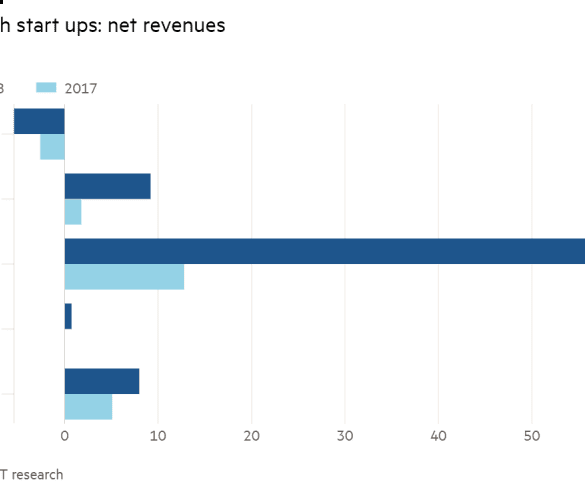

Fintechs have started to follow the Fed and slash rates on savings accounts by an average of 1 percent; the...

I examine the unbelievable transformation and restructuring happening in high finance. Global bank HSBC is planning to lay off over 10% of staff, looking at reductions of 35,000. E*TRADE is being acquired by Morgan Stanley, integrating its 5,000,000 accounts and $360 billion of assets into the Wall Street investment firm. Legg Mason and its $800 billion of assets are being folded into Franklin Templeton for $4.5 billion, less than what Visa had paid for fintech data aggregator Plaid and half of what Robinhood is likely valued privately. How do we make sense of these developments? How do we appeal to the heart?

Forbes is reporting that Betterment is looking to take on one of the core offerings of banks: the checking account;...

Building off of the $70mn funding round from the summer Betterment is now reportedly worth $1bn; the $1bn mark is significant as it denotes that a company is considered a unicorn; the valuation makes Betterment the first robo advisor to reach unicorn status; the company currently has over $11bn in assets under management. Source.

Through the partnership, the firm hopes to provide more personalization to their over 270,000 users; both portfolios were vetted by Betterment to ensure quality and affordability standards; Dan Egan, director of behavioral finance investments at Betterment stated, “We wanted to get these strategies out to our clients as quickly as possible, rather than build them out ourselves.” Source

With the increase in market volatility over the last few weeks young traders have tried to catch the markets at...

We are like the hungry at the all-you-can-eat buffet. In the beginning, there is not enough! Let's democratize access to food; to music; to transportation; to healthcare; to finance; to payments; to banking; to lending; to investing. The billions in institutional capital across universities, pensions, and sovereigns are delegated to smart portfolio managers. The day before yesterday, it was allocated by small cap stock pickers (hi Warren!). Yesterday, it was the alternative managers of hedge funds and private equity. Today, it is the trading machine and the venture capitalist. Tomorrow, it is the cryptographic artificial intelligence.

Betterment is looking to cater to their wealthier clients as they make portfolios more personalized; they launched the Betterment Flexible Portfolio which allows customers to shoes how assets weights are allocated; the typical Betterment client uses the asset weights set by the robo advisor, but this feature is meant to personalize the wealth clients portfolio; the move will try to help the company to position themselves as a full service firm that can cater to different levels of clientele, not just the younger investor. Source.

Schwab Intelligent Portfolios now boasts $24 billion assets under management and has hired Cynthia Loh, the ex-general manager of Betterment for Business; article reports on Schwab’s robo-advice platform growth, the cannibalization the firm saw with the offering, and what the new hire might mean for Schwab’s future plans. Source

Jon Stein first looks to the past of investing in stocks with significant milestones such as the introduction of index funds, trade automation and decreasing trading costs leading to the ability to be easily diversified; thus old models of charging people to trade or to be diversified don't work; looking at the current and future trends Jon discusses that investors are now more responsible than ever for their own retirement and need advice; Jon Stein shares how Betterment is providing financial advice to more people; the company manages over $8 billion in assets and has 240,000 customers. Source