Generative AI (GenAI) is the topic of the year, as more institutions turn to investment in the technology. This is just the beginning.

AI GPT, is known for its "generative" attributes, but the transformer model underlying its evolution could make the biggest impact.

While statistics vary year by year, there was a 79 percent increase in document fraud in 2022. Such a number doesn't come as a surprise to Inscribe fraud analyst Daragh McMeel. A rise in fraud rates often occurs when the economy travels an uncertain and difficult path.

Sponsored

Sponsored content is a type of promotional media paid for by an advertiser but created and shared by a publisher. Fintech Nexus contracts sponsored content articles to experienced journalists comfortable in the fintech space.

Organized crime groups are exploiting gaps in detection technology to orchestrate financial fraud on a massive level simultaneously across multiple businesses and geographies. The result? Actual fraud rates are multiple times higher than reported

Money Laundering is a perpetual thorn in the side of financial institutions. BIS reports that AI and use of networks could be way forward.

Fraud is rising with the increased reliance on alternative payment methods, and AI could stop it. FIs have difficulties in adopting the tech.

Lenders gravitate towards using artificial intelligence (AI), so they must be dedicated to removing biases from their models. Luckily there are tools to help them maximize returns and minimize risks.

The increased use of AI in financial services is inevitable, but for it to fully flourish, many issues must be addressed, including legal, educational and technological ones. As they get resolved, several factors will still increase use in the interim.

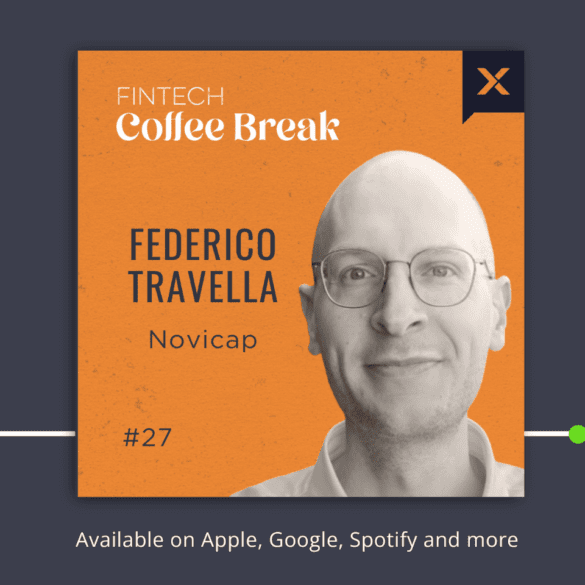

This week, Isabelle sat down with Novicap's Federico Travella, to talk about deep tier financing and the power of AI.

Fintech advances, including emerging digital neobanks, embedded banking, AI, and other tools, are expanding consumer options.