Whether it’s through splitting a bill at dinner with friends or sharing bills with housemates, most of society has had experience with shared expenses.

As housing prices continue to rise in some areas of Europe increasingly, fewer people can afford to buy. They are instead renting or buying homes under shared ownership.

Between 2010 and 2021, rental prices rose by 15.3%. This has worsened with what some call the “Airbnb effect,” where landlords choose to rent out their rooms for the short term and let them at a higher rate, pushing the price of rentals up further. The World Economic Forum found that typically households now spend between 25-40% on rentals within Europe.

With these rising rent prices comes an increasing inability to afford the rent alone. The rate of shared households has risen significantly over the past decade, even giving birth to the new “co-living” market.

In addition to homes, shared ownership of items is a growing trend. The sharing economy is projected to rise by $320 billion between 2014-2025, and with changing economic conditions could be even more. Inevitably, with shared ownership comes shared costs.

Even Steven

Steven is a company dedicated to this shared expenses space. Born in Stockholm, Sweden, in 2016, they have built up a product offering focused on facilitating expense sharing without the “awkwardness” that comes with it.

“Steven is targeted to everyone,” said Jon Wimmercranz, CMO of Steven. “If you do things with others, you’re most likely going to share expenses.”

Over the past few years, the platform has focused on its app, which streamlines and tracks the division of expenses. Users can create groups connected to their banks where expenses are uploaded and divided easily. Currently, they operate mainly within Sweden.

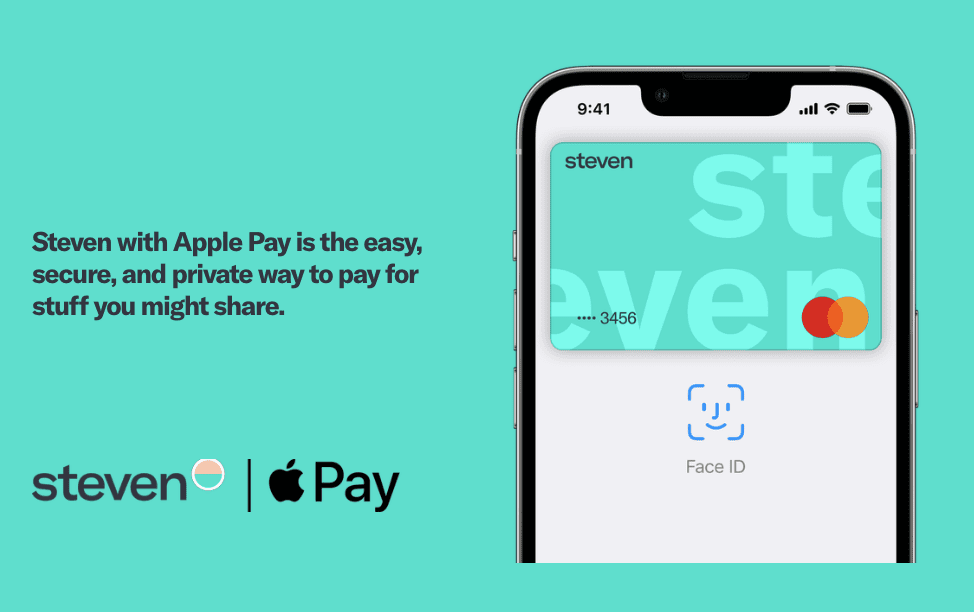

The latest development for Fintech is the launch of their shared payments card due to their collaboration with Enfuce in association with Mastercard. The card is described as the “first of its kind.” Topped up via Swish, payments made with the card trigger notifications to the users, who can then decide whether they want to share the cost.

Pandemic triggered rise in household expense sharing

“We have doubled during the pandemic, and what we’ve seen is that there’s a new type of user that’s getting more central to Steven, and that is the household user,” said Wimmercranz.

“So we started to see more and more young couples that use Steven in their household to keep track of utility bills, groceries, etc. This is why we launched the card.”

“Our users told us that what they need is a real-time experience, which means that when you make a purchase, you immediately get nudged to take action. They don’t want to have a pile of transactions and then split once a month and do the admin because that’s exactly what they tried to get rid of. This card supports our solution for sharing expenses.”

The two companies were brought together with Mastercard’s FINITIV program, an initiative that connects fintechs to strengthen their combined offering of financial products.

“We highly value our partnership with Enfuce because we are doing great things together,” said Wimmercranz. “They are enabling us to launch a payment card as well as digital wallets making sharing expenses with friends and family even more seamless in Sweden and a handful of other EU markets in the near future.”

Global and Digital expansion

Enfuce is a payments, open banking, and sustainability service provider to enable long-term, scalable solutions. Founded in Finland, the company has expanded into northern Europe and is positioned to facilitate Steven’s bid to do the same.

Monika Liikamaa, CEO and Co-founder at Enfuce, said, “Steven is a forerunner in expense sharing. We’re very happy to partner with them to help them scale their innovative solution all across Europe. Like Enfuce, Steven has global aspirations, and we are on this journey together.”

Steven is currently on the brink of expansion into new Northern European markets and expects to launch over the next year.

Related:

Enfuce’s expertise in the payments sector has helped Steven develop the card, and the two companies continue to work together, soon releasing a credit facility.

“Enfuce has provided a core system for us,” said Wimmercranz. “We will most likely be looking at credit features going forward, looking at developing tailored credit solutions for our type of users. “

Insights shape future exploration of expense tracking

“Keeping track of the shared expenses is important also from an individual perspective if you want to keep track of your finances,” he continued. “Tracking expenses actually applies to a bigger problem than going on a trip with five friends sharing the cost for Airbnb and dinners. (Because that’s the vanilla use case. That’s why you first search for solutions like Steven.).”

“If you keep track of your shared stuff, it’s fairly easy. But if you track it with your individual spending, you get a much more updated and accurate view of your finances, and the more you share, the more important that this is. Tracking both simultaneously becomes much easier to know, ‘okay, so am I up? Or am I down? And how much money do I have? Do I have enough to pay the bills?'”

“This is something of an insight that we will be exploring.”