Big fintech news this week came from Apple, Visa, Blockchain.com, Cross River, Consumer Financial Protection Bureau, Bilt Rewards, Wells Fargo, Alviere, Coinbase, Axie Infinity and more.

Lots of crypto news this past week with a big round from ConsenSys, a big vote in the EU and everyone wonders what Apple will do with crypto.

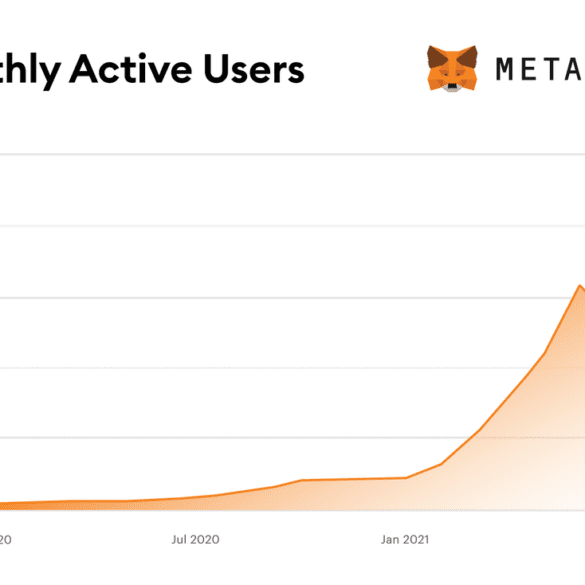

In this conversation, we chat with Daniel Finlay – a former Apple software developer, co-founder and co-lead developer on MetaMask – a non-custodial Ethereum wallet, allowing users to store Ether and other ERC-20 tokens and make transactions. Further. With the growth of DeFi and NFTs over the past year, MetaMask has increased in prominence as an entry point for novice users. So much so that its user base is now over 20 million monthly active users.

More specifically, we touch on how Dan went from teaching kids to code to having an app rejected by the Apple App Store to MetaMask, the philosophy behind e-government, questioning the role and job of software engineers, how crypto wallets compare to neobanks, and so so much more!

We started the month with the huge news that Square was acquiring Afterpay and we ended with Amazon’s deal with Affirm.

It seems like every day there is more news coming out of this sector, it is white-hot right now.

I have been following Citizens Bank for many years as they built this robust online lending operation across multiple verticals....

The news this week was led by Apple with another fintech acquisition. We also had a big funding round for Ramp and Dave is getting into crypto with FTX US.

How did competition between the top consumer debt contenders heat up over the long-awaited holiday shopping spree?

We discuss the Facebook pivot into the metaverse and its rebrand into Meta. Our analysis touches on the competitive pressures faced by the company from big tech players, other ecosystem builders, and limits to growth for a $1 trillion business that likely motivated this refocus. We further dive into network effects around platforms, and why super apps and financial features are attractive, and how owning the hardware is a required defensive strategy. Lastly, we discuss these development through the crypto and Web3 lens, deeply disappointed with Facebook trying to domain park a generational opportunity with a centralized solution.

exchanges / cap mktsgaming & sportsgovernanceidentity and privacyMetaverse / xRNFTs and digital objectsregulation & complianceSocial / Community

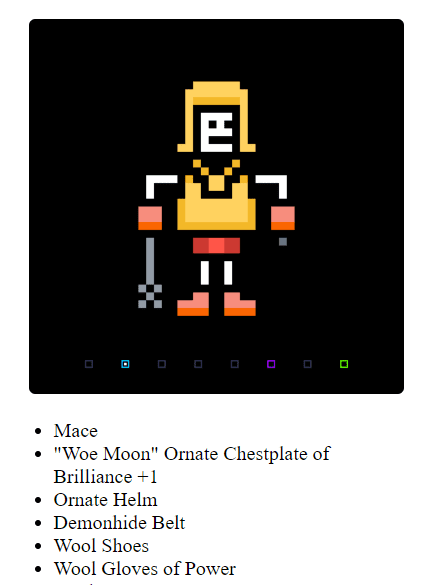

·We discuss the top-down and bottoms-up approaches to innovation and project building. For the former, we reference Australia’s draconian surveillance laws, and the integration of US driver’s licenses into Apple’s wallet. For the latter, we dive into the Ethereum-based Loot project and its incredible derivatives, $500MM token, and $200MM of volume. Last, we conclude by highlighting the role of creators on the coming wave of Fintech.

This week, we look at:

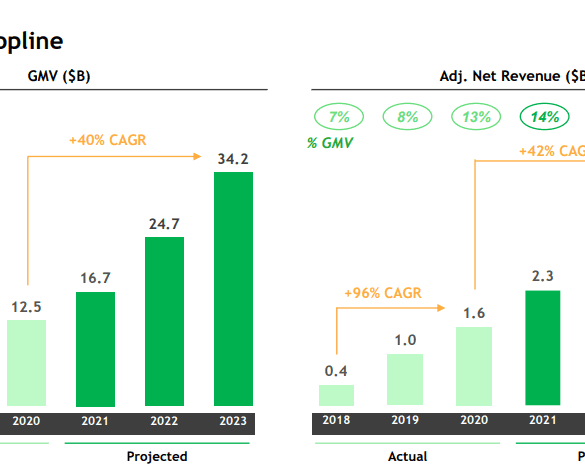

The economics of Southeast Asia’s largest super-app and its $40 billion SPAC valuation

The industrial logic of building out financial features adjacent to the core business of transportation and delivery

Why this model has not worked for Uber, but has worked for Apple, and the broader impact on financial services.