Gen Z teens are the largest generation due to come of career age, so enticing them with attractive investment options is a fintech golden ticket.

To offer teens and their families modern financial tools with a healthy slice of financial education, Co-Founders CJ MacDonald and Alexey Kalinichenko launched the fintech Step in 2018. Today, they announced plans to add stock and crypto investing to the mobile app.

“Over the past year and a half, we’ve been able to help more than 3 million customers establish a strong financial foundation and begin to think about their long-term goals,” MacDonald said in a release.

As a natural next step in their financial journeys, we’re thrilled to be able to offer teens the ability to budget, spend, save, build credit, and now invest for their financial futures directly within the Step App.”

Another feature for GenZ finance

Step had previously offered a p2p spending app with a Visa spending card to build credit on cash transactions.

MacDonald described on the Fintech One on One Podcast in Feb; like Venmo, mobile payments meet Wells Fargo FDIC insured bank accounts for the next generation.

“We brought those worlds together, and so what Step offers is a banking platform for the next

generation. we have a mobile app geared towards the younger generation from a UI/UX

perspective; we built a secured Visa spending card,” MacDonald explained to LendIt chairman Peter Renton. “It’s the only product in financial services that helps you establish and build a credit history before you turn 18; that’s pretty unique in the marketplace.”

With similar parental controls and permissions, later this year, Step will offer a library of over 30 crypto tokens, NFTs, and on-chain wallets for every customer and U.S. securities through partner Zero Hash. It’s the first stock financial app to let customers under 18 buy, sell, and receive crypto.

“We are excited to be partnering with Step to expand access to crypto investing by making it available to younger customers who want to get a jump start on investing for their future,” Edward Woodford, Founder, and CEO of Zero Hash said in a release. “Since our inception, we have helped dozens of leading fintech and challenger banks meet growing consumer demand for these new investment products in dynamic and innovative ways.”

Like many features from the rest of the app, parents will be able to control their child’s access to investing. For example, by setting monthly limits on investing, viewing what securities or crypto their child invests in, or denying access to the entire investing suite.

Grandpa had it right

MacDonald, a self-described serial entrepreneur, said Step’s original inspiration came from the realization that there were few great investment options to help his children, compared to the gift U.S. treasury bonds he received “religiously” from his grandfather as he grew up.

“I remember when my kids were a little bit younger, my parents would call me before their birthdays or holidays and ask, ‘what can we get your kids?’ And I remember just thinking, I wish there were modern-day savings bonds similar to what Grandpa used to give to us,” MacDonald said. “After doing a lot of research and talking to families and kids and college students, I saw a big gap in the market with financial services for the younger generation.”

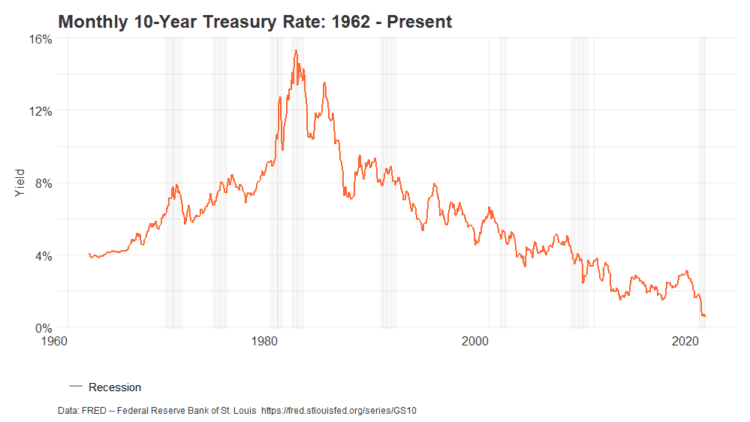

As he did more research, he became convinced he could offer an alternative and capture that financial gap. This graph from the Reason Foundation, a libertarian think tank, shows the bonds had their heyday in the 1980s with nearly 16% returns since plummeting to a dismal .52%.

Help Gen Z with financial literacy

To solve the problem, and help his daughters have a better option, MacDonald and his team built Step, offering planning devices to help teens save, send money to their peers and parents, and credit building services.

As MacDonald explained to Renton, Step records good credit activity but treats their card like a debit card. At the age of 16, they are allowed to register two back years of credit data, and at 18, they are allowed to add the data to a user’s credit history.

“We innovated and built this new type of secured card that we today secure against your deposit balance at Step. If your kids have $100 in their Step account, they can only spend $100; when they spend $10 at Starbucks, we pull $10 from their account, they can only spend $90,” MacDonald said. “We don’t report until your child turns 18, but we can report years of history while they’re using it when they’re 14, 15. When they turn 18, we give the option, would you like us to report this.”

High demand for investing

Investing was the number one requested feature based on a survey of 1,359 users the Step team conducted in March.

The same survey of teens aged 13-18 found 56% were bullish on crypto like Bitcoin and NFTs. A fourth of teens said they believe investing is the single-most-important skill to master before graduating high school, which is why MacDonald said they are focusing on the educational capability of the product offering.

“At the end of the day, our goal at Step is to help improve the financial future of the next generation by providing them with access to affordable, modern financial tools and education in a truly Gen Z way,” said MacDonald. “We’re excited to be bringing teens and their parents a revolutionary way to start investing at an earlier age so they can reap the long-term benefits and create generational wealth.”

Eighty-five percent of Step’s teen customers open their first bank account on the platform, and 95% say that the firm has helped improve their financial literacy. Steps Series C round, the last they raised totaled more than $175 million in venture funding, backed by Coatue, Collaborative Fund, Crosslink Capital, General Catalyst, and several other prominent investors.