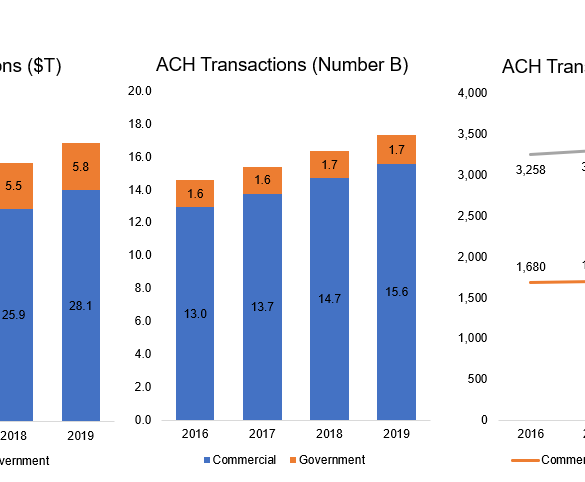

The largest payments network in the US is the ACH network. It is probably the most important fintech infrastructure ever developed and it is now 50 years old.

We have a problem in this country. For the most part, money moves around slowly, at much the same speed...

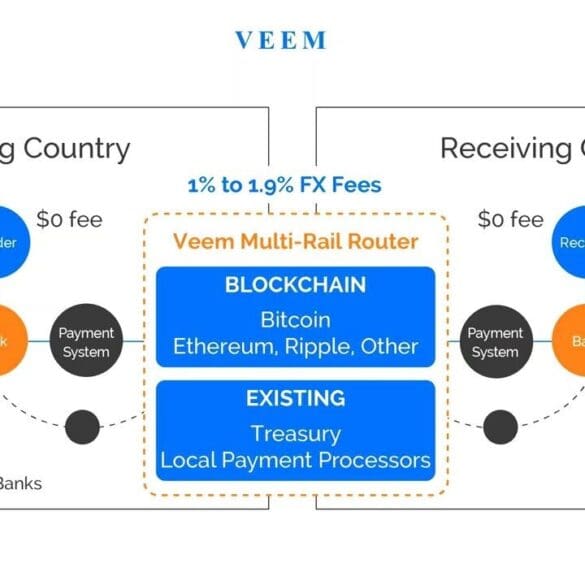

In this conversation, we talk with Marwan Forzley of Veem about how the rampant evolution of the mobile phone spurred his fascination to turn the phone into a business-to-business (B2B) payments network. Additionally, we explore how generations of companies have tried to use correspondent banking to solve for B2B cross border and failed, the intricacies of payment rails and the infrastructure to support them, the impact of COVID on global e-commerce, how the future will blend the distinctions between digital wallets, banking services, and crypto wallets.

Much of the attention of the Paycheck Protection Program has been on the automation of the approval process; this was...

Mastercard launched a set of open banking tools through Finicity, enabling b2c transactors to check user accounts before requesting an ACH.

In this conversation, we chat with Chris Dean, who is the Founder & CEO at Treasury Prime. Previously, Chris was the CTO & VP of Engineering at Standard Treasury, which was acquired by Silicon Valley Bank for an undisclosed amount.

More specifically, we discuss all things banking-as-a-service, FinTech APIs, embedded finance, and the general evolution of the FinTech banking industry over the last decade.

Let’s do some math homework. It’s good for you:

The Federal Reserve money movement system broke for several hours. We look deeply into its volumes and transactions, and value it like a Fintech unicorn.

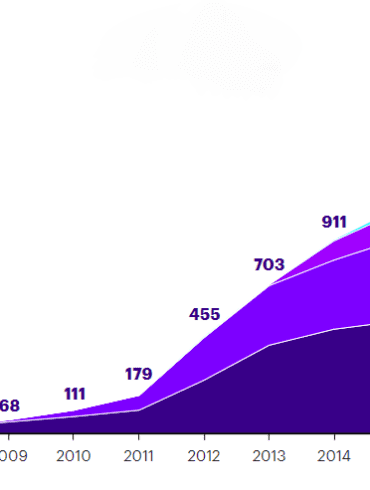

The Ethereum ecosystem is throwing around as much volume in settlement as the Fed check processing system. We explore scalability barriers and solutions.

Can eCommerce fit into our emerging infrastructure? We anchor to the market numbers in China and the United States.

Things break.

Sometimes the things that break are the US Federal Reserve ACH service, Check 21, FedCash, Fedwire, and the national settlement service. They were down for a few hours — discovered at 11AM on Feb 24th and still in trouble at 3PM that day. Everything is now up and running again.

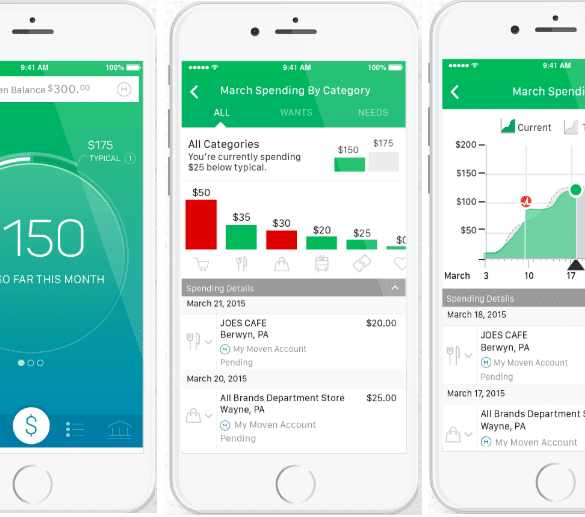

Today we're joined by Brett King, founder and executive chairman of Moven, one of the world's original digital banks, and Lex Sokolin, global head of fintech at ConsenSys. Lex and I discussed Moven's recent announcement to shutter its B2C business on episode 170 of Rebank. And we're happy to have the opportunity to connect with Brett directly to discuss the decision in more detail.