The use of buy now, pay later (BNPL) services has exploded over the past few years, and only now are we beginning to learn the impact of that boom.

The CEO and Head of US operations for Curve discuss financial super apps, BNPL, launching in the US, credit cards and more

The lending space has come a long way since the original online lending pioneers came on the scene 15 years...

In the biggest webinar of the new year, three credit experts went live Thursday in front of the LendIt audience to talk about the future of AI analytics in credit.

In 2021, firms who had stayed alive through the initial pandemic became giants: fintechs became banks, banks became super apps, and super apps became some of the most successful public companies in the world.

Buy Now, Pay Later companies are gaining ground in Latin America, with Kueski reporting more than 1 million customers.

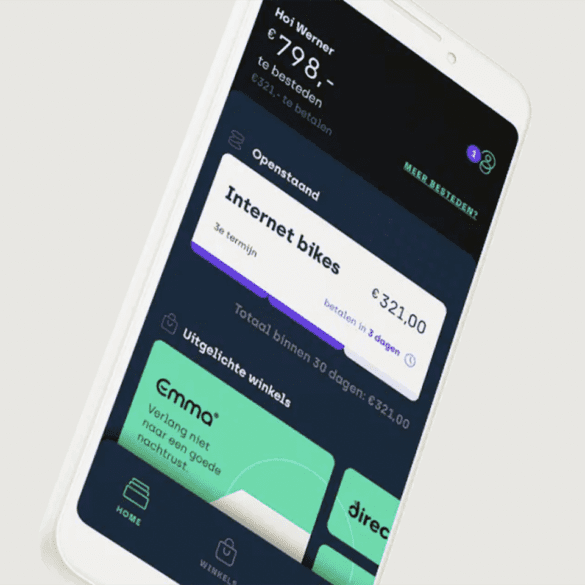

In the Netherlands, BNPL company In3 has been a part of this growth and is now set to expand into other markets.

Identiq provides a higher level of risk analysis for buy now, pay later (BNPL) customers by leveraging tech that has been around for decades.

How did competition between the top consumer debt contenders heat up over the long-awaited holiday shopping spree?

Walia sees plenty of activity in BNPL, beginning with brands partnering with banks to introduce their BNPL capability.