Brazil's Minister of Finance criticized "stratospheric" revolving credit card interest rates amid a campaign to push through economic reforms.

According to Creditas' recently released figures, the company recorded a loss of $26 million, a 60% drop from the same period in 2022.

PicPay stated that, before reaching the market, the solution went through tests for eight months with 10,000 company and partner employees.

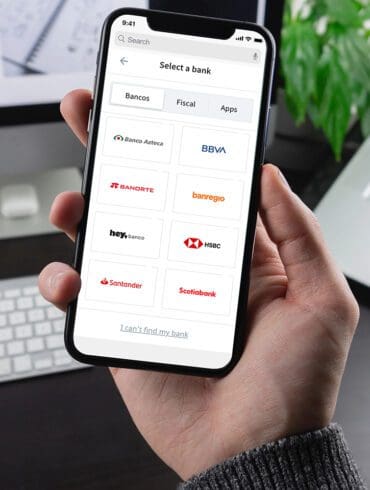

This is the first acquisition in the history of the Open Finance platform, which was created in 2019 by Pablo Viguera and Oriol Tintoré.

With payroll lending, Nubank blazes a trail into secured lending, an asset that bears less risk than credit cards and individual loans.

More than a year after it would expand to Latam, British neobank Revolut has officially launched in Brazil with its global account product.

Pix achieved the milestone of 3 billion monthly transactions in March, up from a previous record of 2.8 billion by the end of last year.

Brazilian Nubank reached 79.1 million customers in Latin America by early April. That is up almost 20 million compared to a year ago.

Brazil's teenage-focused neobank Z1 received a $10.4 million investment to build new products to cater to young adults as well.

The payment operation, which has been awaiting regulatory approval for three years, will first focus on small merchants and will be implemented gradually in the South American country.