BNY Mellon says Chainalysis’ compliance software will keep an eye on crypto trends, as well as the nitty gritty of real-time transaction monitoring.

UK based small business lender Iwoca secured €100mn from Insight Investment, which is owned by BNY Mellon, to dramatically increase...

There has been a lot of discussion in the last few years about blockchain technology and its potential impact on...

Zelle has quickly made a name for themselves in p2p payments, now BNY Mellon is looking to leverage the company for business payments; "There are rapid changes in the payments space," Carl Slabicki, director and product line manager for immediate payments at BNY Mellon, said to American Banker. "If you want to remain relevant and allow your clients access to new payment systems, you need to be quicker to market with a faster payment solution.”; b2b payments have no been easier to automate but BNY is hoping to help move the process in that direction. Source.

·

[Editor’s note: This is an article written by BNY Mellon’s Sonal Patel and Andrew Taylor. In the article, they discuss growing...

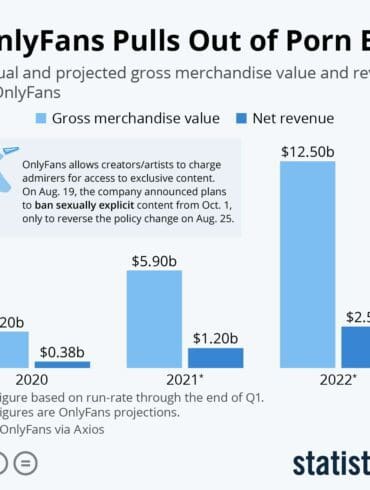

We talk about OnlyFans, and how its bank vendors pressured it to try to ban adult content, and how and why that failed. We also discuss the crypto tax provisions in the Senate version of the $1 trillion infrastructure bill, and their impracticality. These themes are tied together with a metaphysical hypothesis about the role of financial services, anchored in a discussion of the Platonic model of the mind. How are rationality, emotion, and social context involved to define the shape of our industry?

BNY Mellon is one of the oldest banks in New York; Roman Regelman who is head of digital at the...

A new report by BNY Mellon and the UN point to flaws in design and marketing that make financial products less available to women than men; the report finds financial firms are missing out on $7bn in credit card revenue, $14bn in personal loans and $4bn in housing; TearSheet sat down with a former financial services marketer in their latest Confessions series to talk about these issues; the interview covers the misconceptions in marketing to women customers, why women are still viewed as a niche customer when they are the majority and that banks don’t really understand their customers. Source.

Finastra, R3 and seven global banks are teaming up to build a blockchain based marketplace for syndicated loans; banks include BNP Paribas, BNY Mellon, HSBC, ING and State Street; Fusion LenderComm, which uses R3's Corda platform, will be able to handle real-time credit agreements, accrual balances, position information and transaction data. Source.