Latin America Ebanx expects growth in alternative payment methods as e-commerce continues to grow in the region, as well as in Africa.

Ebanx announced the expansion of its operations to the African continent after acquiring an essential presence in 15 Latin American nations.

Studies have highlighted Africa's growing adoption rates of cryptocurrencies but little has been devoted to how the crypto winter impacts,

Typically the fintechs in Africa getting a lot of attention center around those focusing on payments; however Quartz reports that...

South African bank Capitec could be acquiring up to 49% of European online lender Creamfinance; the bank has structured an investment deal with three tranches totaling 21 million euros ($22.81 million) and an additional financing round which could include an additional 5.4 million euros ($5.9 million) if shareholders choose to sell an additional 9% stake in the company; Creamfinance provides online consumer loans in six global markets: Poland, Latvia, Georgia, the Czech Republic, Mexico and Denmark; Capitec says it has been analyzing international investments and sees Creamfinance as a good fit because of its business model and specifically its technology-driven approach. Source

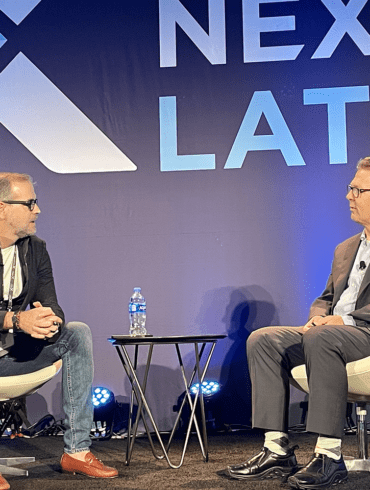

Wagner Ruiz, Co-founder of EBANX, talked at the Fintech Nexus LatAm 2022 event about the outlook for payment innovation in emerging markets.

The Central Bank of Kenya (CBK) announced the complete interoperability of mobile money payment services in Kenya.

Nontraditional data is relevant across Africa as credit bureaus don't have the historical depth their Western counterparts enjoy.

Lidya has raised $1.25 million to expand its financing services for small and medium enterprises in Africa; the funding round was led by Accion Venture Lab and will help the company enhance its credit scoring for small businesses and improve access to small business funding; it is targeting $4.9 million in loans for its first year of business. Source

German-based marketplace lender Bitbond has partnered with African payments provider BitPesa to improve the lending experience for small and medium enterprise (SME) borrowers; Bitbond will enhance the blockchain lending services of its platform by incorporating cross-border payments through BitPesa; the BitPesa payments platform can make payments in 20 minutes and is now live in Kenya, Nigeria, Uganda and Tanzania. Source