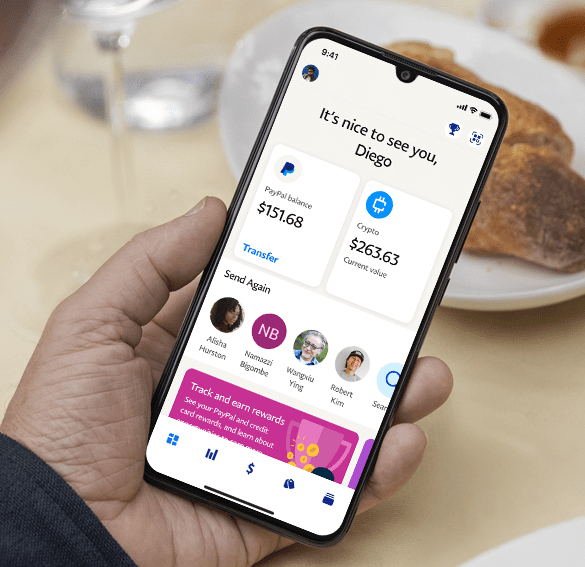

PayPal just launched what it calls a super app. It has a cash account with a 0.40% interest rate, direct deposit, money movement, bill pay, and remittance features. It also integrates shopping functionality with rewards and cash back. In this analysis, we compare this offering with Google Pay and Square Cash App, as well as trace the DNA of PayPal to understand whether such an offering will succeed where others failed.

In this video conversation we feature a roundtable by The Defiant exploring how and if the gap between Fintech and DeFi will be bridged.

DeFi Panelists

Lex Sokolin, head economist at ConsenSys

Santiago Roel Santos, angel investor

Spencer Noon, Investor at Variant

Vance Spencer, co founder at Framework Ventures

Fintech Panelists

Keith Grose, head of Plaid international

Nik Milanovi?, founder of This Week in Fintech

Simon Taylor, co-founder of 11:FS

Bruno Werneck, Business & Corporate Development at Plaid

Moderator

Camila Russo, Founder of The Defiant

Crypto isn’t magic. It’s math. Two trillion dollars worth of math.

We are still, often, asked incorrect questions about the crypto currency markets. Questions like — “but what is the fundamental value?”

You have to unpack the word “fundamental”. That word signals a Warren Buffet view of the world: there are companies out there, they have equity shares well specified by corporate law in a particular jurisdiction, some are expensive while some are cheap, and that bargain shopping can be determined by a spreadsheet analysis of their cashflows relative to others. It’s so fundamental!

The story of such fundamental truth is anchored in our cultural and social history. We can point to the intellectual tradition of rationalism and classical economics, and talk about the theory of the firm, and its production function. We can point to how these things grew out of governance by religion, and natural rights as granted by a deity, and all sorts of other non-empirical hand waving.

The main driver of today's entry is the news -- which has largely percolated -- that ConsenSys acquired Quorum from J.P. Morgan, as well as received an investment from the bank in the company. There is a lot of jargon in the blockchain industry, and I want to try to pull this news apart to explain why it is interesting both to incumbent financial services players, as well as meaningful to the developing decentralized finance industry.

Uber recently said they are de-prioritizing their finance related projects to better weather the current crisis; this comes only a...

Paypal Mafia buy now pay later fintech the talk to the town having snagged the biggest e-commerce market in the world.

Certain customers will be able to use an Affirm pay later option at checkout, Amazon said in a press release.

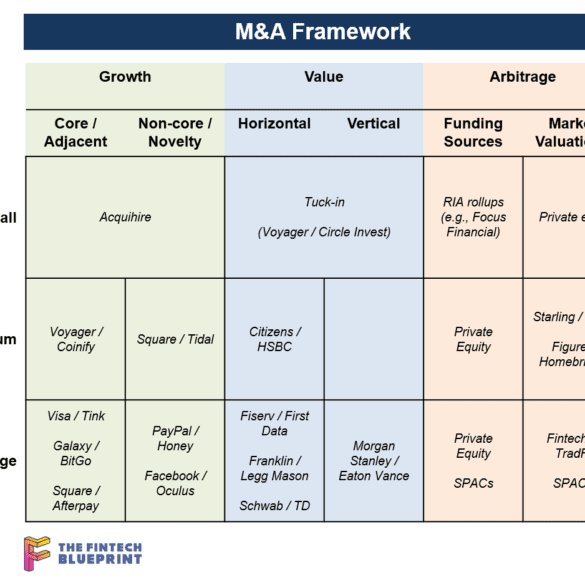

In this analysis, we explore an overarching framework for the M&A activity in the fintech, big tech, and crypto ecosystems. We discuss acquihiring, horizontal and vertical consolidation, as well as the differences between growth and value oriented acquisition rationales. The core insight, however, is about the arbitrage between the fintech and financial services capital markets, as evidenced by the recent transactions for Starling and Figure.

We’ve had this write-up in some various mental states floating around for a while, and better done than perfect. So treat this as a core idea to be fleshed out later.

Payments and banking companies should be looking at how people purchase and store digital goods and digital currency in video games. That experience has been polished over 40 years, and is what will be the default expectation for future generations.

For those interested, here is a website that collects user experiences of shopping across hundreds of designs.

The tech companies will become the storefront to absolutely everything.

There is no Internet, there is only Google.

There is no commerce, there is only Amazon.

There is no finance, there is only WeChat / Tencent?

I don't know about you, but I cannot pay for anything in cash in London anymore. COVID has made the city go cashless. For China, QR codes have long replaced the need for paper money. And if there is no cash, what is the point of ATMs, and ATM fees, and bank branches, and bank branch staff? Financial firms no longer need to be the place where you shop for financial product.

Even though it does have a lending operation Amazon did not take part in the Paycheck Protection Program directly; but...