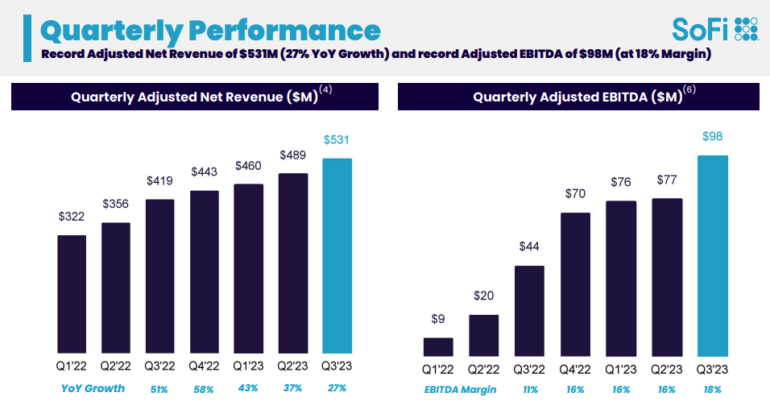

SoFi reported Q3 earnings earlier today and it was mostly good news. The company had net revenue of $537 million for the quarter, up 27% from the prior year period. Adjusted EBITDA was $98 million, up 121% from the prior year period. Both of these numbers were records for the company.

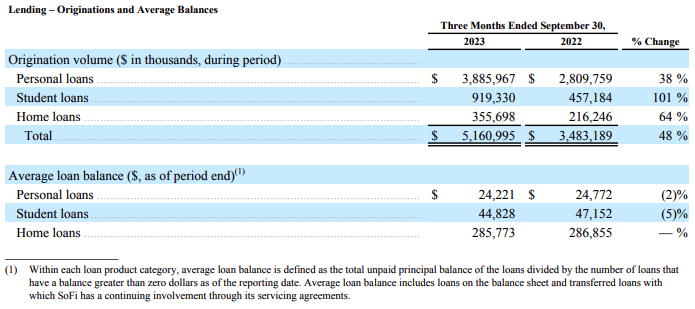

SoFi has been one of the largest personal loan providers for some time and there was strong growth in that segment as well. The company originated $3.9 billion in personal loans in Q3, up 38% year over year. The biggest jump was in student loan volume with $919 million up 101% year over year. The third major lending category for SoFi is home loans where they originated $356 million in new loans, up 64% from the year-ago period.

Today, SoFi is about far more than lending and CEO Anthony Noto pointed this out multiple times on the earnings call. Noto said, “Record revenue at the company level was driven by record revenue across all three of our business segments, with 67% of adjusted net revenue growth coming from our non-Lending segments (Technology Platform and Financial Services segments).”

Keep in mind, SoFi owns Galileo Financial Technologies, a company it acquired in 2020, which it refers to as the Technology Platform. Galileo is the technology provider for many large fintechs including SoFi (obviously), MoneyLion, DailyPay and Dave just to name a few. All told Galileo manages over 136 million total accounts across all its clients.

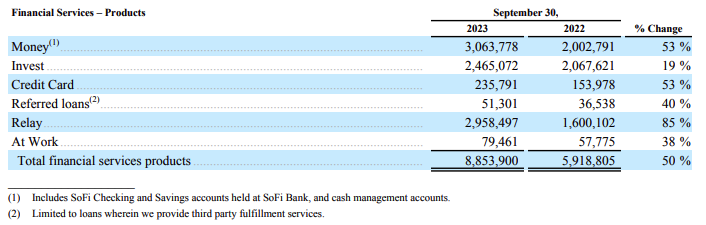

In the Financial Services category, this includes the breadth of SoFi products beyond lending. The above graphic shows the number of accounts in each category with many customers having multiple products. SoFi’s technology platform and its financial services divisions are expected to the driver of growth going forward.

When it comes to the total number of customers, or members as SoFi calls them, they added 717,000 in Q3 to bring the total to more than 6.9 million.

SoFi acquired a bank in 2021 and so has been focused on gathering more deposits since then. In Q3 this was particularly successful as total deposits grew $2.9 billion to $15.7 billion and over 90% of SoFi Money deposits are from members who have set up direct deposit.

Anthony Noto, CEO of SoFi, said in the official release:

We delivered another quarter of record financial results and generated our tenth consecutive quarter of record adjusted net revenue of $531 million. We saw record new member adds of 717,000 and accelerating growth of 47% for total ending members of over 6.9 million, along with record new product adds of over 1 million, also with accelerating growth of 45% to over 10 million total products.

Looking ahead, SoFi increased its guidance for full-year revenue to $2.045 to $2.065 billion, up from its prior guidance of $1.974 to $2.034 billion, and full-year adjusted EBITDA of $386 to $396 million, up from its prior guidance of $333 to $343 million.

SoFi’s stock jumped at the open, primarily due to this increased guidance, but had a volatile day and finished the day up 1%.

The consensus of the analysts on the earnings call is that this was a solid report for SoFi and the company is poised for continued growth in 2024.