In this conversation, we chat with Richard Turrin – an award-winning executive, previously heading FinTech teams at IBM, following a twenty-year career, heading trading teams at global investment banks. He’s also the author of the number one international bestseller, Innovation Lab Excellence. One of his books is Cashless: China’s Digital Currency Revolution, which brings the story of China’s incredible new central bank digital currency to the west. He lives in Shanghai, China, where he’s had the privilege of living in China’s cashless revolution firsthand.

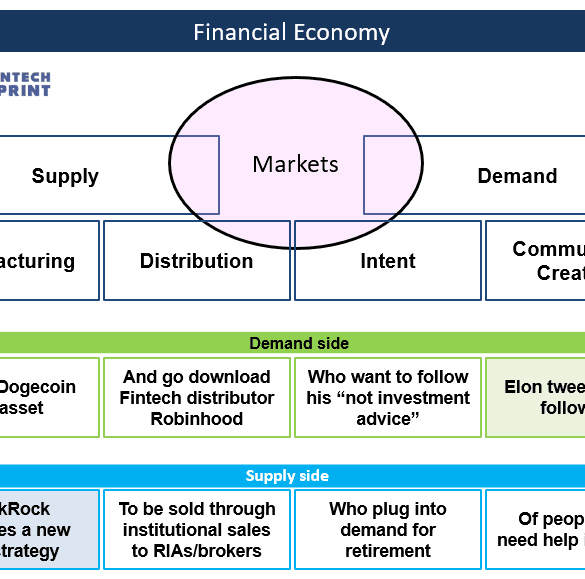

Square upgrades Cash App into a payment processing powerhouse, completing the loop between the consumer and merchant side of the house. Goldman Sachs acquires GreenSky, adding a lending business at the point of intent. This analysis connects these symptoms into a framework explaining the increasing integration between commerce and finance, and the increasing role that demand generation plays. That in turn explains how the attention and creator economies interconnect with financial services.

We are syndicating a deep conversation across roboadvice, high tech and payments, and fintech bundling that we had with Craig Iskowitz of Ezra Group Consulting.

Check out Ezra Group Consulting here to learn more about digital wealth and Craig’s consulting practice. He is one of the sharpest software consultants in the RIA space, and his firm works with wealth management firms and fintech vendors to provide technology strategy and market research.

We had a lot of fun in this conversation and cover TD & Schwab, Wealthsimple, M1 Finance, Ant & Tencent, and Robinhood, among others. The full transcript is provided along with the recording — worth a read for the illustrations alone.

This week, we look at:

The Bitcoin money supply being worth as much as the M1 of several countries

The Visa/Plaid deal DOJ anti-trust filing and the PayPal integration of Bitcoin

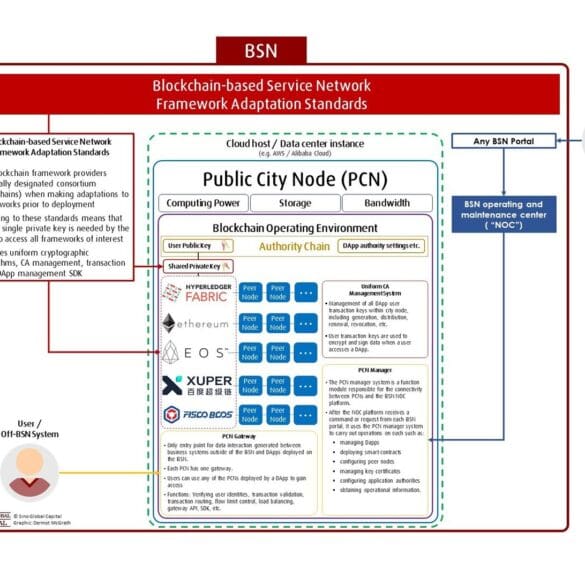

Understanding Central Bank Digital Currencies in the context of card networks, payment processors, and digital economies

Chinese CBDC and how it could relate to stopping the $34B Ant Financial IPO

How a CBDC ecosystem is like an operating system, rather than a payment rail

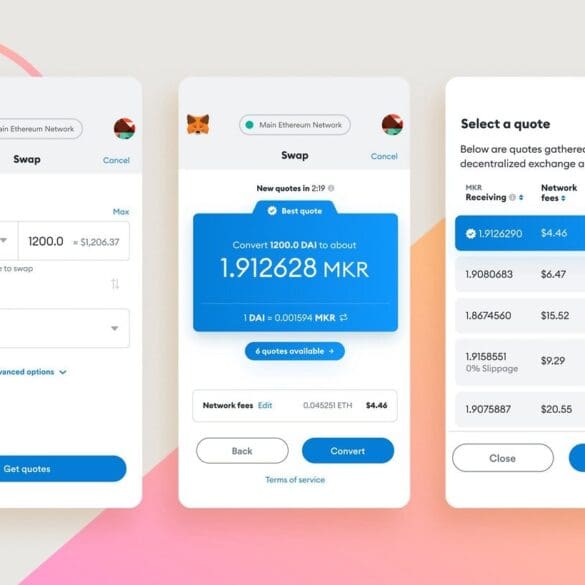

The main driver of today's entry is the news -- which has largely percolated -- that ConsenSys acquired Quorum from J.P. Morgan, as well as received an investment from the bank in the company. There is a lot of jargon in the blockchain industry, and I want to try to pull this news apart to explain why it is interesting both to incumbent financial services players, as well as meaningful to the developing decentralized finance industry.

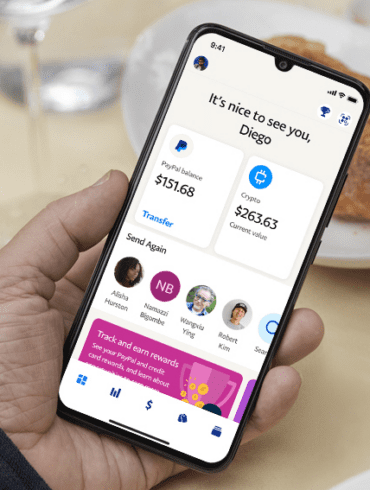

PayPal just launched what it calls a super app. It has a cash account with a 0.40% interest rate, direct deposit, money movement, bill pay, and remittance features. It also integrates shopping functionality with rewards and cash back. In this analysis, we compare this offering with Google Pay and Square Cash App, as well as trace the DNA of PayPal to understand whether such an offering will succeed where others failed.

This week, we look at:

China’s Five Year Plan, the industrial logic of the system, and its ramifications for blockchain and fintech in the country

The regulatory challenges faced by Chinese tech companies, including the resignation of Ant Group’s CEO and the anti-competition fines for Tencent

The growth path of the e-CNY digital currency, as well as Beijing’s enterprise blockchain powering the city infrastructure and governance

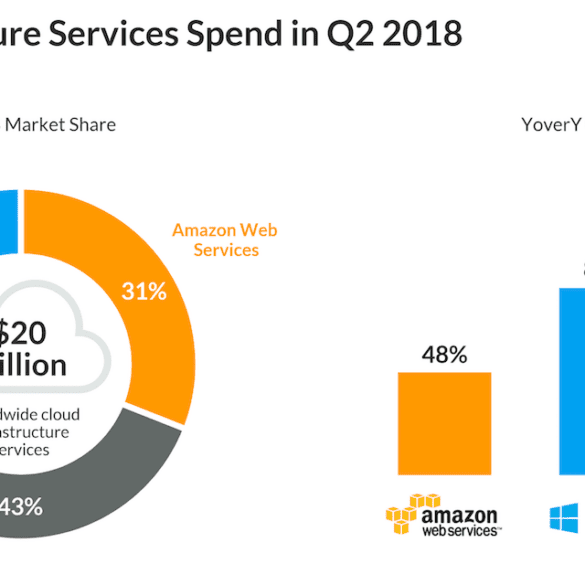

Footnote: Stripe worth $95 billion, closing $600 million investment

This week, we look at:

The relationship between an individual and a system, and how that applies to the power games of politics and economics. Did Trump change the system, or did the system generate Trump?

The difference between fighting and signalling, and what creates fragility and flexibility in governance structures

Why the Communist Party stopped Ant Financial's IPO, and how Jack Ma bears a resemblance to Mikhail Gorbachev

In this conversation, Max Friedrich of ARK Invest, Will and Lex break down Ant Group’s highly anticipated IPO.

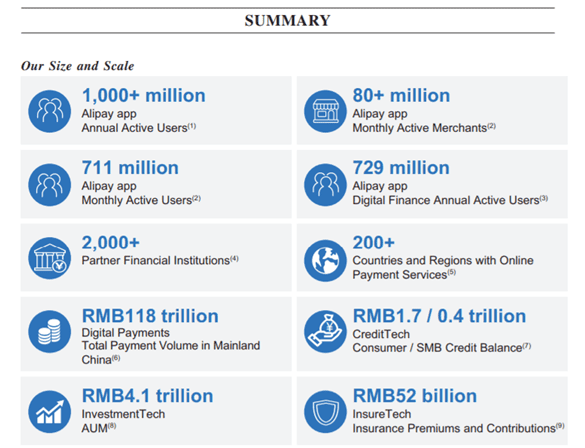

Ant, a spinout from Alibaba and the parent of Alipay, one of China’s leading payments companies, filed papers to IPO in Shanghai and Hong Kong.

Max, Will and Lex dig into Ant’s business, from the origins to today, discuss growth opportunities and potential headwinds and explore the multi-faceted relationships between Ant and other big tech companies and national governments.

We cannot understate how impressive Ant Financial has become, connecting 700 million people and 80 million merchants in China, with payments, savings, wealth management and insurance products integrated in one package. The company also highlights the likely road for traditional banks — as underlying risk capital, without much technology or client management.

This week, we look at:

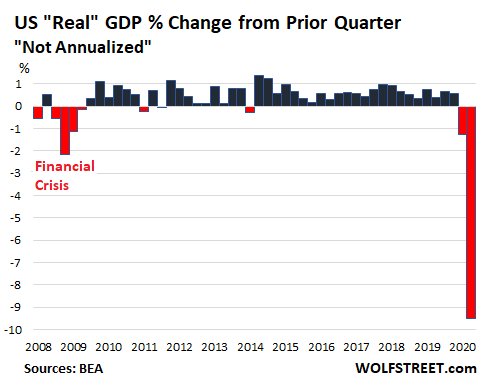

The 10% collapse in GDP across the US & Eurozone, and how it compares with China's second quarter

The geopolitical battle over TikTok, its alleged spying, and understanding the winners and losers of the Microsoft deal

A framework for how to win in open source competition, explaining both Shenzhen manufacturing success and decentralized finance growth to $4 billion