The crypto firm enables users to buy and sell crypto, earn credit rewards on their accounts, and send money peer-to-peer: it will open up the Mastercard network to the cryptocurrency world.

In this conversation, Will Beeson and I break down a few important pieces of recent news — the SPACs for SoFi and Bakkt, and Plaid/Visa falling apart.

SoFi is going public with a SPAC deal worth over $8 billion. A few things we touch on in detail: (1) this is still largely a lender, (2) there is a gem of an embedded finance play called Galileo that SoFi owns, and (3) the multiple is a little over 10x T12 revenues, which is not crazy expensive, but not cheap.

Speaking of Galileo and finance APIs, we transition to Plaid, and how it is is not going to be one of the networks in Visa’s network of networks. Who wins and who loses in the equation? And last, we cover the Bakkt SPAC of over $2 billion and our view on its future.

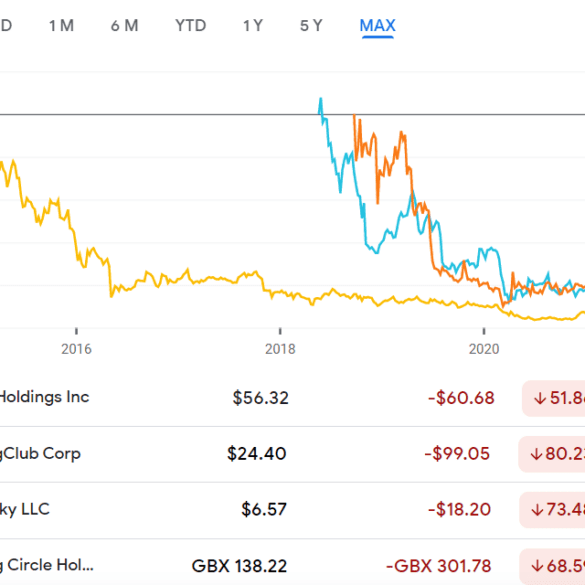

We look in detail at the state of marking recently-private-fintechs to the public market in mid-2021. Multiple industry segments have seen IPOs, direct listings, and SPACs transition fintech darlings into traditional stocks. How is performance doing? Is everything as magnificent and rich as we expected? Have multiples and valuations fallen or held steady? The analysis explores the answers and provides an explanatory framework.

Digital asset services fintech Bakkt has raised a $300mn series B from Microsoft’s venture capital arm M12 and fintech PayU;...