In this episode we talk with fintech legend, Max Levchin, the co-founder and CEO of Affirm, where he opines on BNPL, why it is better for consumers than credit cards, and how his company has grown into an industry behemoth.

Affirm's earnings call came with an announcement of layoffs, in an effort to streamline in accordance with low revenue growth.

This year has already seen some major shifts in focus for the BNPL market- should banks be concerned about the B2B focus?

With regulation taking center stage, there's an opportunity for banks to take the place of some large BNPL providers and lead the space.

BNPL providers should consider the FTC's suggestion to "conduct a compliance check," including reviewing their policies and procedures.

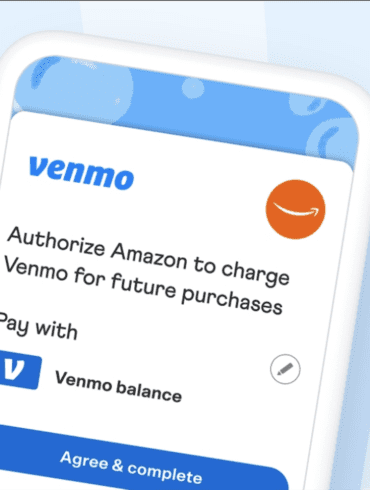

Amazon's deal with Venmo has the potential to set a new standard for payment tenders in general, and other brands are likely to follow in its footsteps.

Kueski plans to launch new products this year as it seeks to serve the underbanked. BNPL application rising on the back of e-commerce.

While fintech is no exception to the changeability, there remains appeal from both investors and consumers in tech-enabled financial tools.

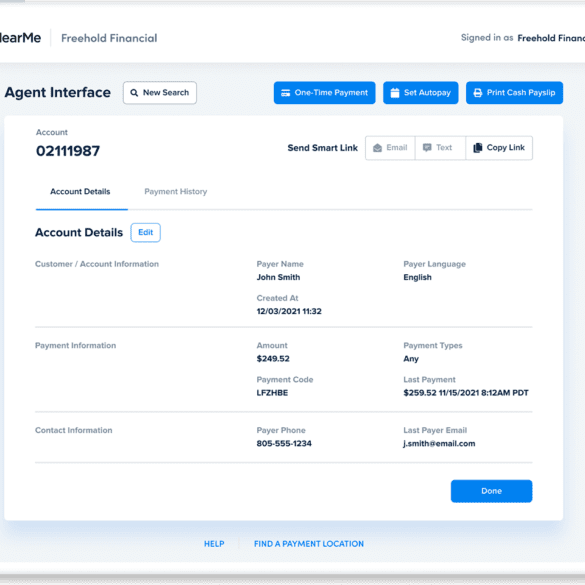

As the payments world is constantly evolving, new channels are popping up, and new payment types are popping up.

Addi has targeted the Colombian and Brazilian credit market with their BNPL product. CEO Santiago Suarez says insights make the difference.