Earlier this year, ethereum creator, Vitalik Buterin, announced the impending release of Soulbound tokens (SBTs).

Many were intrigued by a name that sparks images of a fantastical world filled with heroes and legends.

Shortly after, Radicalx Change founder Glen Weyl and Flashbots strategist Puja Ohlhaver, with Buterin, put together a paper outlining the application of the tokens in creating a new ecosystem, a Decentralized Society (DeSoc).

Building upon the technology of Web3, the paper explains that the use of SBTs could “encode the trust networks of the real economy to establish provenance and reputation,” mirroring the nuances of society with the enhanced connectivity brought by Web3.

Critical to the creation of the whitepaper is the groundwork which came before. Weyl wrote and released Radical Markets with the attorney Eric A. Posner in 2018, a book centered on rethinking markets for a more dynamic economy. Shortly after, he founded RadicalXChange.

“Radical markets and many of the ideas from RadicalXChange have been implemented,” said Weyl. “As they’ve been implemented, we’ve seen some limitations in them. Identity was very important to making something like quadratic voting work because our direct voting tries to down-weight the voices of the wealthiest. Still, you can’t really do that if people can make multiple identities.”

“We quickly realized that just individual identities aren’t enough because someone can always get a bunch of friends to sign up for different accounts. So you need some way of knowing people’s social context of people and their relationships and social connections. And so, since early on, maybe 2019, we’ve been thinking about how to do that.”

“When early this year, Vitalik, wrote a post about Soulbound Tokens, I realized that there was a lot that you could do, building directly off of what’s already in the Web3 space if you have these non-transferable tokens.”

So, what is a Soulbound token?

Fundamentally, an SBT is a non-transferable token. Designed to move away from the hyper-financialization of the economy, SBTs are coded without speculative value instead of pulling together the connections between individuals and entities (dubbed “Souls”) to create a network. This network then acts as a tool for verification and facilitates economic functions that use trust as their basis.

Souls can be individuals, companies, or institutions, and there is no requirement to link the Soul to a legal name. SBTs can be issued to any Soul regardless of their association in the physical world.

The whitepaper opens by outlining the value of trust within core economic activities. Despite this, the authors perceive the current financial system to be unable to transfer this to the digital landscape.

SBTs are a suggested solution to this issue, quantifying and encoding the trustworthiness and reputation of a Soul through their accumulation. In addition, the tokens are seen as a tool for decentralization, upholding the ideals and mechanisms of the proposed DeSoc.

The non-transferability is vital and opens the tokens to various applications, which currently are not possible on Web3.

A ‘stairway’ of applications

SBT adoption is already underway, although Weyl predicts mass adoption will be seen in 2023 or 2024.

The whitepaper outlines a “stairway” for increasingly complex applications of the tokens working towards the DeSoc, although Weyl predicts that it will take a while to unleash their potential fully. The order of application is stated as follows:

- establishing provenance

- unlocking undercollateralized lending markets through reputation

- enabling decentralized key management

- thwarting and compensating for coordinated strategic behavior

- measuring decentralization

- creating novel markets with decomposable, shared rights and permissions

Although starting small, the development culminates in creating DeSoc, a decentralized interconnecting network of individual souls formed through interaction, collaboration, and sharing of assets and data.

“I think very simple things are going to be the first types of applications,” said Weyl. “There’s lots of work to be done to determine the right standards and properties to embody these.”

Weyl explained that some of the applications he could see in the short term ranged from simple property rental agreements that could be conducted using Web3 to tools assisting in creating and regulating NFTs.

“There are lots of people who want to be issuing NFTs but don’t want speculation on them,” he continued.

NFTs, although the receiver of much media attention due to the speculative value of artwork collections such as The Bored Ape Yacht Club are increasingly regarded as vehicles for non-speculative applications. Goldman Sachs announced their exploration of the technology earlier this year in the creation of financial instruments, while there is ongoing research on the potential of NFTs in societal infrastructure.

The non-transferable and non-speculative nature of SBTs plays into the ongoing development of these applications. Already, Weyl explained, entities such as Optimism DAO are using the tokens as governance tokens for quadratic voting.

Disruption of the finance sector

The tokens, therefore, could have some far-reaching effects on the finance sector.

Initially, Weyl sees one of the most simple applications as being within uncollateralized lending. SBTs could provide a decentralized database pertaining to individual Souls, focusing on increasing trust through verifiable accumulations of tokens, reducing the need for centralized credit scores.

“I think it’s an application that people are likely to be engaged in within the relatively near term,” he said. “There’s been a variety of thinking about it in the fintech sector already based on Web 2 platforms. I think you’ll get better verification and better computability out of Web3. So it just seems like a natural extension.”

SBTs representing education credentials, work history, and aspects such as rental contracts could be added to souls, providing a transparent record of reliability that could be used for uncollateralized lending and loans between peers.

“More exciting to me than a top-down version of uncollateralized lending would be one that actually forms networks of people lending to each other,” he continued. “Social relationships where groups make joint commitments to support each other’s loans. But it will take longer to do that.”

Additional tokens could be created to facilitate these loans, added within a Soul’s token stack, and burned on completion. The ease of creation of the tokens would bring this facility into the hands of the Souls and the communities around them, reducing the need for institutional involvement.

“There are also more exciting applications. For example going beyond simplistic notions of property, where you split up different rights to assets, some people can access them, some people can dispose of the assets or have the right to have an option to purchase them, and other people can benefit from the profits they generate. Slicing everything up becomes possible when not everything is fully transferable.”

Many potential applications rest on the ability to improve the security and privacy of the Souls and their associated tokens. To reach this functionality, the need for more complex data must be collected and shared.

Nurturing a different kind of sharing economy

A significant focus of SBTs and DeSoc is supporting the plurality of goods and services. The SBTs positioned on Web3 open engagement to a broader market.

The white paper explains that one of the greatest strengths of DeSoc is its network composability. Through the creation of networks across digital and physical borders, the returns ceiling is described as much higher than traditional network creation.

“Only through technological innovation and growing broader, if looser, cooperation with neighboring networks for new sources of increasing returns can value continue to grow exponentially,” it states.

Currently, there is the possibility to own goods on Web3, although on large, this is centered on the ownership of fully transferable assets, such as NFTs. This has provided restrictions, making it virtually impossible to support basic property contracts, such as lease or usage rights, without a sale.

SBTs have been developed with enough flexibility to support this type of ownership. Their non-transferability facilitates various functions such as access permissions of goods (both physical and digital) to trusted parties, data cooperatives that allow decentralization of ownership and access permission, experimentation with local currency, and democratic mechanism design (such as quadratic voting), and market design.

They also provide scope for managing the spectrum between fully public and fully private goods, allowing for and rewarding participation despite differences. As souls’ diverse communities are represented through tokens, cooperation with other souls with differing affiliations can be made visible. This can be transferred to scaling-up of goods used by broader networks,

The tokens are a tool to enhance the decentralization of society, allowing for a broader scope of property usage and permissioning access across different networks.

Risk of digital discrimination

The move into digital has the potential to reduce discrimination on a physical level. The use of algorithms and AI has been implemented in various finance sectors to move away from human bias in descisioning.

There is a purely fact-based approach based on data points, although there are concerns regarding historical discrimination in existing data sets. Advancements in machine learning hope to mitigate these problems.

However, as functions become more complex, there is still potential for discrimination based on digital literacy. Digitalization is happening at breakneck speed. Many are already having trouble understanding even the basics of Web3.

“It’s very hard to racially discriminate against a crypto wallet directly because you don’t know anyone’s race, whereas you can in real life because it’s usually visually apparent,” said Weyl. “As we get towards systems with more social markers in them in Web3, there will be the possibility of discriminating against people based on those social markers. I believe that blindness doesn’t help us get to justice. Blindness actually undermines our ability to offset and adjust for social factors that are persistent sources of inequality.”

“Any technological improvement naturally tends to offer opportunities to those who master them and leave behind those who are unwilling, unable, or excluded from mastering them. It’s a general problem of technological advancement.”

“There’s no cut and dry, simple way around these dystopias; I hope they keep getting raised because it’s only by attending to those natural problems that we will address them.”

Digital identity opportunity

SBTs have significant potential in the field of Digital Identity. Although not exclusively associated with individuals, by nature, the tokens lend themselves to increased verification of the holder through their network of connections.

An area currently under much debate, digital identity is increasingly being seen as key to the development of Web3. Issues of privacy and security surround the idea, as concerns of identity theft and misuse of stored data become a realistic possible outcome.

Positioned on blockchains, SBTs are extremely difficult to adjust and falsify. The whitepaper outlines multiple approaches to enhance this attribute, including the verification of Souls without a real individual associated.

The whitepaper specifies that although SBTs could theoretically be “self-certified” by an individual “Soul,” the full power of the tokens is realized when issued by other “Souls” — “the ethereum Foundation could be a Soul that issues SBTs to Souls who attended a developer conference. A university could be a Soul that issues SBTs to graduates. A stadium could be a Soul that issues SBTs to longtime Dodgers fans,” it reads.

Initially released essentially as an extended, verified LinkedIn account, potential applications in the development DeSoc may require the storage of more extensive details, posing a potential risk to the Soul’s privacy.

The issue of privacy

The concept of DeSoc relies on the mass adoption of a transparent digital identity and thousands of public data points through the collection of SBTs. The need for security and regulated privacy control is therefore essential to its development.

DeSoc has an air of optimism. The vast ecosystem each Soul could accumulate, transparent by design, would hold thousands of data points spanning work history to interests and hobbies. This has the potential to carry a significant security risk to privacy.

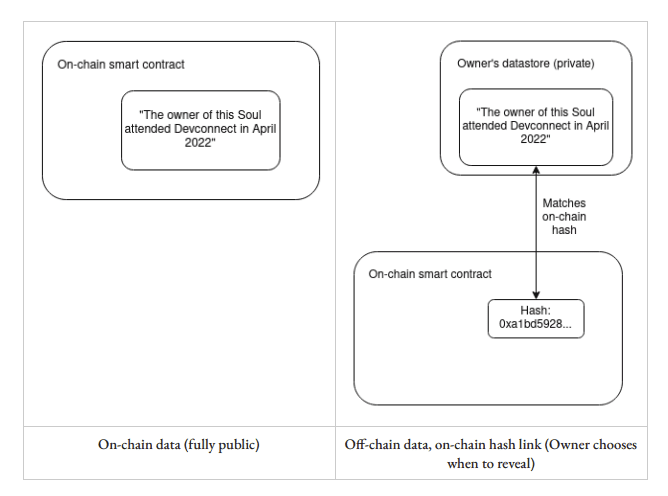

Weyl, Ohlhaver, and Buterin have addressed this concern, stating, “Without explicit measures taken to protect privacy, the “naive” vision of simply putting all SBTs on-chain may make too much information public for many applications.” They propose a system of privacy layers that keep blockchain’s inherent transparency while retaining security over some levels of identity.

Individuals could determine which data and SBTs are stored off-chain, using cloud services or personal devices. Access to these layers would be facilitated through hash links, revealing when the owner decides.

Zero-knowledge and designated-verifier proofs, among many other cryptographic solutions, are also proposed, enabling access to SBTs conveying negative reputation points.

The antidote to hyper-financialization

For Weyl and many more, society is becoming hyper-financialized, even more as we move into Web3. The finance sector has become increasingly digitalized, reducing the individual to data points and credit scores, automated and standardized beyond recognition, and increasingly led by money and profit margins, power being distributed according to wealth.

Black Mirror is mentioned in the whitepaper, referencing a potential dystopia of top-down opaque social credit systems that engineer social outcomes and reinforce discrimination. Despite some in the fintech community regarding reducing the individual to data points, ready for processing with the help of AI, reduces bias; Weyl and his co-authors disagree.

“At best,” they write, “score systems opaquely overweight and underweight factors relevant to creditworthiness, and bias those who haven’t accumulated sufficient data—mainly minorities and the poor.”

“The paradigms we have for the future are either top-down control by advanced artificial intelligence or complete financial takeover of everything. Anarcho-capitalism,” said Weyl. “I don’t think we have the option of simply having no vision for the future.”

DeSoc with the associated SBTs is designed to move away from that perceived dystopia. The writers seeking to set forth an alternative based on transparency and the strength of the network Souls create, resistant to censorship.

DeSoc’s layers of sociability, Souls connected by piling SBTs collected from other individual and institutional souls, retain the many facets of social difference, leveraging them for security and reputation.

Potential for backfire

There is potential for the system to backfire, creating a reality that resembles precisely that which they are trying to avoid.

The whitepaper reads, “The same SBTs that could be used to compensate for in-group dynamics and achieve cooperation across differences could also be used to automate red-lining of disfavored social groups or even target them for cyber or physical attack, enforce restrictive migration policies, or make predatory loans.”

However, it is seen to be the lesser of two evils as it continues, “DeSoc does not need to be perfect to pass the test of being acceptably non-dystopian; to be a paradigm worth exploring. It merely needs to be better than the available alternatives.”

“Whereas DeSoc has possible dystopian scenarios to guard against, web2 and existing DeFi are falling into patterns that are inevitably dystopian, concentrating power among an elite who decide social outcomes or own most of the wealth.”

Although it is recognized that DeFi initially was created to counteract the financialization of ‘traditional’ finance, Weyl et al. state that already there is a shift toward old patterns, allowing for monopoly pressures, and they pose the concept of DeSoc as an alternative.

They recognize the implementation of SBTs does have the capacity to turn away from democracy. However, according to the naturally occurring community of Souls, they are designed to enable democratic resolution.

Weyl follows up, concluding, “I would much prefer a vision for the future that has a path that allows for pluralism and social cooperation across differences. And I think those are the values held by the vast majority of people,”

“If we have a world where people are just financial objects, and everything is just a financial wrapper around financial objects, you won’t have any society, you won’t have any faction, all you’ll have is an anarcho-capitalist dystopia, where everything is a transaction.”