While there have been many false starts, the market for P2P payments is finally taking off in this country; two-thirds of...

When it comes to laying the groundwork for success in 2019, and beyond, the only New Year’s resolution banks and...

After several years of tightening credit requirements for business loans over the last couple of years more banks have been...

It has been fascinating to watch the TSB saga unfold in the UK. The challenger back had an embarrassing outage...

European finance chiefs believe that tech companies moving into financial services is a threat to financial stability; they also highlight the need for companies to be held to the same regulation as big banks; banks are especially concerned as open banking regulations are now in effect; article shares perspectives from BBVA, ING and Lloyds. Source

A recent CNBC report showed that fintech companies accounted for 38% of personal loans in 2018, up from 5% in...

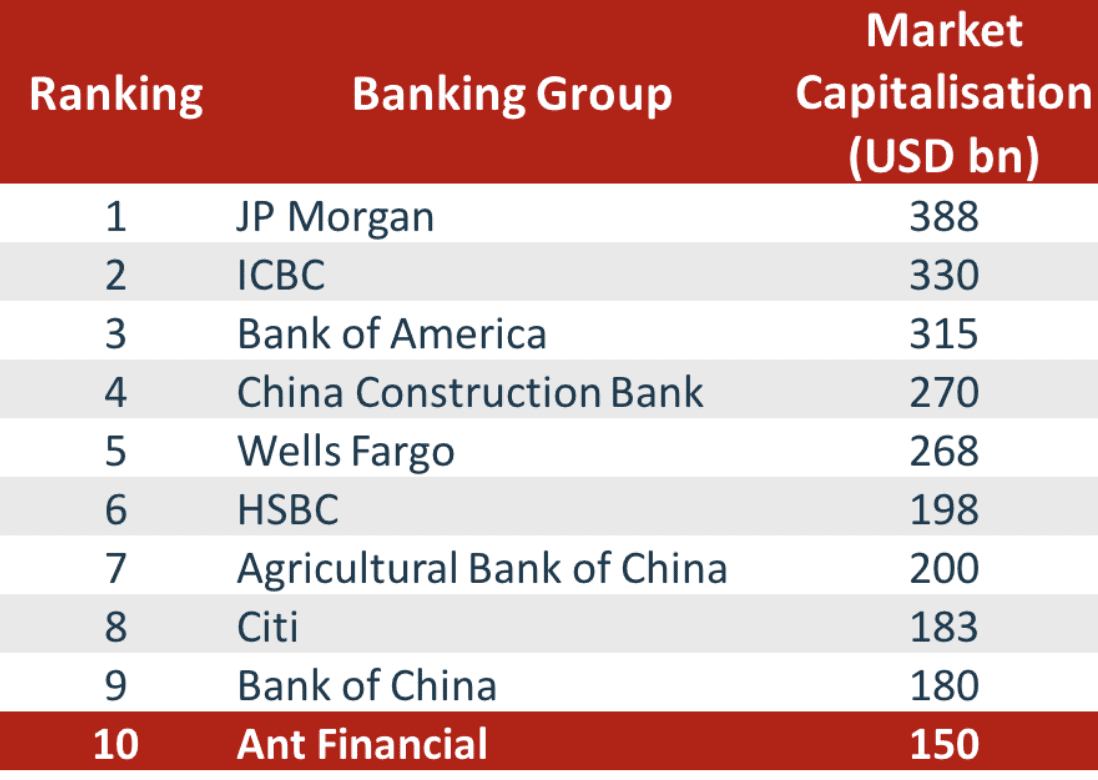

It had been rumored for some time now. Ant Financial, the Chinese financial behemoth, was raising a very large funding...

Since the financial crisis mergers and acquisitions by banks has reduced substantially. This has been a global trend that may...

Crowdfund Insider explores Sofi’s move to offer banking service without become a bank itself; the rent a bank model allows for FDIC insured accounts while Sofi gets to own the customer experience and offer these services without the regulatory burden of a bank; Sofi Money is set to roll out in 2018 and will offer 0.96% APY on accounts; there are no account fees and they will offer free ATMs internationally; many banks still have legacy systems and lack the culture of fintech companies so it will be interesting to see how they compete. Source

Since the financial crises banks, for the most part, have focused their time and effort on complying with new regulations and building up capital ratios in case another crisis hits; while they were doing this another industry, fintech, emerged and has eaten into some of the core profit making businesses of the banks; banks have started to catch up with technology and as countries like the US look to pare back some crisis era rules the banks see the next few years as the perfect opportunity to invest wisely in technology; the one thing the banks might not be able to handle is if Amazon, Facebook or Google begin to encroach further into fintech, potentially bring in competition who can immediately match up in size and strength. Source.