Exclusive interview with Andrew Seiz, head of finance at Kueski, on the 2024 outlook for consumer lending and Buy Now Pay Later in Mexico.

Embedded consumer lending offers many benefits over BNPL. Working with a BaaS provider like Finastra allows banks to control their roadmap.

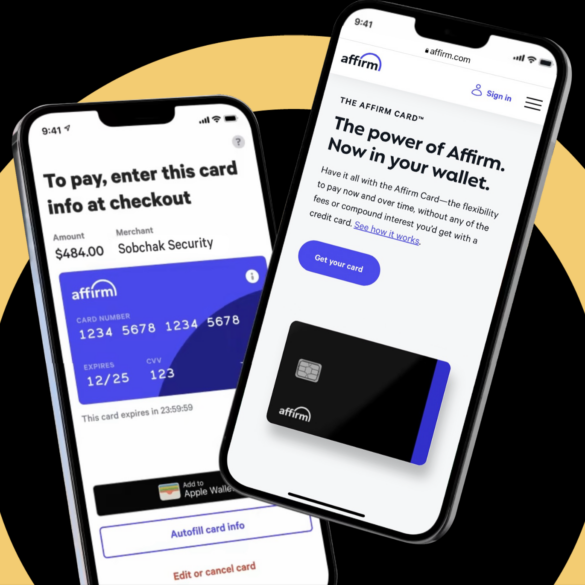

Affirm's earnings were fantastic. This continued the trend of publicly traded fintech companies breaking records for revenue and profitability.

Despite regulatory concerns banking-as-a-service continues to grow in popularity. Here are three tips for any business considering going the BaaS route.

Mexican fintech Kueski announced a partnership with Amazon to offer BNPL on its marketplace, a first for the retail giant in Mexico.

Mexican fintech Aplazo concluded its Series B funding round, securing $70 million, with an additional $45 million in new equity financing.

Consumers love buy now pay later but sometimes they have challenges with the pay later part.

As scrutiny of Buy Now Pay Later increases, so too do satisfaction scores among customers using the short-term financing mechanism structured like an installment loan.

J.D. Power's 2024 U.S. Merchant Services Satisfaction Study finds 54 per cent of small businesses accept BNPL and that those operations score the relatively new way to pay highest among payment methods, with a 744 score on a 1,000-point scale.

Embedded finance and buy now, pay later (BNPL) are hotbeds of innovation, and Marqeta is in the middle of the action, CEO Simon Khalaf said.