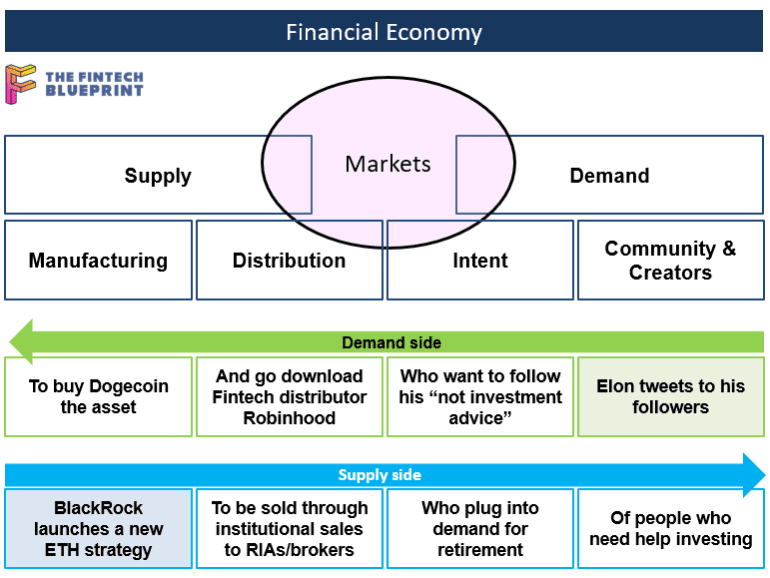

Square upgrades Cash App into a payment processing powerhouse, completing the loop between the consumer and merchant side of the house. Goldman Sachs acquires GreenSky, adding a lending business at the point of intent. This analysis connects these symptoms into a framework explaining the increasing integration between commerce and finance, and the increasing role that demand generation plays. That in turn explains how the attention and creator economies interconnect with financial services.

exchanges / cap mktsidentity and privacymarketingMetaverse / xRNFTs and digital objectsSocial / Communityvisual art

·The structure of capital markets precedes the innovations that come from it. High frequency trading, passive ETF investing, SPACs, and crypto assets all telegraphed their value proposition before becoming large and meaningful in scale. We are now seeing a new market shape emerge, one that starts with community and builds up into financial instruments that are cultural and social. This analysis looks at the most recent developments in the overlap between decentralized social and cultural work and related financial features.

This week, we look at:

TikTok has become a platform with billions of views for investing and stock recommendations to teens. This emotional and persuasive labor can be traced from Jim Cramer to Roaring Kitty.

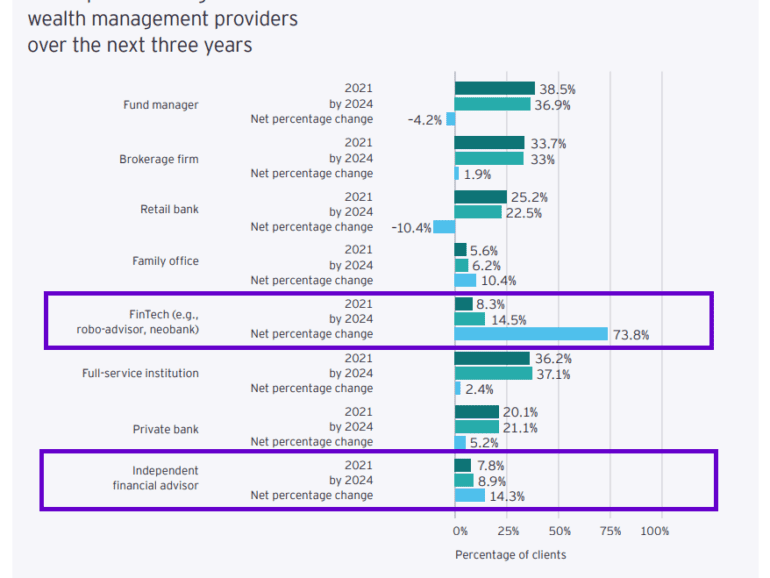

78% of Millennials (vs. 31% of Boomers) plan to use more digital tools in wealth management and 81% of them think that technology has made investing more efficient (vs. 61% Boomers)

This generational change has implications for investing technology, digital wallets, and the role of people in the financial advice process

This week, we look at:

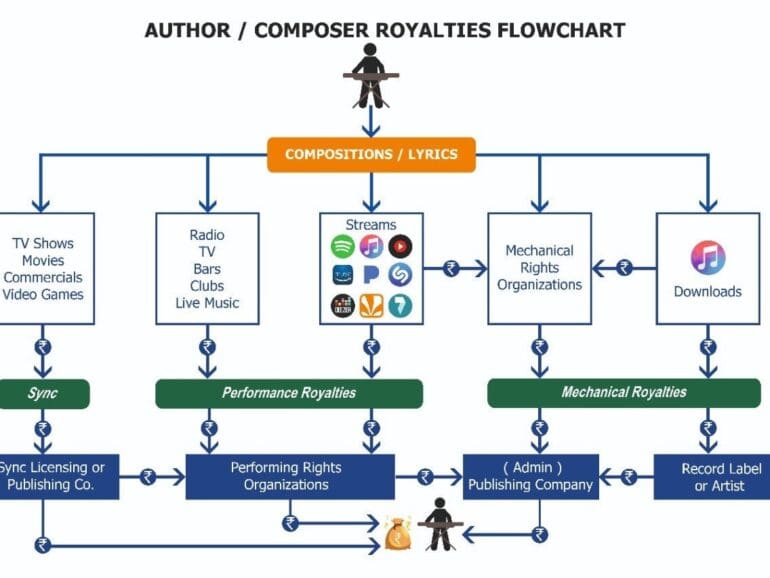

Square acquiring Tidal and its 1-2 million of subscribers for $297 million, and the logic for what a payment processors has in common with the creative industry

How celebrities and creators like Mark Cuban, Gary Vaynerchuk, Grimes, 3LAU and others are generating millions in NFT sales

The impact on the economic model of the music industry, including a look at royalty structures, revenue pools, and financial vehicles when tokenized

The philosophical divide growing between a feudal platformed commons (e.g., YouTube) and a collectivist anarchist capitalism

central bank / CBDCcivilization and politicsenterprise blockchainmacroeconomicsnarrative zeitgeistphilosophyregulation & complianceSocial / Communitystablecoinsthings that are not true

·We anchor our writing around the World Economic Forum 223 page report on CBDCs and stablecoins. The analysis highlights the key conclusions across several white papers in the report. We then add a layer of meta analysis around the language in the report, and question what it is trying to accomplish, and whether that will work with the Web3 revolution. This leads us to think about the tension between populism, as represented by crypto, and institutionalism, as represented by banking structures. We discuss theories of cultural and national DNA, and the rise of populism, as difficult problems to solve for any global alignment.

No More Content