Neu’s path to success will produce financially literate college graduates and a strong bottom line. The journey began in late 2023 with the release of the Neu Card, whose attributes include no late fees and interest charges, a maximum $1,000 spending limit, no Social Security number required, and no credit history or cosigner required.

For entrepreneurs looking to overcome these challenges, revenue-based financing is a compelling alternative.

Venture-backed Nova Credit set about developing an alternative to traditional credit analysis to empower borrowers and lenders.

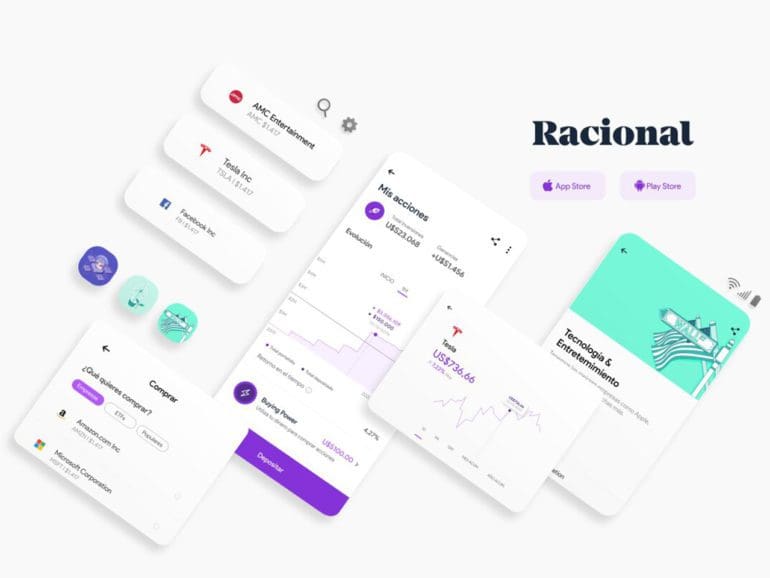

With this capital injection, Racional will seek to double its team in the short term and reach 100,000 users in Chile, Brazil, and Colombia.

Chile's fintech Migrante to acquire a motorcycle loan startuup in Colombia. It also changed its name to Galgo, or "greyhound" in Spanish.

The FIS Fintech Accelerator 2024 will see 10 startups meet with business leaders, scale their products, and develop a market-centric value proposition.

In celebration of International Women's Day we provide some suggestions for female founders in fintech to help grow their startups.

Early stage founders face a challenging climate and many lack the expertise to drive growth.Support from an experienced hand may be critical.

While VC funding to Latin American startups saw a year over year decline, the fact that it is stabilizing offers hope to the industry.

Cortex collaborates with several fintechs and giants of the financial market in Brazil, such as BTG Pactual and XP.