I've seen a whole bunch of headlines this past week about how Facebook is launching its version of the "Supreme Court", as if that were an app feature. The oversight board is meant to police controversial content decisions, and have the power to overrule Zuck's judgment on political matters. Its charter is drafted as if Facebook's 3 billion users were citizens of an Internet nation. Add to this the insanity over WeWork's failing IPO plans, where the CEO has been personally named in the amended filing documents with clear checks on demonstrated abuses of power. We are drifting into a Twilight Zone episode where modern corporations act as if they were feudal states run by divine kings negotiating with their nobility over a Magna Carta. Which is actually sort of where we are.

Let’s look at the recent Fortnite blackout and compare it to neobank Chime's embarassing down time, as well as explore the business model implication of what it means to be the social square where people hang out. Does Finance have such an equivalent? Maybe it is Venmo, crypto Twitter, or the credit unions. We also look at statistics behind influencer marketing, and how influencers have usurped the position of music labels. Perhaps banks should get ahead of this game too.

Chlöe Swarbrick, a 25-year old climate MP was presenting her climate change case to the New Zealand parliament, and was heckled by an older audience member. Without missing a beat, she acknowledged and dismissed the challenger with a pithy “Ok, Boomer.”

The recording has since gone viral, inspiring everything from merchandise to Vogue articles. While the incident isn’t the source of the phrase “Ok, Boomer”, today it is the most well known manifestation. So what does the phrase mean? If you are inclined to more colorful language, see Urban Dictionary. But the meaning is obvious on its face — Gen Z is dismissing utterly and without consideration the judgment and protestations of society's elders on multi generational issues like economics, climate change, and social norms.

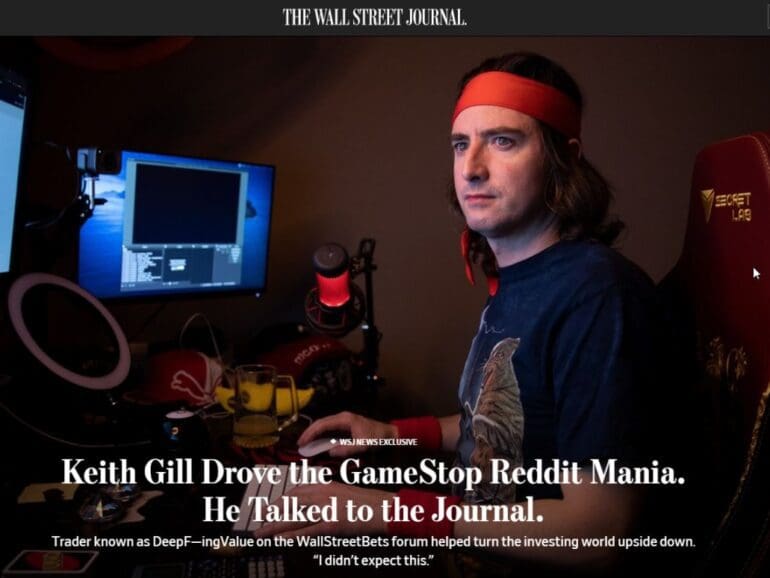

Despite its best efforts to the contrary, Robinhood did end up stealing from the rich and giving to the poor.

Melvin Capital, the $8 billion hedge fund that didn’t find GameStop funny, lost 53% of its portfolio in January ($7 billion) trying to short against the rallying cries of the Reddit Capitalist Union. Gabe Plotkin also faces the embarrassment of having to get bailed out by your old boss.

Speaking of, New York Mets owner and former name-on-the-door of SAC Capital, known most recently for its insider trading fine of $1.8 billion, Steven A. Cohen, put $2.8 billion of capital into Melvin’s fund.

Ken Griffin, owner of the Citadel hedge fund (an investor in Melvin), and Citadel Securities (a massive market maker and buyer-of-order-flow for Robinhood), is seeing capital losses in the former and Washington cries for scrutiny into market structure in regards to the latter.

Robinhood itself — which for goodness sake is *not Wall Street*, but as *Silicon Valley* as it possibly gets — raised $1 billion immediately to protect itself from class action lawsuits, DTCC capital calls, and a now-rapidly-closing IPO window. That means Yuri Milner of DST Global chipping in yet again.

That’s at least 4 people that have had a very bad, no good day.

This week, we look at:

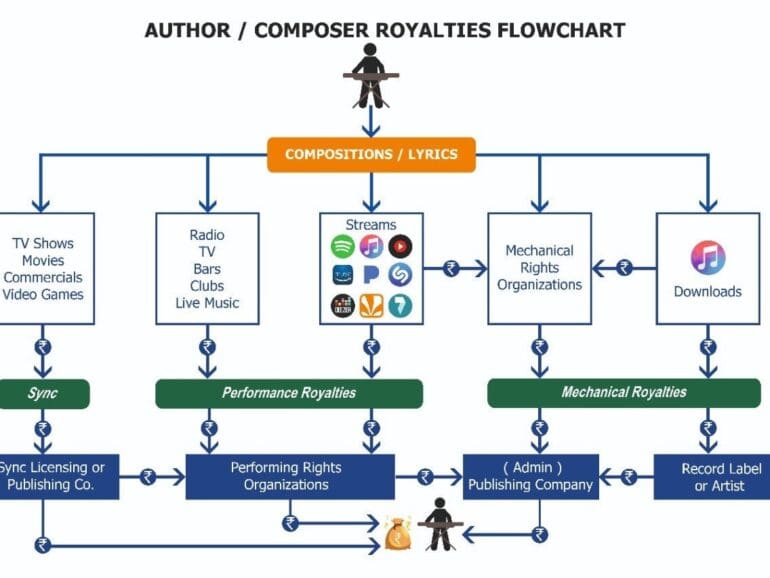

Square acquiring Tidal and its 1-2 million of subscribers for $297 million, and the logic for what a payment processors has in common with the creative industry

How celebrities and creators like Mark Cuban, Gary Vaynerchuk, Grimes, 3LAU and others are generating millions in NFT sales

The impact on the economic model of the music industry, including a look at royalty structures, revenue pools, and financial vehicles when tokenized

The philosophical divide growing between a feudal platformed commons (e.g., YouTube) and a collectivist anarchist capitalism

In this conversation, we talk with Camila Russo of The Defiant and author of The Infinite Machine, about her journey as a successful financial journalist was derailed by the Crypto boom and subsequent winter of 2017. Additionally, we explore the success behind her first book, the nuances of the NFT craze, and how The Defiant became one of the most popular crypto media brands to date.

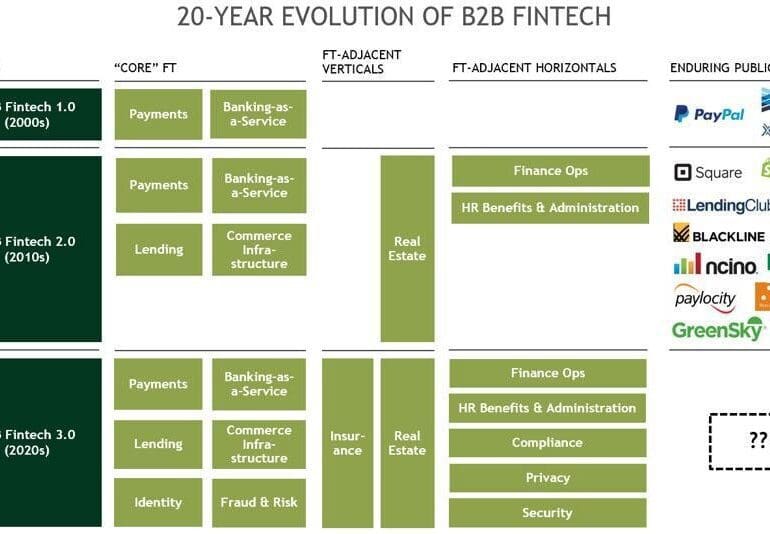

This week, we look at:

The fundraises of Jumio ($150MM), Feedzai ($200MM), and Chainalysis ($100MM) and the function they perform in the fintech industry

The nature of human competition and hierarchies, and why inequality is recreated across the various economic networks that exist

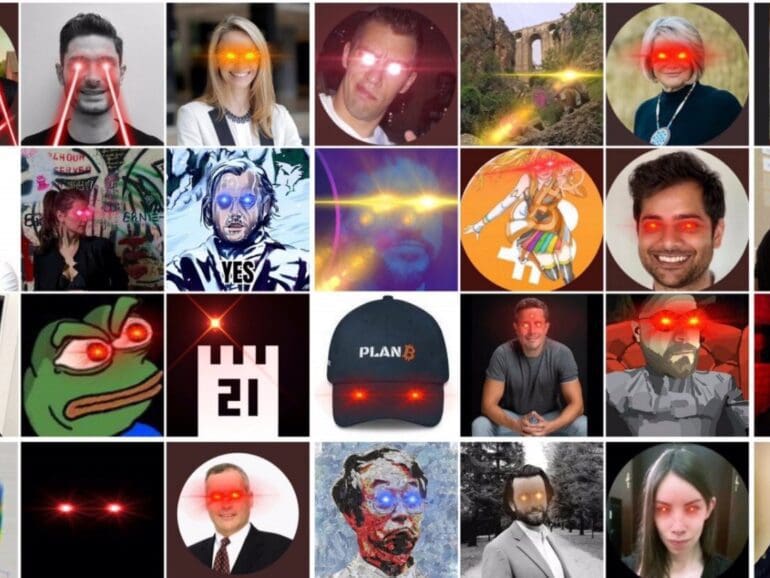

How the NFT markets have higher engagement than DeFi, which is more participatory than Fintech, which is more participatory than finance

The emergence of signalling in the crypto economy that resembles digital citizenship and social capital

This week, we look at:

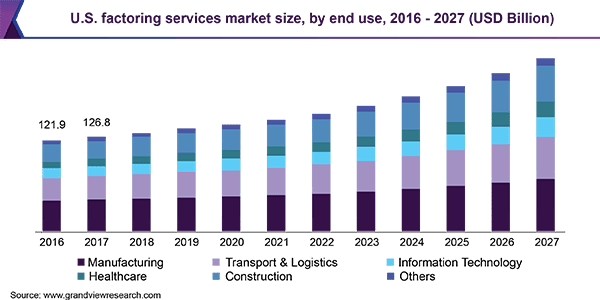

Pipe’s $150 million raise at a $2 billion valuation to turn annualized revenue run-rate into a new peer-to-peer asset class

BitClout’s $200 million of Bitcoin contributions and its mechanisms to turn social media profiles into digital assets

How both projects trade future performance for current monetization

In this conversation, we talk with Anil Aggarwal of Clarity Payment Solutions (acquired by TSYS) and TxVia (acquired by Google) about how he “stumbled” upon the payment space at the right time.

Anil is an absolute FinTech icon as the founder of renowned FinTech conferences – Money20/20 and FinTech Meetup. Additionally, we explore the various concepts of payment network utlity, the market timing large platform shifts, as well as, how social capital and community formation can serve as drivers towards the monetization of our attention even further.

This week, we look at:

TikTok has become a platform with billions of views for investing and stock recommendations to teens. This emotional and persuasive labor can be traced from Jim Cramer to Roaring Kitty.

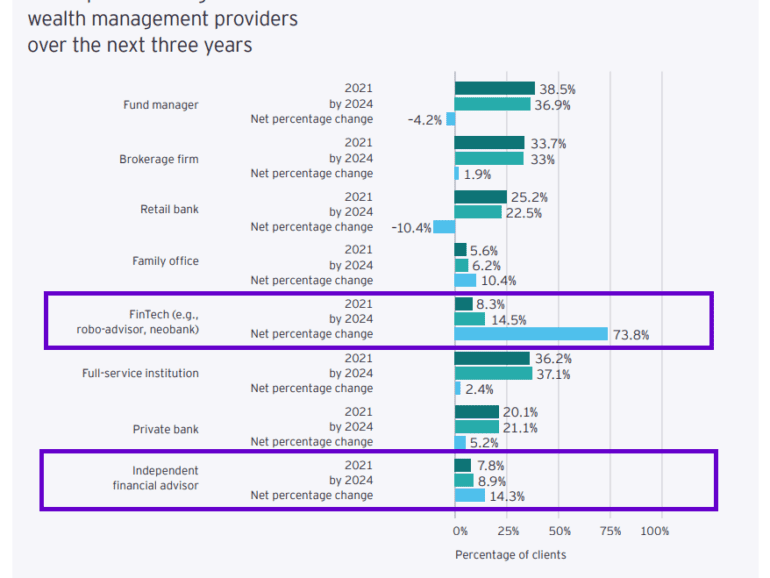

78% of Millennials (vs. 31% of Boomers) plan to use more digital tools in wealth management and 81% of them think that technology has made investing more efficient (vs. 61% Boomers)

This generational change has implications for investing technology, digital wallets, and the role of people in the financial advice process