[Editor’s note: This is a guest post from Dmytro Spilka. He is a tech and finance writer based in London....

Here are the most read news stories from our daily newsletter today: Deadline for the Global Covid-19 Fintech Survey is...

On May 12 BMO closed their first home equity line of credit remotely using Blend’s digital closing product Blend Close;...

JPMorgan Chase, Wells Fargo and now Ally Bank have all outsourced a part of their home lending process to fintech...

Timothy Mayopoulos is the most recent example of a high profile executive moving into fintech; Mayopoulos will serve as President...

This week, we look at:

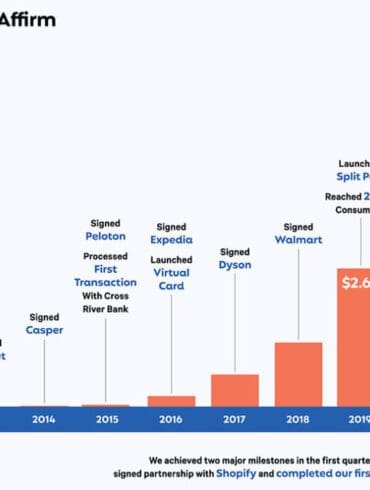

Over $1 billion in raises announced last week, and over $10 billion in Fintech company value creation: Checkout.com with $450 million at a $15 billion valuation, Affirm more than doubling after its IPO to $30 billion, lending enabler Blend raising $300 million, and payments enabler Rapyd raising $300 million.

A systems theory framework that explains the stocks and flows of goods and services, and what monetization strategies are available to fintechs

How transactional models are thriving and creating 50-100x revenue multiples

Mortgage fintech Blend is on a roll; Blend’s customer base now accounts for more than 25% of the $2.1 trillion...

While the coronavirus is impacting many companies there are a few bright spots for a handful of fintechs; Nigel Morris,...

Blend is on a mission to expand into more banks and credit unions with their new digital account opening product;...

Lennar Corp. is the largest homebuilder in the United States; they will leverage technology built by Blend to allow their customers to apply for mortgages online and through mobile devices; this will cut down significantly on the time to apply for a mortgage and Lennar hopes it will also help attract millennial buyers. Source