There was a powerful synergy built between banks and fintechs in 2018 that truly lifted the entire financial sector. All...

·

It was back in December of 2015 that we first learned about OnDeck’s partnership with JPMorgan Chase. This was the...

The recent surge in financial innovation has caused many community banks to rethink how they are serving their customers and...

Grameen America wants banks and social impact investors to help fuel a doubling of their loan portfolio in the next 5 years; most of the new money to lend will come from their inaugural Small Business Fund and the remaining amount is where they will turn to banks and social impact investors; “It's a way to appeal to impact investors who are interested in this kind of concept as opposed to pure philanthropy,” says David Gough, CFO, to American Banker when talking about the company’s shift to impact investors to fuel growth. Source.

According to KPMG’s Pulse of Fintech report fintech investment increased for the third straight quarter to $5.8bn; the big driver behind this is banks continue to increase their investments and partnerships with fintech firms; “You’re seeing more partnerships because there is more interest on both sides in collaborating, and bringing two different sets of values to the table,” said Luis Valdich, managing director of venture investing at Citi Ventures, to American Banker; banks have been keen to focus on news technologies like artificial intelligence, advanced analytics tools and blockchain. Source.

Upstart has been quietly doing something that many others have found difficult: building a profitable online consumer lending business. I...

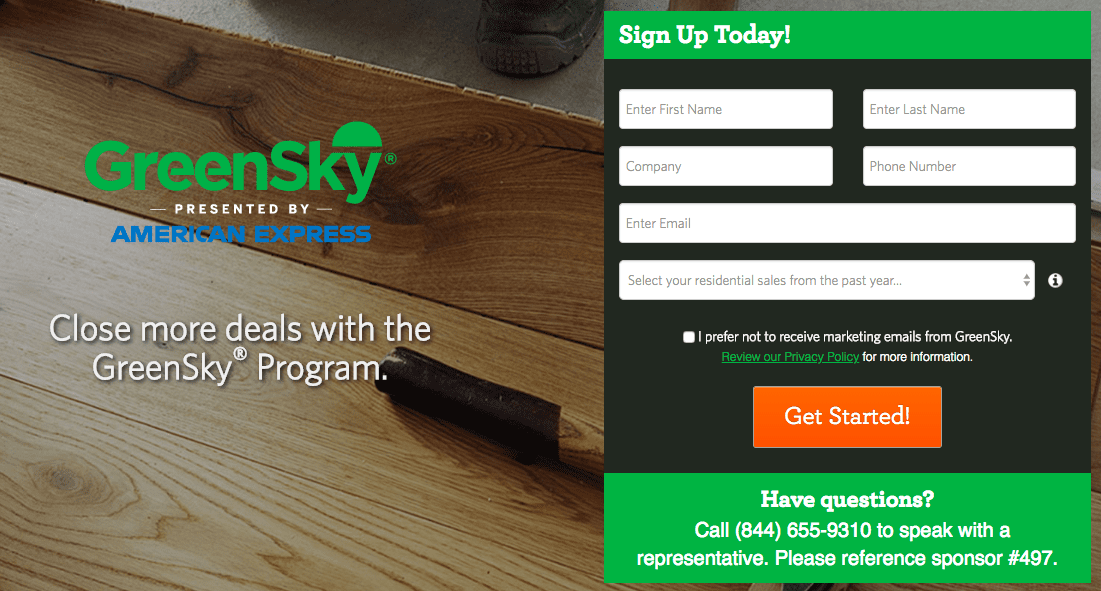

We heard on Monday that newly public fintech company, GreenSky, has partnered with American Express in a wide ranging deal....

News of Amazon in talks with JPMorgan Chase and Capital One to offer a checking account product has brought up a number of regulatory questions; key questions include who owns the customer, what is Amazon’s role in the accounts, who regulates Amazon in this instance and will Amazon need to become a bank; while details of the deal are not fully known regulators will be keeping a close eye on the partnership. Source.

In this week’s PeerIQ Industry Update they cover the rising volatility in credit markets and the recent Q4 economic numbers; while at SFIG in Vegas PeerIQ shared comments from investors which show a lot of optimism and demand for MPL; they also talk about their recent product offerings and the continued push by banks to work with fintechs. Source.

Happy New Year everyone. As I do every year at this time I make a few predictions for the year...