There are new ways for Americans to build their emergency savings today from a new government program offered through retirement plans to new fintech offerings.

Helix, a fintech-focused BAAS by Q2, hosted an unveiling on March 4 for the team at the New York Stock Exchange.

The fintech industry is coming up on the tipping point of funding, revenue generation, and user acquisition to rival traditional finance with $20 billion in YTD fintech financing, the several SPACs, and Visa’s $2B Tink purchased. Defensive barriers have eroded.

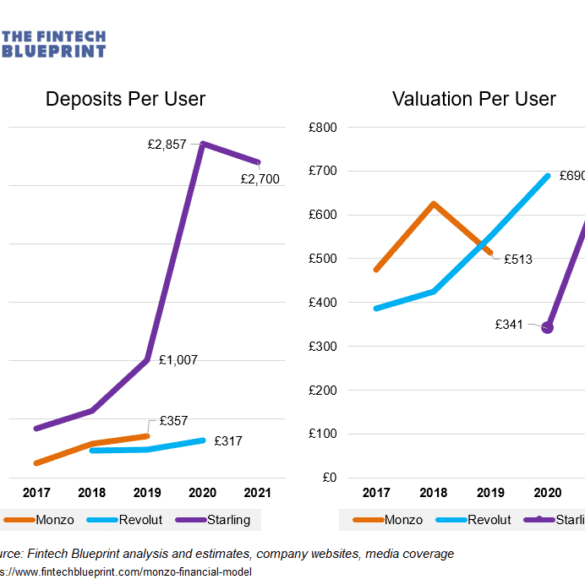

Let’s take a moment to compare capital. While it is not the money that wins markets, it is the transformation function of that money into novel business assets that does. And while the large banks have a massive incumbent advantage with (1) installed customers and assets, and (2) financial regulatory integration (or capture, depending on your vantage point), there is a real question on whether a $1 generates more value inside of an existing bank, or outside of an existing bank — even when it is aimed at the same financial problem.

big techdigital lendingdigital transformationInvestingmega banksOpen Bankingpaytechroboadvisorsuper app

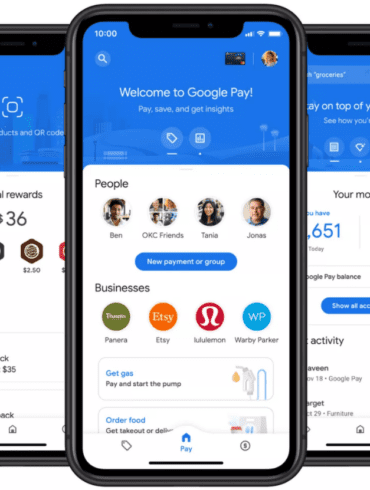

·Google has done it. In a massive update to Google Pay, the company highlighted exactly the direction of travel for high tech, fintech, and the global banks. It has articulated a vision for competing with Apple Pay and Ant Financial. Let's walk through the features.

Acorns Targets Babies With New Custodial Account Capital raises $9M for its AI-based ‘capital as a service’ funding platform for...

The new Mighty Oak Visa debit card from Acorns has a solid foundation for success says a representative from long-time partner Helix by Q2. GM Ahon Sarkar said he’s not surprised by Acorns’ prosperity since the two companies first partnered seven years ago, which is an eternity in fintech.

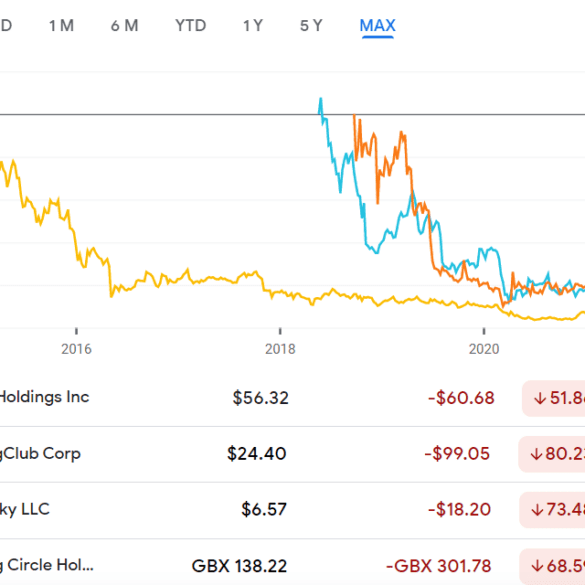

We look in detail at the state of marking recently-private-fintechs to the public market in mid-2021. Multiple industry segments have seen IPOs, direct listings, and SPACs transition fintech darlings into traditional stocks. How is performance doing? Is everything as magnificent and rich as we expected? Have multiples and valuations fallen or held steady? The analysis explores the answers and provides an explanatory framework.

This week, we cover these ideas:

The Acorns SPAC deal, including its valuation and detailed metrics

The growth levers and obstacles for point-solutions as they scale into the millions of users and hundred of millions of revenues

What a $50 billion fund should do to roll this stuff up

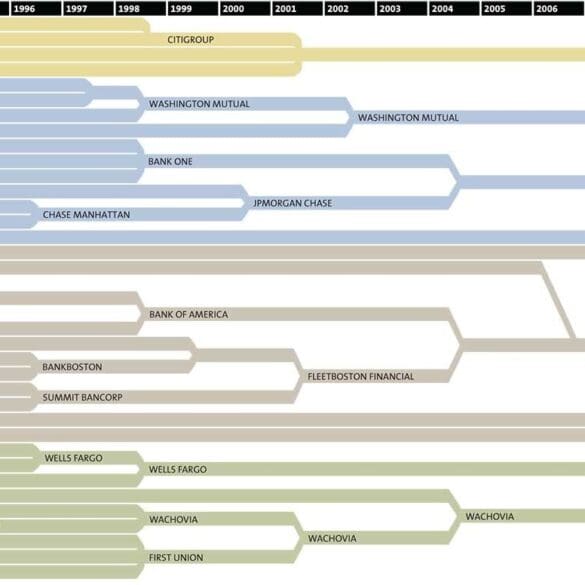

It is looking like a pretty good time to go consolidating individual financial product footprints. Leaving aside whether consolidated companies are good or bad for some particular reason, the simple observation is that there are just far too many point-solution brands out there. Too many to be left alone to operate. And now a number of them are going to be public, which means that a number of them are going to be up for sale.

Hedosophia is not a household name, and that is by design. The fund is one of the most secretive investors...

Cambr was created as a banking-as-a-service partnership between Q2 and Stonecastle but Q2 has decided to end this partnership; Q2...