Although generative AI's development is a concern to some, its application to the lending sector could create even more access to credit.

The ability to bolster human knowledge in a short amount of time is a tantalizing prospect for the application of artificial intelligence.

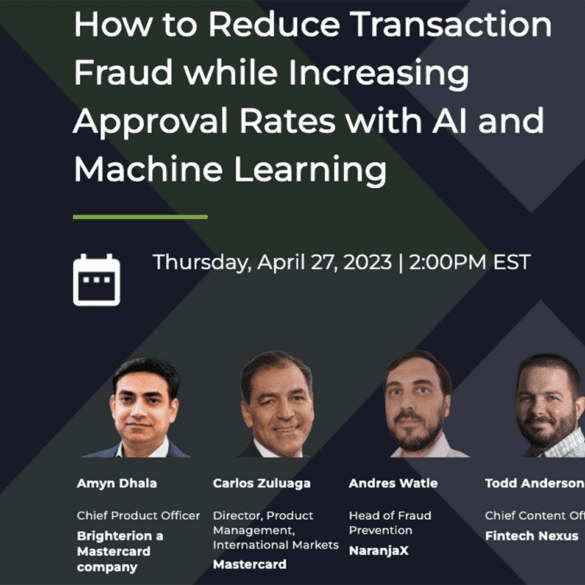

Join AI and transaction fraud experts from Mastercard and NaranjaX and learn how AI can increase approval rates, and much more.

Ternary's AI-enhanced capabilities allow it to go beyond basic recommendations. It's a "more sophisticated way of helping companies understand what they can do amidst all of these moving parts to make their spend efficient."

Everyone is talking about how AI is the next big thing, and there is no doubt it is making waves. But is the world ready?

In this episode we talk with the CEO of Zest AI, Mike de Vere, about using artificial intelligence in underwriting and why it is now an essential tool for all lenders today.

From an anti-money laundering perspective, organizations had significant increases in new customers and transactions over a short period.

In this episode we chat with Pankaj Kulshreshtha, the CEO and founder of Scienaptic about advanced underwriting technology and why AI is key to their solution

The international firm, whose US headquarters are located in Parsippany, NJ, grew its revenue by 35 percent in 2022 while increasing the number of customers by 24 percent.

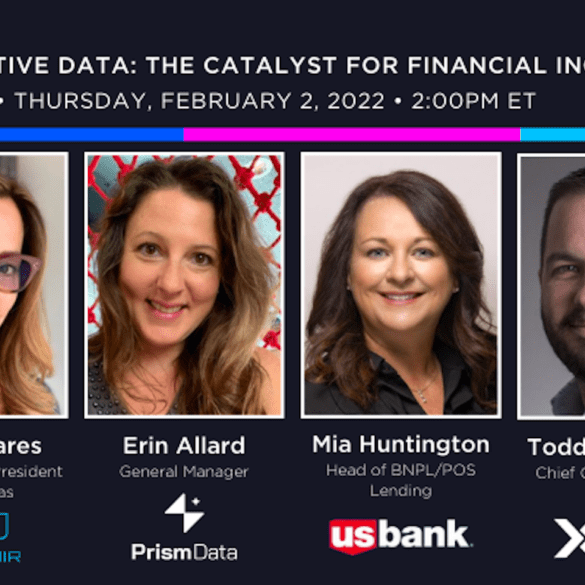

Alternative data could be critical to financial inclusion, but industry experts say it isn't all plain sailing. Find out why.