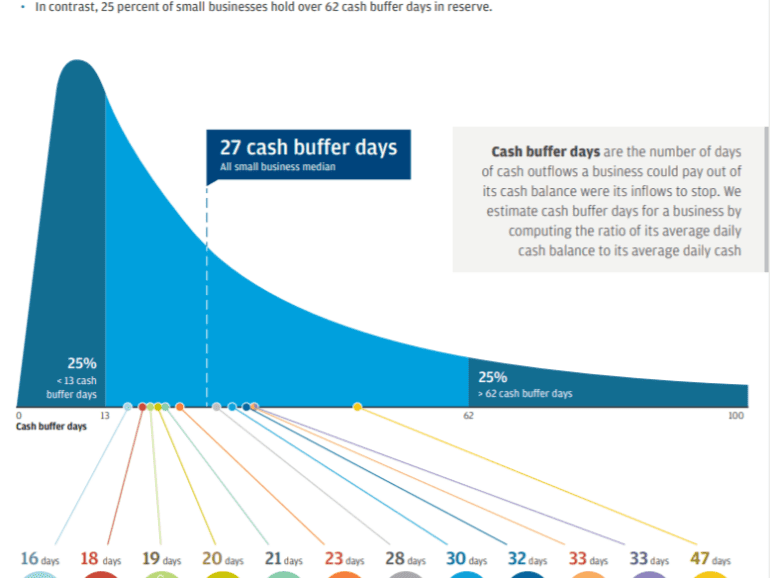

Another heavy week. It is hard to find the right, or even the interesting, thing to say. I look at why the $2 trillion in US bailouts may not even be enough to stave off the economic damage. In particular, I am alarmed by the large and fast rise of unemployment claims (higher than 2008 peak), estimates that GDP may fall by 20-30%, and the broad impact on small business. Small businesses have 27 days of cash on hand, and power half of our economies through both employment and output. So how do we meet this challenge? What strength should we draw on in the moment of doubt to become the artists of tomorrow?

·

Small businesses have shown high demand for real time payments. Fintechs may be a key for smaller banks to fulfil it.

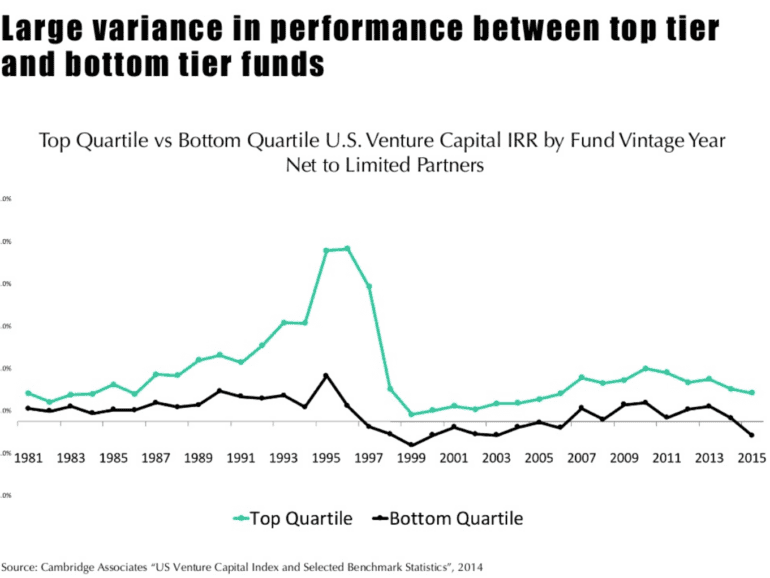

We look at why venture capital investors are slowing down, and the dynamics of how their portfolios work under duress. We talk about the incentives of limited partners to derisk exposure, the implication that has on cash reserves, new deals, and fundraising. We also touch on how the various Fintech themes are responding to an increase in digital interaction while seeing fundamental economic challenges. Shrewd competitors will be able to consolidate their positions and gain share during the crisis, but that will have to come from the balance sheet, not intermittent growth equity checks.

No More Content