As workers require more technical and digital skills to master emerging technologies, many organizations risk being left behind.

TikTok has been falling short, and banks need to step up. Here's how they can learn from financial influencers and help customers.

Upstart announced Q2 earnings on Monday, disappointing investors. The company lost $32.1 million overall, on total revenue of $228 million.

As underwriting turns toward AI, experts agree if credit solutions have a hope of meeting their potential, alternative data is vital.

Companies that are slow to incorporate alternative data into their R&D, marketing, investment, risk analysis, and other key processes expose themselves to extreme opportunity loss at best and operational peril at worst.

The commercial lending process is still very document-driven; while many documents have moved online, the overall market is still using a process developed years ago. Able is helping to change that equation by streamlining the lending process.

Over $70 trillion in wealth transfer is in motion, underscoring the need for institutions to invest in serving the needs of younger consumers.

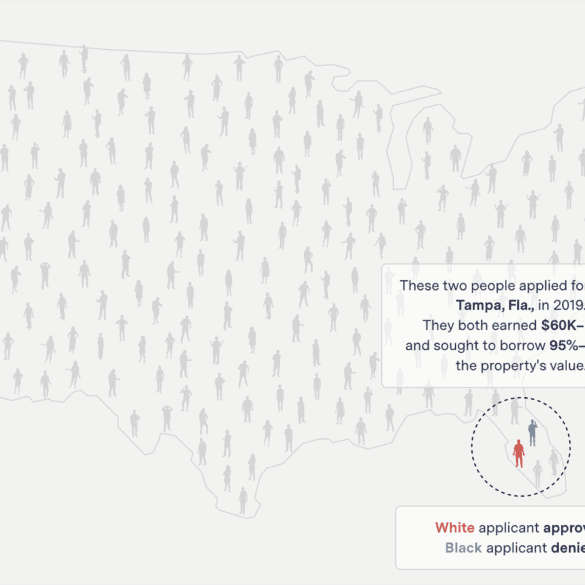

Bias in credit underwriting is an issue some worry will be exacerbated by AI others believe it is the only way forward. At Fintech Nexus USA 2022, approaches were discussed to mitigate concerns.

Blockchain-enabled structured finance platform Intain announced the addition of a 'verification agent module' with UMB as its first customer.

In episode 364 we talk with Kareem Saleh, the CEO and Founder of Fairplay where we discuss fairness in underwriting models and why we have to do better as an industry in eliminating bias