As of May 2022, the PIX system had roughly 118 million users, 56% of Brazil's population.

As of April, the Brazilian economy reached the ninth spot as the country with the highest number of unicorn firms.

I have said many times that Latin America is the hottest region for fintech on the planet. The digital banks...

Santander InnoVentures has led a $5 million round in the SME lender a55; a55 currently lends in both Brazil and...

Last week we reported that N26 crossed 5 million customers but we didn’t have insight into how their US business...

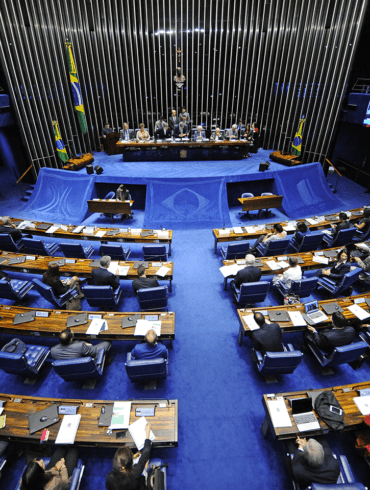

Brazil, the largest country in Latin America, is moving closer to regulating cryptocurrencies with its own version of a Bitcoin law.

Several LatAm countries moved forward in 2021 with regulatory initiatives seeking to promote competition and data sharing in the industry.

WhatsApp launches payments in Brazil and is unceremoniously shut down by the central bank a week later, MasterCard buys Finicity to protect itself against Visa’s recent acquisition of Plaid, Checkout.com continues its largely silent meteoric rise in payments, Softbank-backed and DAX 30 index component Wirecard “loses" $2 billion from its balance sheet and files for insolvency, Upgrade raises $40 million at a $1 billion valuation to extend its personal credit offering.

Brazil and Mexico are often talked about as fintech booms in Latin America; the size of the industry overall is...

The Brazilian Central Bank has proposed allowing fintech companies to lend money without taking deposits; the bank is set to hold public hearings for the next two and a half months on the proposed rules; according to Central Bank Director Otávio Damaso the rules do not need congressional approval; the Brazilian fintech industry has grown sixfold in the past few years and now the regulators are looking to make the country more fintech friendly; banks will also be able to create their own fintech arms when the new rules take effect. Source