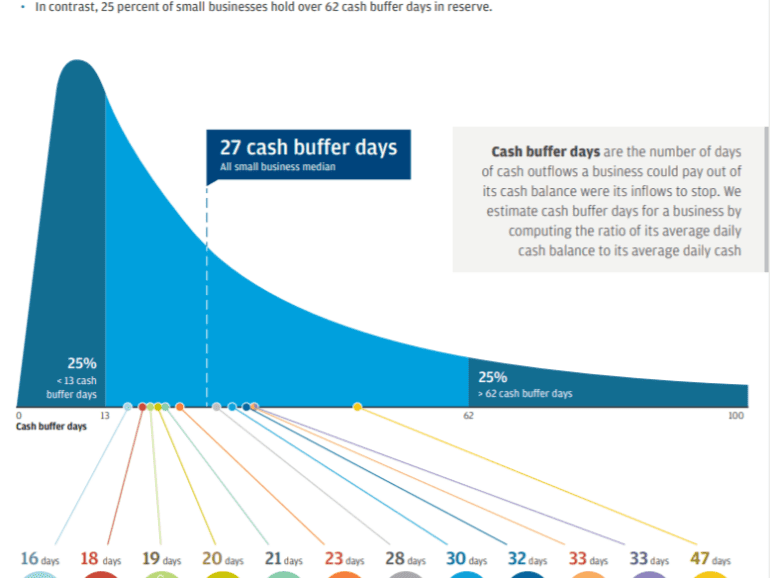

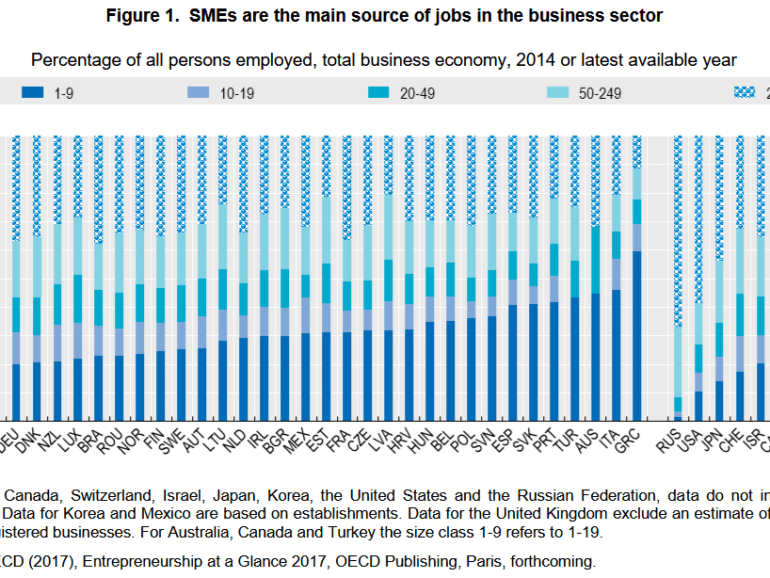

Another heavy week. It is hard to find the right, or even the interesting, thing to say. I look at why the $2 trillion in US bailouts may not even be enough to stave off the economic damage. In particular, I am alarmed by the large and fast rise of unemployment claims (higher than 2008 peak), estimates that GDP may fall by 20-30%, and the broad impact on small business. Small businesses have 27 days of cash on hand, and power half of our economies through both employment and output. So how do we meet this challenge? What strength should we draw on in the moment of doubt to become the artists of tomorrow?

Funding Circle was approved for a 7(a) license by the SBA but now there are some in Congress that want to take that away from them.

Chinadigital lendingeCommerceMetaverse / xRneobanksmall businessSocial / Communitysuper appsupply chain / trade

·This week, we cover these ideas:

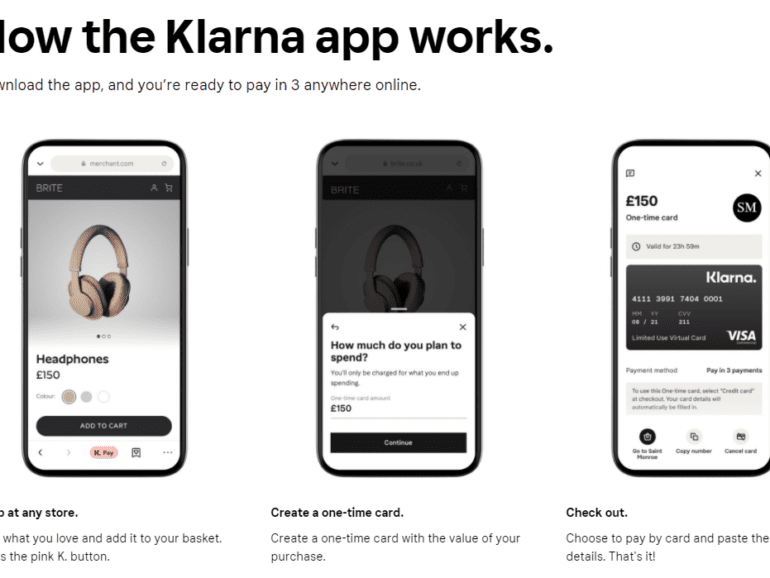

Klarna’s $640 million raise and its $45 billion valuation, and how its business model arbitrages the payments revenue pool to build a lending business

Pinduoduo’s growth path to a $150B marketcap, and the links between shopping, media, and financial mechanisms that help it compete with Alibaba

A comparison of approaches to growth and economics

Implications for crypto assets for capturing “the real economy”

Klarna is raising $640 million on a $45 billion private valuation, with over $1 billion in net operating income. The buy-now-pay-later company has over 90 million active customers and 250,000 merchants. It was founded in Sweden in 2005.

On the other side of the ocean, Chinese ecommerce company Pinduoduo is beating Alibaba with 820 million active buyers, generates over $3 billion in revenue per quarter, connects buyers to 12 million farmers, and has a market capitalization of $150 billion. It was founded in China in 2015.

I have been reading Alibaba: The House that Jack Ma Built this week, something everyone interested in understanding the future of Google, Goldman, Uber, or Amazon should do. The narrative starts with China's small business explosion, and Ma's genius is to tap into global demand for the products of those businesses through an online marketplace and associated financial services. But I am getting ahead of myself. Let's pause to acknowledge a massive, systemic transaction that was announced this week: payments processing company Global Payments acquiring TSYS (Total Payments Systems) for $21.5 billion.

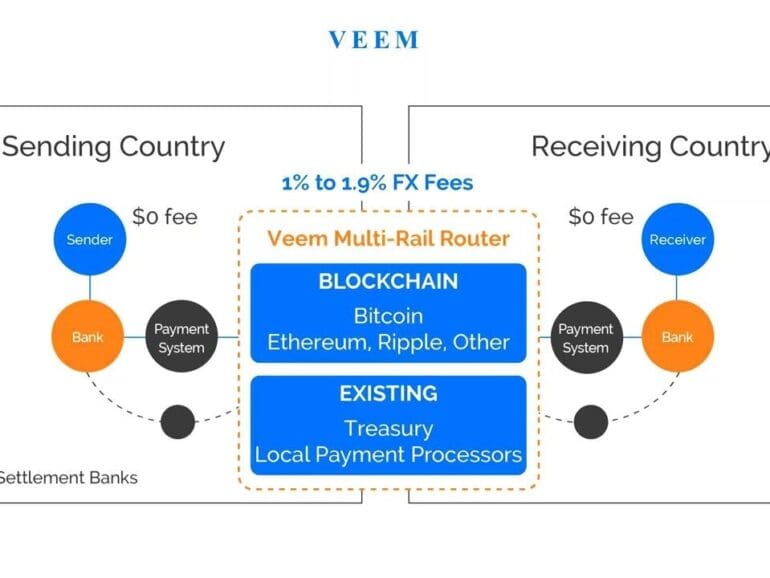

In this conversation, we talk with Marwan Forzley of Veem about how the rampant evolution of the mobile phone spurred his fascination to turn the phone into a business-to-business (B2B) payments network. Additionally, we explore how generations of companies have tried to use correspondent banking to solve for B2B cross border and failed, the intricacies of payment rails and the infrastructure to support them, the impact of COVID on global e-commerce, how the future will blend the distinctions between digital wallets, banking services, and crypto wallets.

The SBA is making updates to its lending program opening the door for fintechs. But much more needs to be done.

The economic climate has caused many to turn away from SMB finance. Banks could provide fintechs with the stability to ride out the storm.

A report reveals that 9 in every 10 SMBs in the region are currently underserved. This presents an opportunity for Latin American fintechs.

·

Small businesses have shown high demand for real time payments. Fintechs may be a key for smaller banks to fulfil it.