Their website mentions names such as 'digital sterling' or 'Britcoin' and emphasizes the difference between CBCDs and cryptocurrencies.

I examine the rising relevance of Central Bank Digital Currencies. We look at the World Economic Forum policy guide to understand different versions of CBDCs and their relative systemic scale, and the ConsenSys technical architecture guide to understand how one could be implemented today. For context, we also dive into a very different topic -- Lithium ion batteries -- and show how a change in the cost of a fundamental component part (e.g, 85% cost reduction in energy, or financial infrastructure) opens up a massive creative space for entrepreneurs.

Fighting Chinese Artificial Intelligence with lasers and American Crypto with European Central Banks

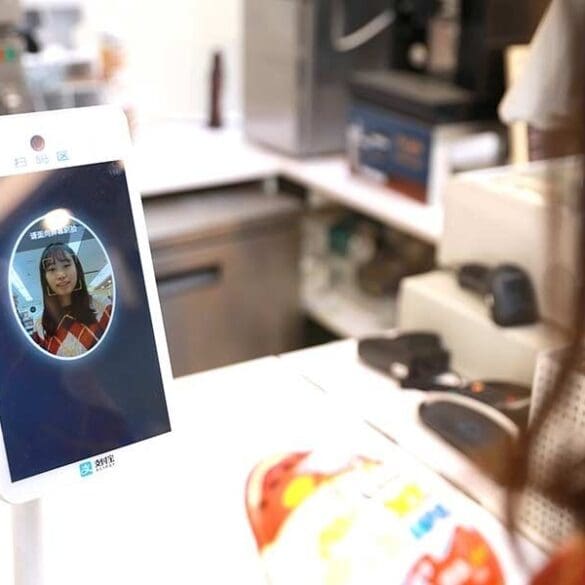

How do the Americans and the Chinese have such different ethical takes on privacy, self-sovereignty, media, and the role of government? We can trace the root cause to the DNA of the macro-organism in which individuals reside, itself built over centuries and millenia from the collective scar tissue of local human experience. But there is more to observe. The technology now being deployed in each jurisdiction -- like social credit, surveillance artificial intelligence, monitored payment rails, and central bank cryptocurrency -- will drive a software architecture into the core of our societies that reflects the current moment. And it will be nearly impossible to change! This is why *how* we democratize access to financial services matters. We must be careful about the form, because we will be stuck with it like Americans are stuck with the core banking systems from the 1970s. But the worry is not inefficiency, it is programmed social strata.

While regulators in the U.S. and around the world had mainly negative things to say about Facebook’s new Libra digital...

The Bank of England decided to keep rates steady at 0.5 percent which will be a big benefit to P2P...

While the coronavirus continues to take most of the headlines the UK Chancellor Rishi Sunak released the 2020 budget; the...

The new company called Vive just received their restricted banking license from the Bank of England; Vive plans to launch...

For the first time the Bank of England intends to offer tech companies the chance to have accounts at the...

‘Another one?’ Bankers react to Facebook’s digital currency Next decade is set to be transformative for small business finance PwC...

The UK Chancellor of the Exchequer Philip Hammond will announce the creation of a task force focused on cryptocurrencies; the task force will include the Treasury, the Bank of England, and Britain's financial watchdog the Financial Conduct Authority; the task force will help manage the risk surrounding cryptocurrencies and better understand how blockchain technology can be implemented. Source.