The web of investment bank technology, there are 20 or more core vendors on which systems run. Adding Blockchain to the mix merely adds a 21st system, which is by design incompatible with everything else. Thus enterprise chain projects have been focusing on integration and proofs of concepts, not re-engineering the core. But we know how this plays out -- as it has over and over again across Fintech. Digitizing "unimportant" channels and hoping for them to succeed simply doesn't work. See JP Morgan giving up on Finn, or Northern Trust capitulating its pioneering idea into Broadridge, or any other number of examples from Bloomberg to LPL Financial. Even the struggles of Digital Asset could be used as an example of the danger of working oneself into an existing web of solutions, and trying to preserve their dependencies.

Sometimes more is more, and sometimes less is more.

In that spirit, we strongly urge you to check out Messari’s Crypto Theses for 2021. It is a mammoth work of 134 pages, covering each and every development in the ecosystem.

If you don’t want to fuss around with the email gate, the direct link is here.

We are going to pick out five things that are interesting to us substantively and provide a view below. By pick out, we mean screenshot and respond.

In this conversation, we talk with Jon Helgi Egilsson about his incredible journey to becoming Chairman and a co-founder of Monerium.

Jon is a former chairman and vice-chairman of the supervisory board of the Icelandic Central Bank, a former adjunct professor in financial engineering and MBA lecturer at Reykjavik University, a visiting scholar at Columbia University, and co-founder of four software companies. Additionally, we explore the various concepts of digital money in the framework creating a competitive yet unified environment between fiat money, banking based on fractional-reserve, and the token economy.

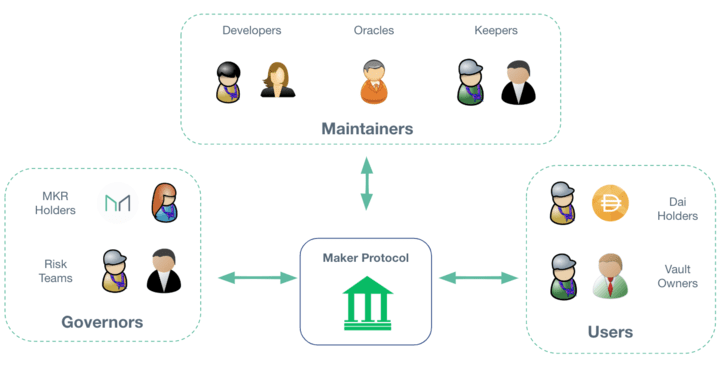

In this conversation, we talk with Rune Christensen of Maker Foundation about how he became one of the most influential builders in the DeFi ecosystem. Additionally, we explore the creation, experiences, and evolution of Decentralized Autonomous Organizations (DAOs), the nuances of stablecoins, the interaction between Maker and DeFi with traditional finance and traditional economies, and Maker’s approach to leveraging layer 2 solutions to aiding scalability and transaction throughput.

This week, we look at:

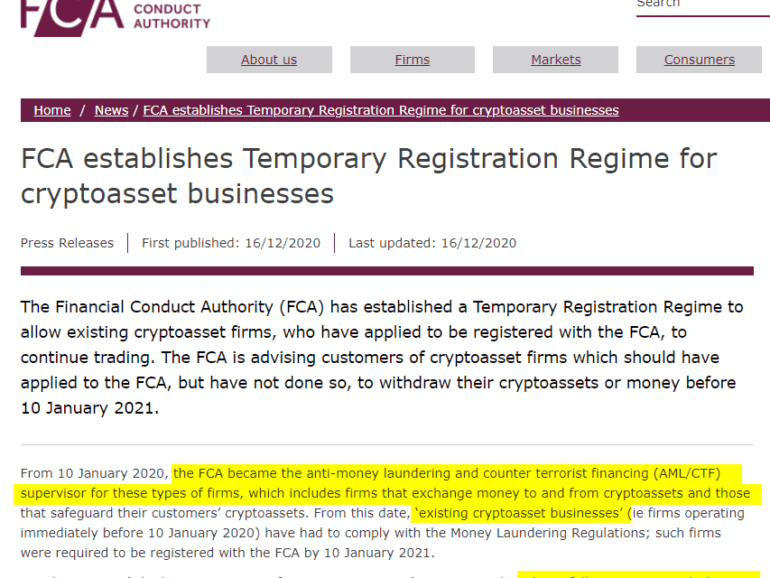

Proposed US regulation from FinCEN, legislation from the House of Representatives, and UK FCA registration requirements that would impact the crypto industry

The difference between competition for share within an established market, and competition between market paradigms (think MSFT vs. open source, finance vs. DeFi)

The crypto custodian moves from BBVA, Standard Charters, and Northern Trust

The bank license moves from Paxos and BitPay, as well as the planned launch of a new chain by Compound, in the context of the framework above

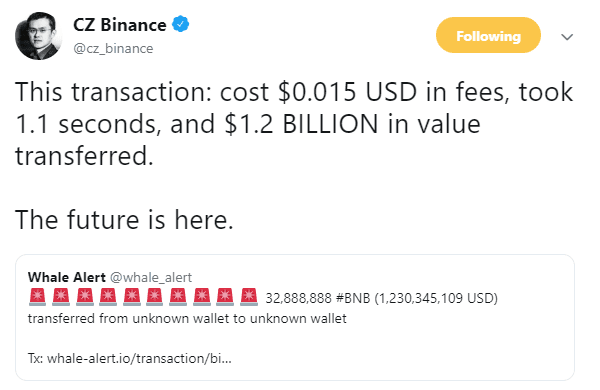

Permissionless finance is a paradigm breach. It pays no regard for the very nature of the incumbent financial market. Without banking, it creates its own banks. Without a sovereign, it bestows law on mathematics and consensus. Without broker/dealers, it creates decentralized robots. And so on. It tilts the world in such a way as to render the economic power of the incumbent financial market less important. Not powerless -- the allure of institutional capital is a constant glimmer of greedy, opportunistic hope. But the hierarchy of traditional finance does not extend to DeFi, and thus has to be re-battled for the incumbent. This is cost, and annoying.

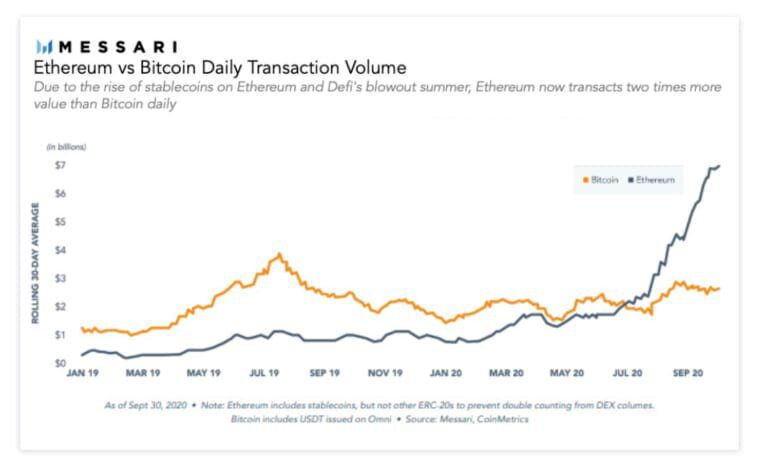

In this conversation, we go through the essentials of Decentralized Finance with Kerman Kohli, who is a serial entrepreneur and the writer of the DeFi Weekly newsletter. We discuss the mechanics of issuing stablecoins, decentralized lending, decentralized exchange, automated market makers, and the increasing complexity of synthetic assets that have grown the sector to nearly $7 billion in August of 2020.

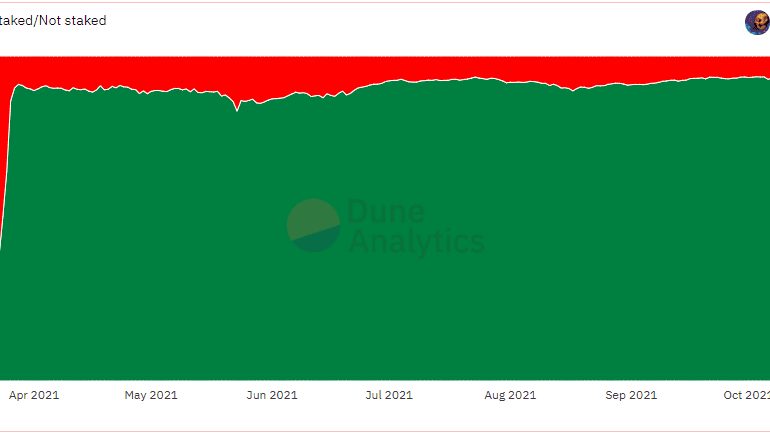

Decentralized finance is formulating new mechanisms to correct for the pitfalls of liquidity mining, yield farming, and other early token distribution approaches. This is happening both at the level of individual projects like Alchemix or Fei, and at the level of industry wide consolidation through Olympus DAO and Tokemak. We explore where this evolution is going, and potential outcomes. In this first part of the analysis, we look closely at Olympus DAO, the concept of Protocol Owned Liquidity, and whether the economics make sense.

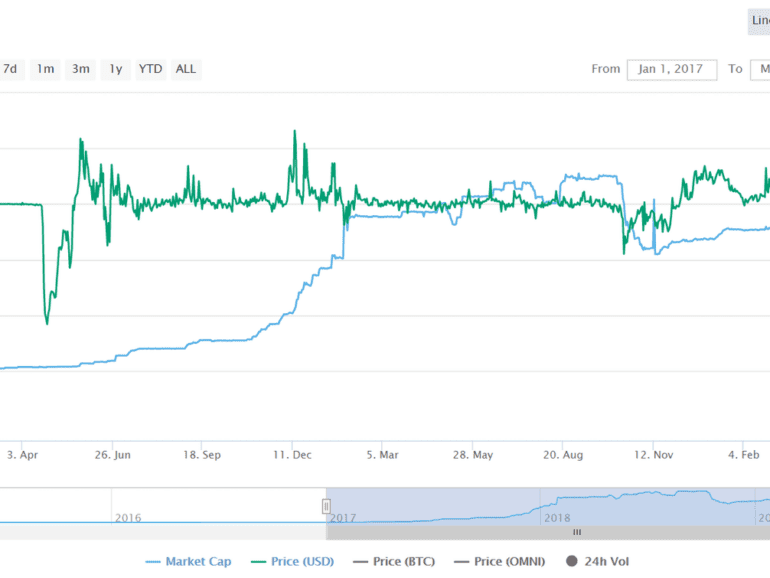

There is poetry in the symmetry of this situation. Bitfinex is looking to raise $1 billion in capital to support the most popular stablecoin Tether, which it controls. Facebook is reportedly looking to raise $1 billion in capital from First Data, Visa and Mastercard and other payments companies to shore up its own stablecoin asset. Poetry is where the similarities end, and all these devils are in the details.

This week, we look at:

How banks and financial advisors have failed to deliver on $1 trillion in capital appreciation for their clients over the last 12 years

The role of bank regulators in the United States, and the tensions between state and federal agencies

How the OCC is laying the groundwork for national banks to custody crypto assets, bank stablecoin reserves, run blockchain nodes, and use crypto payment networks

And instead of financial advisors or other CFAs guiding the retail market in good decision making, a newsfeed of *what’s popular* has driven Apple, Google, Tesla and the other John Galt hallucinations to the stratosphere. Don’t get us wrong. We love the robot as much as the next Fintech commentator. But it is clear to us that “the masses” are not being “advised”. And that the capital appreciation that matters — cementing the next trillion dollar networks for global future generations in work yet to emerge — is misunderstood and misrepresented by most financial professionals to their clients.

A digital world needs digital money, and a few influential players are actively working to build it. China's BSN initiative and Facebook's Libra embody the East's public sector led approach to building and owning the internet of value and the West's private sector led (and public sector challenged) attempt at cheaper commerce on the web. While the nature of the approaches may be different, the data and privacy considerations are eerily similar. For all of our past episodes and to sign up to our newsletter, please visit bankingthefuture.com. Thank you very much for joining us today. Please welcome Lex Sokolin.