Stripe announced an open banking product called Financial Connections late Wednesday, sparking a testy Twitter tussle with Plaid CEO Zachery Perret.

Perret suggested his company’s successful onboarding solution bore an uncomfortable resemblance to Financial Connections.

While there are other competitors in the open banking space — like Yodlee, Fiserv’s Alldata Aggregation product — Stripe’s place as a leading fintech brand could heighten the controversy.

Perret quickly took to Twitter to chide the announcement.

“Wow! Jay, you took interviews with Plaid & asked probing questions multiple times over the past few years, and your team sent repeated RFPs (under NDA!) to us asking for tons of detailed data. I wish y’all the best with these products, but surprising to see the methods,” Perret wrote.

Perret alleged that product developers for the new Stripe product brain-drained Plaid for data on their open banking product used to connect nearly every consumer-facing fintech product from Robinhood to Coinbase.

The head of Product Jay Shah celebrated the news and commented that the accusation was unfounded.

“Zach, sorry you feel this way, but this isn’t true and I think you know that. You reached out to me repeatedly — I never reached out to you for information. Stripe did an RFP because we work with partners for this product, and we had hoped to include Plaid,” Shah wrote.

b2b open banking before IPO

Stripe, rumored by Bloomberg to be close to an IPO after a $95 billion valuation last year, is the highest valued fintech company in the world, beating out the neobank Revolut.

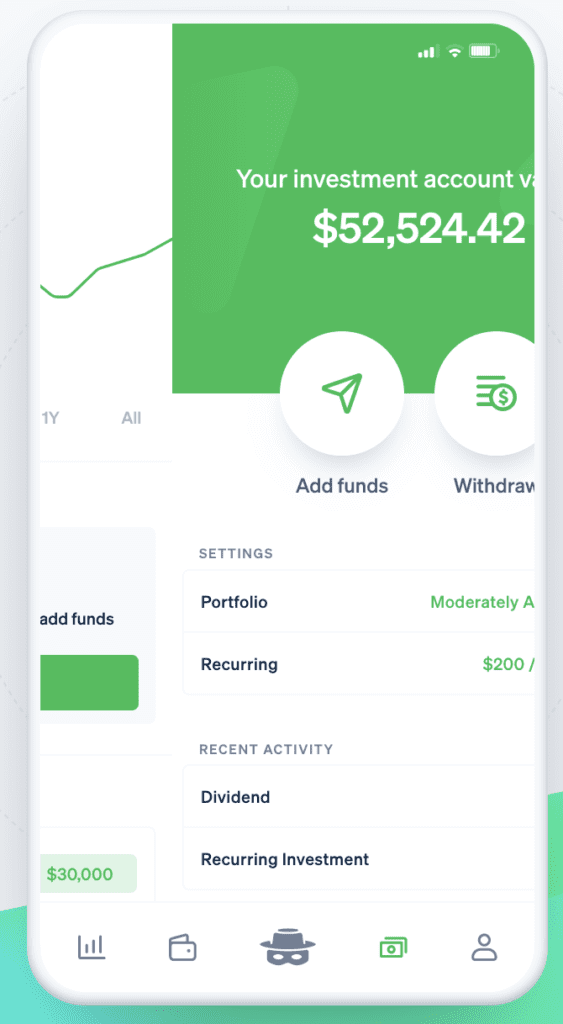

In a release, the firm said the launch of Financial Connections would enable a business to seamlessly connect to customer bank accounts, track spending patterns to reduce payout failures by 75%, and connect with 90% of all bank accounts.

Businesses have been asking us for an easy, secure way to connect and verify their customers’ bank accounts,” Clara Liang, business lead at Stripe, said. “Stripe Financial Connections delivers just that.”

Beef posted to ‘Hacker News’

In comparison, valuation-wise, the open banking king of fintech unicorns, Plaid, raised a $425 million Series D a year ago at a valuation of $13.4 billion.

The founder took to the Y Combinator forum to post his grievance, focusing on Stripe’s new product as not a direct integration, but instead one that works with MX and Finicity by Mastercard.

“Plaid founder here. Stripe does not integrate with any bank APIs directly (AFAICT). They wrap two aggregators, MX and Finicity to build this product. (Also, not sure what MX products they are using, but MX itself is an aggregator of aggregators, including others such as Yodlee,” Perret wrote.

“On pricing, Stripe’s listed rates are 30-200% higher than Plaid rates (perhaps due to high vendor costs). That said, if anyone does have feedback on where Plaid pricing is prohibiting new use cases, we’d love to hear! I’m Zach at Plaid if folks would like to discuss.”

Related:

Clapback was fast

Immediately a self-identified Stripe rep named Edwin responded, denying the claim and stating many banks do not have their own APIs to directly connect.

“Edwin from Stripe here. Stripe does integrate directly with banks. In our beta period, most volume we’ve seen has been over bank APIs. Some banks do not have APIs—we use financial partners to connect with them, and we’re talking with many banks in hopes that they will enable direct API access soon,” he wrote. “Our pricing is upfront: https://stripe.com/en-us/financial-connections#pricing. We’ve worked with a large beta group of users to make sure the pricing is in line with what they see in the market.”

Fintech Twitter was abuzz with commentary.

One fintech exec, Taylor Schaude the head of Partnerships at R&D grant fintech Neo.Tax said it was an excellent day for Stripe, while Plaid had to watch out.

“Plaid: Time to sharpen our axes,” he wrote.