Brex has announced a significant $150 million round at a time when fintech funding has slowed significantly; the round was...

Corporate credit card fintech Brex is helping their clients to apply for PPP capital through partner bank Radius Bank; the...

Ramp is a credit card startup focused on corporate cards; the company is New York based, founded by a team...

Credit card startup Brex is starting to expand their product set beyond the core credit card offering and recently announced...

The startup has officially raised their $100 million round, valuing the company at $2.6 billion; what’s amazing is that the...

It has been an interesting to say the least as we have watched everything play out with the Paycheck Protection...

Credit card fintech Brex has made three acquisitions as the company looks to grow through a number of different ways;...

Mastercard is already working with names like Brex, Revolut and TransferWise; they have also announced programs in order to make...

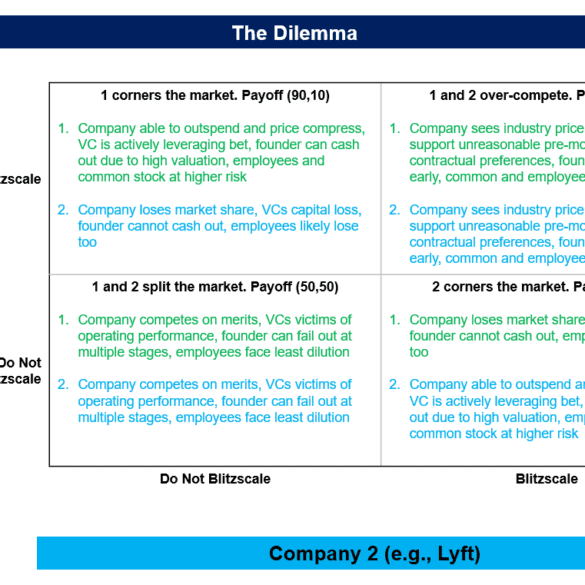

Why are high valuations bad? You've heard me talk about how the trend of Fintech bundling, and the unicorn and decacorn valuations led by SoftBank and DST Global, are creating underlying weakness in the private Fintech markets. Of course, they are also creating price compression and consolidation in the public markets (e.g, Schwab/TD, Fiserv/First Data) across sub-sectors. But public companies are at least transparent and deeply analyzed. Private companies have beautiful websites, charismatic leaders, and impressive sounding investors. Often when you look under the hood, it's just a bunch of angry bees trying to find something to sting.

Fintech startup Brex is in discussions to raise a fresh round of capital that will value the company at $2bn...