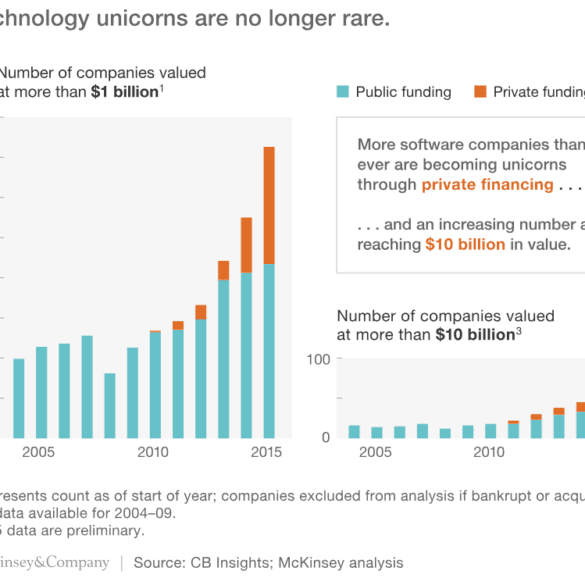

The world is on fire with talk about Uber going public. First, let's talk about who makes money and when. It is becoming a truism that companies are going public much later in their vintage, and as a result, the capital that fuels their growth is private rather than public. The public markets are full of compliance costs, cash-flow oriented hedge fund managers, and passive index manufacturers -- not an environment for an Elon Musk-type to do their best work. Private markets, on the other hand, are generally more long term oriented with fewer protections for investors. This has a distributional impact. Private markets in the US are legally structured for the wealthy by definition and carve-out. As a retail investor, your just desserts are Betterment's index-led asset allocation. As an accredited investor, you get AngelList, SharePost and the rest. I am yet to see Uber on Crowdcube. Therefore, tech companies are generating inequality both through their functions (monopoly concentration through power laws, unemployment through automation), and their funding.

Hong Kong authorities are planning to issue digital banking licenses to Tencent, Ant Financial and Xiaomi; Goldman Sachs estimates there...

A year ago US regulators nixed a deal for Chinese fintech giant Ant Financial’s buyout of MoneyGram; this time around...

Mobile payments in China have taken off in recent years as Ant Financial and Tencent dominate the market; in recent...

It had been rumored for some time now. Ant Financial, the Chinese financial behemoth, was raising a very large funding...

Chinese tourists are able to use Alipay at more than 200,000 U.S. locations but the company does not have plans...

Green Dot Eyes Banking-As-A-Service, Gen Z To Build On Q4 Growth $650 billion asset manager Franklin Templeton is embedding data...

Ant Financial’s Yu’E Bao fund has shrunk to its lowest size in over two years as the government looks to downsize...

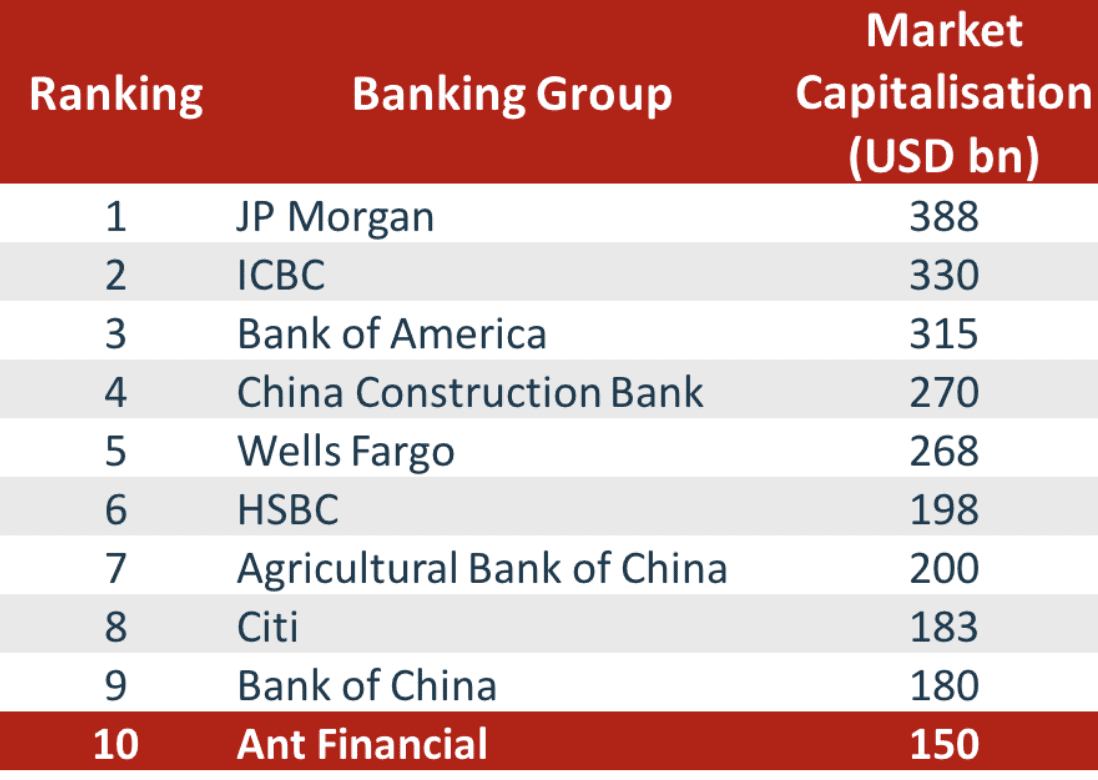

Based on market capitalization Ant Financial is the 10th largest banking group in the world; Ant Financial recently closed a...

Ant Financial recently raised an oversubscribed $10bn round which values the firm higher than Goldman Sachs, American Express and BlackRock;...